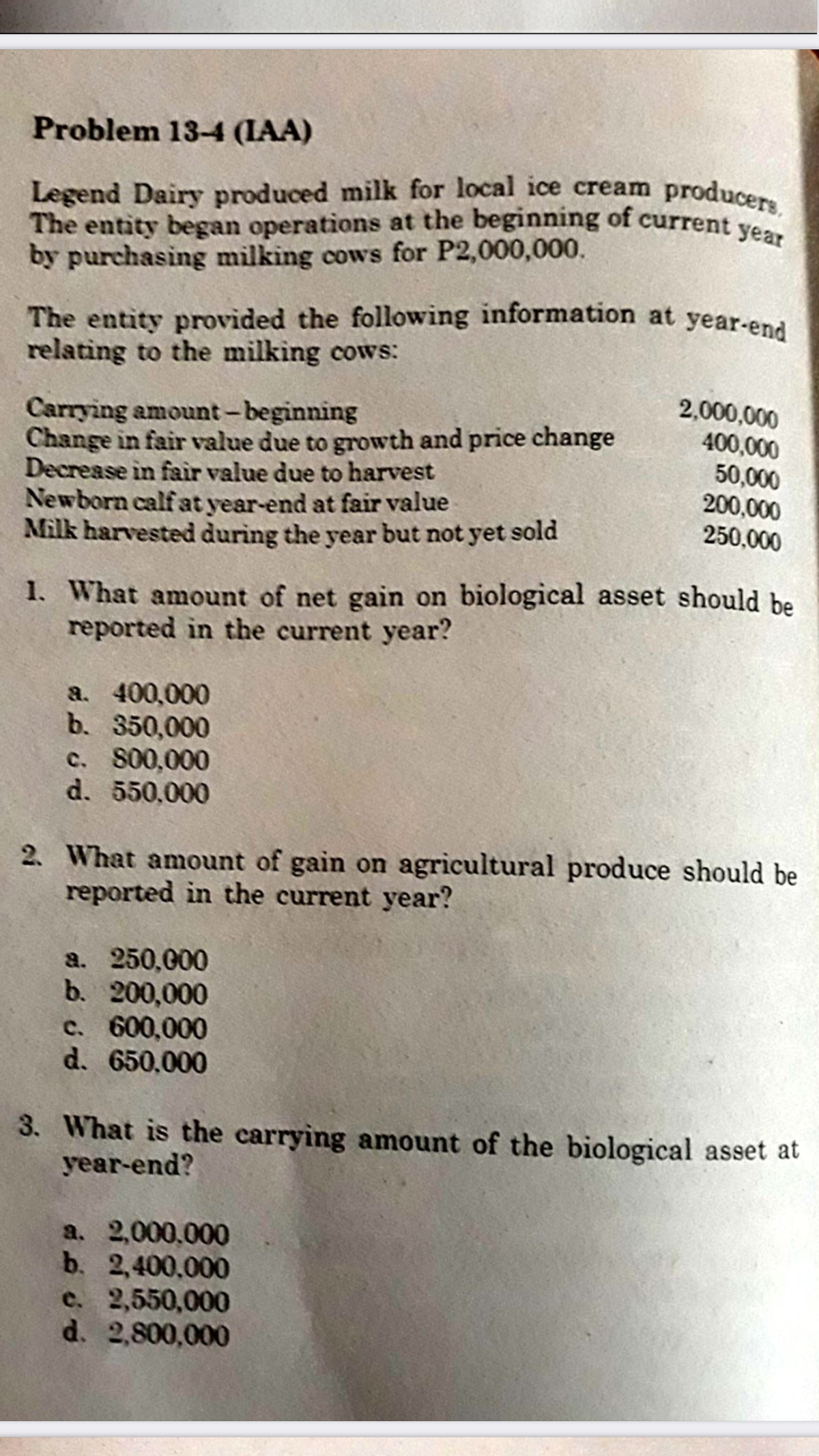

What amount of net gain on biological asset should be reported in the current year?

Q: The following information is available to reconcile Branch Company’s book balance of cash with its b...

A: Bank reconciliation statements are referred as a statement which is made by the company/organisation...

Q: Your Fan retails computer fans in two sizes: small and large. The business has provided you with the...

A: Contribution Margin = Sales - Variable Cost Notes: Since you have posted a question with multiple ...

Q: Division A makes a part with the following characteristics: Production capacity in units........

A: In the case of inter-departmental transfers, we should assess the impact at the company level.

Q: K. Canopy, the proprietor of Canopy Services, withdrew $6,200 from the business during the current y...

A: In a partnership firm, partners introduce capital, executes the business, generates profits & wi...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: Total Liabilities of Munimuni Company amounts to P400,000 which is 40% of the total assets. How much...

A: Owner's equity = total assets - liabilities ...

Q: A manager at Thocc, a business retailing and servicing custom keyboards, needs help with interpretin...

A: The question is related to explaining brief narration describing the economic event that corresponds...

Q: 1. Use the accounting equation to compute the missing financial statement amounts (a), (b), and (c)....

A: The accounting equation is written as: Assets = Liabilities + equity Equity = Capital - withdrawals ...

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of ath

A: Present value = Annuity amount x present value of annuity due at $ 1 at 4% for 3 years Present value...

Q: Besik Inc. operates a customer loyalty program. The entity grants loyalty points for goods purchased...

A: SOLUTION WORKING NOTE SALES 8500000 POINTS 1500000 TOTAL 1000000.

Q: Destin Company produces water control valves, made of brass, that it sells primarily to builders for...

A: Cost analysis is done for every minor and major decision as any change in the element of cost struct...

Q: Required Information Problem 3-3A (Statie) Preparing adjusting entrles, odjusted trlal balance, and ...

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as of the balan...

Q: QS 2-6 Analyzing transactions and preparlng Journal entrles LO P1 For each transaction, (1) analyze ...

A: Accounting equation of the business says that total assets must be always equal to total liabilities...

Q: Total assets of SanaOl Co. amounts to P2,550,000 with equal liabilities and equity amounts. How much...

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: I. Problem Solving. Show necessary solutions For items 1-10, refer to the following: The owner of Da...

A: The compound interest and compounded value (total cost) is computed using the formula as follows: - ...

Q: During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for ...

A: Journal entry paass when issue raw materials from storeroom to use in production. Separate entry pas...

Q: Job cost sheets show the following information: Job January February March Completed Sold AA2 $2,600...

A: A job cost sheet is a list of a job's real expenses. The accounting division compiles the report, wh...

Q: The monthly income statement for Jordan Stores is given below: 1st Branch 2nd Branch Total...

A: In the given question, if 1st branch is eliminated, all the revenues and costs associated with the b...

Q: from one division to the other? a. P50 b. P45 c. P20 ...

A: solution given Selling price per chip P50 Monthly capacity 1...

Q: A company delivers inventory to a customer who will pay for it next month. In which of the following...

A: Types of account in balance sheet: Asset account: These are the resources of company or any amount o...

Q: Which of the following is a correct statement?

A: When a sole property dies during the financial year leaving the estate that is known as Deceased ass...

Q: 1 3 4 6 7. 8 17 ..... Jun. 1) Jenna Aracel, the owner, invested $100,000 cash, office equipment with...

A: The journal entries are prepared to record day to day transactions in four column book as debit one ...

Q: For a defined benefit pension plan, pension expense consists of five components, for which the formu...

A: Defined Benefit Pension Plan: As opposed to directly relying on individual investment performance, a...

Q: The following income statement items appeared on the adjusted trial balance of Schembri Manufacturin...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: Wolmore Resources Ltd. is authorized to issue unlimited numbers of common shares, of which 40,500,00...

A: SOLUTION A JOURNAL COMPANY'S OFFICIAL BOOK IN WHICH ALL BUSINESS TRANSACTIONS ARE RECORDED IN CHRONO...

Q: ve and Abel are partners in Suave Swimsuits. Profits and losses are shared in the ratio of 022, when...

A: Suave Swimsuits have 3 partners Adam ,Eve and Abil who share their profits and losses in the ratio o...

Q: P6-3. Listed Automobile industry players has the following market value and earnings per share: Mark...

A: P:E Ratio = Market value per share / Earnings per share where, Earnings per share = (Net income - Pr...

Q: Use the following information for exercise 15 to 18 LO P2 [The following information applies to the ...

A: Net income = Consulting revenue - Rent expense - Salaries expense - Telephone expense - Miscellaneou...

Q: THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Timing is very important when preparing the end of fina...

A: Services: Services (theoretical) are act or use for which a shopper, firm, or government will pay. E...

Q: Why was the Sarbanes-Oxley Act developed and enacted?

A: Introduction:- The Sarbanes–Oxley Act of 2002 is a federal law in the United States that sets specif...

Q: Laflame Corporation uses a job-order costing system with a single plantwide predetermined overhead r...

A: Total estimated manufacturing overhead includes fixed manufacturing cost and variable manufacturing ...

Q: In capital budgeting, risk can be measured from three perspectives. Explain THREE (3) measures of a...

A: capital budgeting is a process through which business evaluate investment and expenses in order to ...

Q: Journal entry worksheet 4 5 7 8 Annual depreciation on the professional library is $7,200. Note: En...

A: The adjusted journal entries are those journal entries which are made at the end of an accounting ye...

Q: %3D

A: solution given cash flow diagram Year Cash flow 1 100 2 100 3 100 4 0 ...

Q: Nowitzki Corporation sells sets of encyclopedias. Nowitzki sold 4,000 sets last year at ₱25,000 a se...

A: Contribution margin: Difference between the sales and the variable costs is called contribution marg...

Q: 1.17.1 The relevant entry in the Cash Receipts Journal on 30 April 20.7. 1.17.2 The posting to the G...

A: Since, you have posted a question with multiple sub-parts, we will solve the first three sub-parts f...

Q: Required: a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year...

A: FIFO method is the method of the inventory in which it is deemed for the purpose of the cost of the ...

Q: and financlal statements LO P1, Individuals who pay tultion directly to s prepald expenses and unear...

A: Income statement shows the revenue earned and expenses incurred . It calculated the profit or loss o...

Q: The ending Retained Earnings balance of ABC decreased by $1.5 million from the beginning of the year...

A: Answer) Calculation of Net Income earned During the Year Net Income Earned = (Ending Balance of Reta...

Q: 13. Selling price per unit ₱25 Number of units sold 15,000 Contribution margin...

A: Selling price = P25 Number of units = P15000 Contribution margin = 30% Net income = P50,000

Q: onsider the unadjusted trial balance of Riverdale Company at June 30, 2016, and the related month-en...

A: The adjustment entries are prepared at year end to adjust the revenue and expenses of the current pe...

Q: Sun Studio in Irvine plans to initiate an activity-based costing system with two activities: Offerin...

A: Indirect cost: It implies to the expense that is incurred in relation to multiple activities and is ...

Q: Bramble Company just took its physical inventory. The count of inventory items on hand at the compan...

A: Inventory is: An asset Used to generate revenue or has a monetary worth, or An asset that is in th...

Q: Return on Total Assets A company reports the following income statement and balance sheet informati...

A: Introduction:- The return on assets (ROA) measures how lucrative a company's assets are at generatin...

Q: ce increasing the inc ly using a hypothet. d and clothes and s- alothoo oont $20/it

A: Wallmat uses very different strategies to grow their business. The above mentioned is one of them. B...

Q: 2. Inventor of double entry system. A) Marshall B) Robins Lucas D) Batliboi Answer:- ...

A: Accounting- Accounting refers to the system that collects and processes( measures, records, and anal...

