The demand curve and supply curve for one-year discount bonds with a face value of $1,000 are represented by the following equations: Price = -0.6Quantity + 1,100 B°: Price = Quantity + 710

The demand curve and supply curve for one-year discount bonds with a face value of $1,000 are represented by the following equations: Price = -0.6Quantity + 1,100 B°: Price = Quantity + 710

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Money Growth And Inflation

Section: Chapter Questions

Problem 1PA

Related questions

Question

2

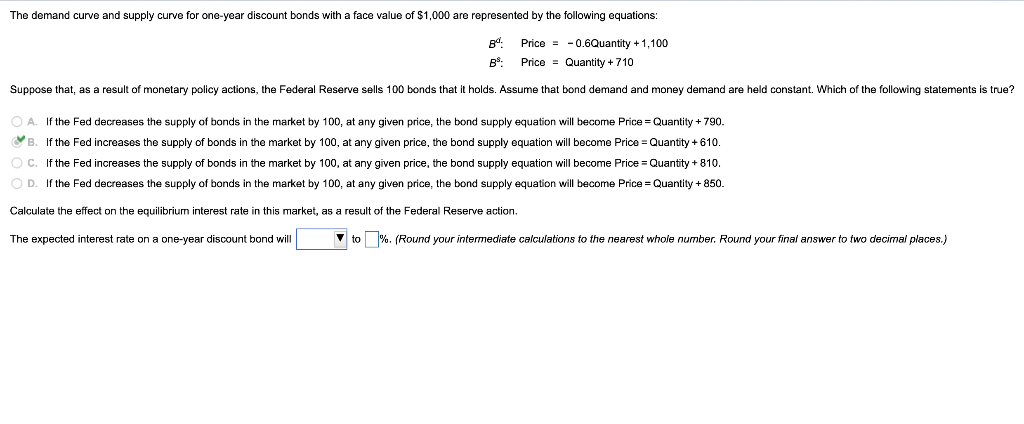

Transcribed Image Text:The demand curve and supply curve for one-year discount bonds with a face value of $1,000 are represented by the following equations:

Price = -0.6Quantity +1,100

B:

Price = Quantity + 710

Suppose that, as a result of monetary policy actions, the Federal Reserve sells 100 bonds that it holds. Assume that bond demand and money demand are held constant. Which of the following statements is true?

O A. If the Fed decreases the supply of bonds in the market by 100, at any given price, the bond supply equation will become Price = Quantity + 790.

OB. If the Fed increases the supply of bonds in the market by 100, at any given price, the bond supply equation will become Price = Quantity + 610.

O C. If the Fed increases the supply of bonds in the market by 100, at any given price, the bond supply equation will become Price = Quantity + 810.

OD.

If the Fed decreases the supply of bonds in the market by 100, at any given price, the bond supply equation will become Price = Quantity + 850.

Calculate the effect on the equilibrium interest rate in this market, as a result of the Federal Reserve action.

The expected interest rate on a one-year discount bond will

V to %. (Round your intermediate calculations to the nearest whole number. Round your final answer to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning