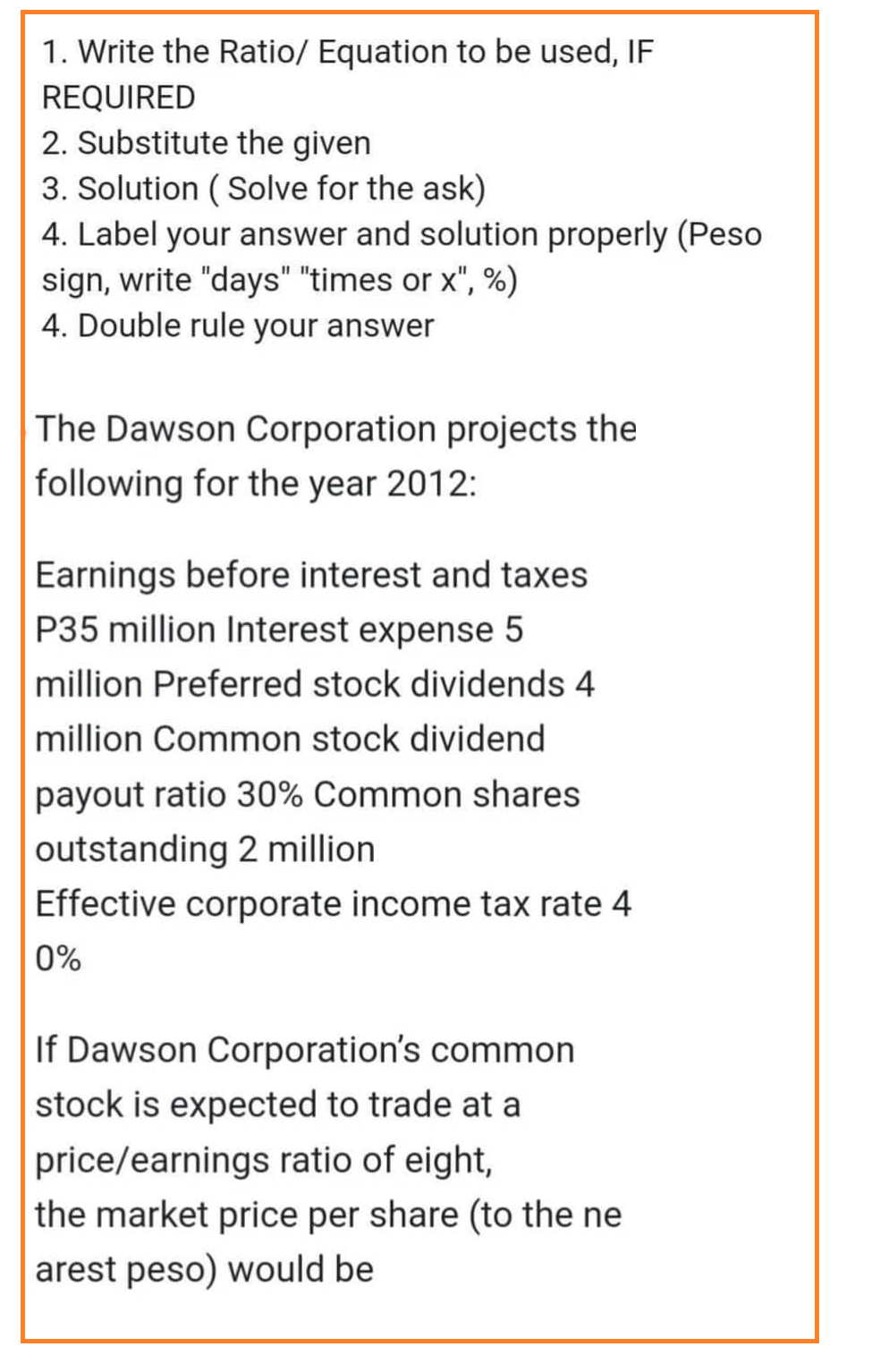

1. Write the Ratio/ Equation to be used, IF REQUIRED 2. Substitute the given 3. Solution (Solve for the ask) 4. Label your answer and solution properly (Peso sign, write "days" "times or x", %) 4. Double rule your answer The Dawson Corporation projects the following for the year 2012: Earnings before interest and taxes P35 million Interest expense 5 million Preferred stock dividends 4 million Common stock dividend payout ratio 30% Common shares outstanding 2 million Effective corporate income tax rate 4 0% If Dawson Corporation's common stock is expected to trade at a price/earnings ratio of eight, the market price per share (to the ne arest peso) would be

1. Write the Ratio/ Equation to be used, IF REQUIRED 2. Substitute the given 3. Solution (Solve for the ask) 4. Label your answer and solution properly (Peso sign, write "days" "times or x", %) 4. Double rule your answer The Dawson Corporation projects the following for the year 2012: Earnings before interest and taxes P35 million Interest expense 5 million Preferred stock dividends 4 million Common stock dividend payout ratio 30% Common shares outstanding 2 million Effective corporate income tax rate 4 0% If Dawson Corporation's common stock is expected to trade at a price/earnings ratio of eight, the market price per share (to the ne arest peso) would be

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 54E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

100%

FOLLOW INSTRUCTIONS AND ANSWER TYPEWRITTEN AND COMPLETELY FOR UPVOTE

Transcribed Image Text:1. Write the Ratio/ Equation to be used, IF

REQUIRED

2. Substitute the given

3. Solution (Solve for the ask)

4. Label your answer and solution properly (Peso

sign, write "days" "times or x", %)

4. Double rule your answer

The Dawson Corporation projects the

following for the year 2012:

Earnings before interest and taxes

P35 million Interest expense 5

million Preferred stock dividends 4

million Common stock dividend

payout ratio 30% Common shares

outstanding 2 million

Effective corporate income tax rate 4

0%

If Dawson Corporation's common

stock is expected to trade at a

price/earnings ratio of eight,

the market price per share (to the ne

arest peso) would be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,