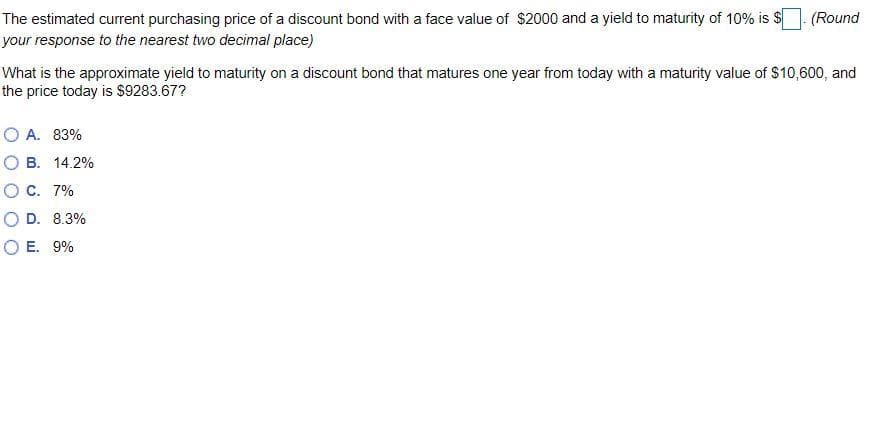

The estimated current purchasing price of a discount bond with a face value of $2000 and a yield to maturity of 10% is $ your response to the nearest two decimal place) What is the approximate yield to maturity on a discount bond that matures one year from today with a maturity value of $10,600, and the price today is $9283.67? O A. 83% OB. 14.2% (Round O C. 7% O D. 8.3% OE. 9%

Q: In class and in recordings or notes on Canvas, we discussed the Lerner index. Most of the…

A: The Lerner index is a measure of market power in imperfectly competitive markets and is defined as:…

Q: Use the strictly dominant strategy to find a Pure Strategy Nash Equilibrium if there is one.

A: The Nash equilibrium refers to the best course of action provided the strategy of the rival firm has…

Q: The property tax is very popular because it is fairly assigned. it is very regressive. of the…

A: A tax levied on the value of the real estate or immovable property, such as land, buildings, and…

Q: Assume that the food delivery market in Australia is perfectly competitive. Use the market demand…

A: A perfectly competitive market is a theoretical model used in economics to describe a market in…

Q: What is the difference between nominal GDP and real GDP? Nominal GDP measures actual…

A: GDP is the value of final goods and services produced in the economy within a given period of time.

Q: Critically evaluate how happiness is related to economic development. Use Macroeconomics and…

A: Economic development refers to the sustained improvement of an economy's overall performance and the…

Q: What would be the highest price (premium) that she would be willing to pay for an insurance policy…

A: To find the highest price (premium) that Priyanka would be willing to pay for an insurance policy…

Q: A project using passive heating/cooling design concepts to reduce energy costs requires an…

A: PW means PV of net benefits arises from the project in the future. It can be computed easily by…

Q: 4. In business dealings in a small, isolated town, a given person can either behave like a saint or…

A: According to the game theory decision-making theorem known as the nash equilibrium, a player can…

Q: The Effective Annual Interest rate (EAR) is the appropriate way to annualise interest rates" Discuss…

A: The effective Annual interest fee (EAR) is indeed considered the appropriate manner to annualize…

Q: Suppose that the market for frying pans is a competitive market. The following graph shows the daily…

A: When the market price, the marginal cost, and the demand curve are equal, perfectly competitive…

Q: In most jurisdictions across Canada, including British Columbia, smoking is banned in all indoor…

A: Fairness or justice in the distribution of resources or outcomes is termed 'equity'. It implies that…

Q: Which of these scenarios would be included in GDP? revenue from selling a four-year-old car…

A: GDP also known as gross domestic product is the sum value of all final goods and services produced…

Q: Below is a table with US labour market data (in thousands): 1998 Working-age population 205, 220…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Ben earns $7,200 this year and zero income the next year. Ben also has an investment opportunity in…

A: The market rate of interest, also known as the prevailing interest rate, is the rate at which…

Q: Q1: A company is going to install a new asphalt plants. Three different type of plants are…

A: For the P.W.C (present worth of cost), the service life of all alternatives either equals or takes…

Q: Samantha Peters inherited an office building from her father. At the beginning of the year, she…

A: The yearly effective rate of return (also known as the annual effective yield or the annual…

Q: Carlos is a stay-at-home parent who lives in Chicago and teaches tennis lessons for extra cash. At a…

A: Elasticity of supply is a measure of how responsive the quantity supplied of a particular good or…

Q: Suppose a firm has the following production function: Q(L, K) = 2K¹/2 L ¹/2 Recall that the isocost…

A: The production function is the mathematical relationship between output and inputs. It represents…

Q: The aggregate quantity of goods and service demanded changes as the price level falls because a.…

A: When the price level falls, it means that the purchasing power of money will increase. As a result,…

Q: Given the demand function D(p)=√√175 - 2p, Find the Elasticity of Demand at a price of $87 At this…

A: A measure of the extent of sensitivity of quantity demanded (D) of a commodity owing to the changes…

Q: Mr. and Mrs. Ward typically vote oppositely in elections and so their votes "cancel each other out."…

A: Nash equilibrium is a concept in game theory that describes a state in which each player in a game…

Q: Econ 312 Macroeconon Theory Question 1. The labor market In an economy, the firms profit-maximize by…

A: (a) To find the equilibrium number of workers, we can set the MPL equal to the wage and solve for L:…

Q: Improvised explosive devices (IEDs) are responsible for many deaths in times of strife and war.…

A: Given Cost of the robot= $120,000 per unit. As per the contract, 3000 robots is purchased now and…