Q: I agreed to do five courses for a client for $2,500 each. immediately and finish before the end of t...

A: Adjusting entries are journal entries made at the end of the accounting year to record accrued expen...

Q: B) Suppose an IAB with a face value of RM3,000,000.00 is sold at a discount rate of 5 percent and ha...

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Discuss and give examples of some of the indicators that affect asset classes

A: Asset classes:- An asset class is basically a collection of investments with some comparable feature...

Q: A prjet was esimated to os 00 i tmeine f 0 ons. Estmate o comple ETC) fr te ojetwaud now be: A. SIG,...

A: In the start of project, the estimated cost of completion was $200,000. But later on, due to some de...

Step by step

Solved in 2 steps

- PT Milkisu produced milk for sale to local and national cream producers. The entity began operations at a beginning of current year by purchasing 500 milk cows for CU8.000.000. The entity had the following information available at year-end relating to the cows:Carrying amount of milking cows, Jan 1 8.000.000Change in fair value due to growth and price change 900.000Decrease in fair value due to harvest 200.000Milk harvested during the year but not sold 400.000 Prepare journal entries to record the gain from change in fair value of agricultural producePT Milkisu produced milk for sale to local and national cream producers. The entity beganoperations at a beginning of current year by purchasing 500 milk cows for CU8.000.000.The entity had the following information available at year-end relating to the cows:Carrying amount of milking cows, Jan 1 8.000.000Change in fair value due to growth and price change 900.000Decrease in fair value due to harvest 200.000Milk harvested during the year but not sold 400.000Required: 1. Is the natural breeding of animals in zoos and game parks agricultural activity?2. Is ocean fishing agricultural activity?3. Is palm plantation agricultural activity? Describe the accounting treatment forbiological assets and agricultural products in oil palm plantationsPT Milkisu produced milk for sale to local and national cream producers. The entity beganoperations at a beginning of current year by purchasing 500 milk cows for CU8.000.000.The entity had the following information available at year-end relating to the cows:Carrying amount of milking cows, Jan 1 8.000.000Change in fair value due to growth and price change 900.000Decrease in fair value due to harvest 200.000Milk harvested during the year but not sold 400.000Required:Discuss and prepare journal entries:1. To record the acquisition of milking cows2. To record the net gain from the change in fair value of the milking cows3. To record the gain from change in fair value of agricultural produce

- Salve Co is engaged in raising dairy livestock. The entity provided the following information during the current year: Carrying Amount - Beginning 5,000,000 Increase due to purchase 2,000,000 Gain arising from change in FV 1,000,000 Decrease due to sales 850,000 Decrease due to harvest 200,000 What is the carrying amount of the biological asset at year-end?WeCareCows Company produces dairy products for sale to grocery stores and direct consumers. When they started their operations, they bought 650 milk cows for P8,000,000. The following information are provided during the year: • Acquisition cost, January 1- P8,000,000 • Change in fair value due to growth and price changes- P2,500,000 • Decrease in fair value due to harvest- P250,000 • Milk harvested during the year but not yet sold- P400,000 What amount of gain on change in fair value should be recognized for biological assets for the year? A. P2,650,000 B. P2,900,000 C. P2,500,000 D. P2,250,000At the beginning of current year, an entity purchased 100 cows which are 3 years old for P15,000 each for the purpose of producing milk for the local community. On July 1, the cows gave birth to 20 calves. The active market, provided the fair value less costs to sell of the biological assets as follows: New born calf on July 1 - 4,000 New born calf on December 31 - 5,000 ½ year old calf on December 31 - 7,000 3 years old cow on December 31 - 18,000 4 years old cow on December 31 - 24,000 Required: Prepare the journal entries with supporting computation as applicable.

- Part 1.PT Milkisu produced milk for sale to local and national cream producers. The entity began operations at a beginning of current year by purchasing 500 milk cows for CU8.000.000.The entity had the following information available at year-end relating to the cows:Carrying amount of milking cows, Jan 1 8.000.000Change in fair value due to growth and price change 900.000Decrease in fair value due to harvest 200.000Milk harvested during the year but not sold 400.000 Required:Discuss and prepare journal entries:1. To record the acquisition of milking cows2. To record the net gain from the change in fair value of the milking cows3. To record the gain from change in fair value of agricultural produce Part 2.Discuss and answer these questions:1. Is the natural breeding of animals in zoos and game parks agricultural activity?2. Is ocean fishing agricultural activity?3. Is palm plantation agricultural activity? Describe the accounting treatment for biological assets and agricultural…On January 1, 20X2, Sansa Company purchases two (2) separate sets of assets and activities from thirdparties, as follows:i. A manufacturing plant of Arya Company. The set of assets acquired and liabilities assumed are as follows:Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000Sansa will continue to employ the existing employees of the manufacturing plant and will pay them thesame salaries as before. The above manufacturing plant is a cash-generating unit that generatesoutputs that are sold to outside customers. Sansa pays a cash consideration of P100 million to AryaCompany.ii. A set of assets and liabilities of Bron Company.Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000The vendor will retrench the existing employees of the factory and pay their termination benefits. The setof assets is not capable of generating independent cash flows. However,…On January 1, 20X2, Sansa Company purchases two (2) separate sets of assets and activities from thirdparties, as follows:i. A manufacturing plant of Arya Company. The set of assets acquired and liabilities assumed are as follows:Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000Sansa will continue to employ the existing employees of the manufacturing plant and will pay them thesame salaries as before. The above manufacturing plant is a cash-generating unit that generatesoutputs that are sold to outside customers. Sansa pays a cash consideration of P100 million to AryaCompany.ii. A set of assets and liabilities of Bron Company.Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000The vendor will retrench the existing employees of the factory and pay their termination benefits. The setof assets is not capable of generating independent cash flows. However,…

- Baker Company sold consumer products that are packaged in boxes. The entity offered an unbreakable glass in exchange for two box tops and P50 as a promotion during the current year. The cost of the glass was P200. The entity estimated at the end the year that it would be probable that 50% of the box tops will be redeemed. The entity sold 100,000 boxes of the product during the current year and 40,000 box tops were redeemed during the year. What amount should be reported as estimated liability at year-end?On January 1, 20x1, an entity grants a franchisee the right to operate a restaurant in a specific market using the entity’s brand name, concept and menu for a period of ten years. The entity has granted others similar rights to operate this restaurant concept in other markets. The entity commonly conducts national advertising campaigns, promoting the brand name, and restaurant concept generally. The franchisee will also purchase kitchen equipment from the entity. The entity will receive ₱950,000 upfront (₱50,000 for the kitchen equipment and ₱900,000 for the franchise right) plus a royalty, paid quarterly, based on 4% of the franchisee’s sales over the life of the contract. The ₱50,000 amount reflects the stand-alone selling price of the kitchen equipment. The entity delivers the kitchen equipment to the customer on February 1, 20x1. The customer commences business operations on April 1, 20x1 and reports total sales of ₱5,000,000 for the year. How much total revenue should the entity…On January 1, 20x1, an entity grants a franchisee the right to operate a restaurant in a specific market using the entity’s brand name, concept and menu for a period of ten years. The entity has granted others similar rights to operate this restaurant concept in other markets. The entity commonly conducts national advertising campaigns, promoting the brand name, and restaurant concept generally. The franchisee will also purchase kitchen equipment from the entity. The entity will receive ₱950,000 upfront (₱50,000 for the kitchen equipment and ₱900,000 for the franchise right) plus a royalty, paid quarterly, based on 4% of the franchisee’s sales over the life of the contract. The ₱50,000 amount reflects the stand-alone selling price of the kitchen equipment. The entity delivers the kitchen equipment to the customer on February 1, 20x1. The customer commences business operations on April 1, 20x1 and reports total sales of ₱5,000,000 for the year. How much total revenue should the entity…