Q: 10. Suppose all individuals are identical, and their monthly demand for Internet access from a…

A: The consumer surplus is the difference between the maximum price a consumer is willing to pay and…

Q: Price and costs (dollar) 16 12 0 90 130 MC ATC 210 170 Quantity (units per day! MR The figure above…

A: The firms in the perfectly competitive market has to accept the price for its output as measured by…

Q: The prospective exploration for oil in the outer continental shelf by a small, independent drilling…

A: ERR is the economic rate of return which is a single metric showing how a project's economic…

Q: The graph shows Esther's best affordable point at A. The price of seeing a movie falls and Esther's…

A: SE and IE are two components of the effect of the price change. SE reflects the change in quantity…

Q: Germany is trying to lower its CO2 emissions by phasing out coal-based electricity production…

A: Germany participates in the European Emissions Trading System (ETS), which imposes a legally…

Q: 4. Problems and Applications Q4 Suppose the economy is in a long-run equilibrium, as shown on the…

A: Short run Philips curve shows tradeoff between inflation rate and unemployment. Long run Philips…

Q: This figure shows the market supply and demand for good A. I price 10 9 8 7 4 3 2 S D 5 10 15 20 25…

A: Demand curve is the downward sloping curve. Supply curve is the upward sloping curve. Equilibrium…

Q: Maria earns $12 per hour in her current job and works 35 hours a week. Her disutility of effort is…

A: Reservation wage is the minimum wage at which the worker is ready to work that makes him indifferent…

Q: 2. Two firms compete by setting quantities simultaneously (Cournot Competition) in a market where…

A: In a Cournot Competition, two firms compete simultaneously on quantities. Given: Market Demand :…

Q: At the beginning of 2014 Country A's Net International Investment Position is - at book (or…

A: Market value is the current price at which an asset or security can be bought or sold in a market.…

Q: Payments of $1000 and $7500 were originally scheduled to be paid five months ago and four months…

A: Present value is the value of investment in today's dollar. Future value is the value of investment…

Q: Because this market is a monopolistically competitive market, you can tell that it is in long-run…

A: A monopolistically competitive firm produces at the intersection of MR and MC curves. Hence, the…

Q: y can be a customer, bank, supplier, another system and __________ a. another department. b. another…

A: A bank is an institution that gives various financial services to individuals and other…

Q: Approximately, what is the value of (P) if A=580, n=21 years, and i= 20% per year? O a. 2355 O b.…

A: Present value is the value of investment in today's dollar. Future value is the value of investment…

Q: didn't get answer

A: The following are arguments in favor of active stabilization policy by the government: The Fed can…

Q: Briefly and intuitively explain why the number of varieties available to consumers after trade opens…

A: When trade opens up between countries, it allows for the change of goods and services between them.…

Q: Case 2 There is a FOB contract under which the buyer has applied to the insurance company for…

A: Insurance refers to a contractual game plan where an individual or an association consents to pay an…

Q: Income Elasticity Cross price elasticity=% change in the price good y % change in QD of good x Use…

A: Since you have posted multiple questions, we will provide the solution to only the first question as…

Q: When the federal government gives a grant to a state or local government without restrictions on…

A: The federal government alludes to the national legislature of a federation, which is a kind of…

Q: You own a yogurt shop. 1) The inputs to the production of frozen yogurt are: 3 machines,…

A: Fixed inputs are those inputs that do not change in order to change the production of a product.…

Q: could you answer part b and c please

A: b) The Pareto efficient level of the public good is where the marginal cost of producing the public…

Q: sony is considering a 10 percent price reduction on its HD TV sets. If the price-elasticity…

A: Elasticity is a measure of the responsiveness of one variable to changes in another variable. In…

Q: Consider a hypothetical economy in which the labor force consists of 300 people. Of those, 270…

A: A country faces a variety of issues that would affect its growth and this includes poverty,…

Q: Homework (Ch 33) Attempts Average / 3 6. Why the aggregate supply curve slopes upward in the short…

A: According to the sticky wage theory, changes in organisation performance or the state of the economy…

Q: Only typed answer and please don't use chatgpt What polices would lead to unintended consequences…

A: The black market alludes to an illegal or informal economic framework where goods, services, or…

Q: what is the difference between permanent income and transitory income increases related to the…

A: n the Keynesian cross model, permanent income and transitory income increases refer to two different…

Step by step

Solved in 4 steps

- How much would you pay for a perpetual bond that pays an annual coupon of $200 per year and yields on competing instruments are 5%? You would pay $. (Round your response to the nearest penny.) Part 2 If competing yields are expected to change to 8%, what is the current yield on this same bond assuming that you paid $4,000? The current yield is %.(Round your response to the nearest integer.) Part 3 If you sell this bond in exactly one year, having paid $4,000, and received exactly one coupon payment, what is your total return if competing yields are 8%? Your total return is %.How much would you pay for a perpetual bond that pays an annual coupon of $200 per year and yields on competing instruments are 5%? You would pay $. Part 2 If competing yields are expected to change to 8%, what is the current yield on this same bond assuming that you paid $4,000? The current yield is %.(Round your response to the nearest integer.) Part 3 If you sell this bond in exactly one year, having paid $4,000, and received exactly one coupon payment, what is your total return if competing yields are 8%? Your total return is %.Suppose that, holding yield constant, investors are indifferent as to whether they hold bonds issued by the federal govemment or bonds issued by state and local governments (that is, they consider the bonds the same with respect to default risk, information costs, and liquidity) Suppose that state governments have issued perpetuities (or consoles) with $78 coupons and that the federal govemment has also issued perpetuities with $78 coupons. If the state and federal perpetuites both have after-tax yields of 8%, what are their pre-tax yields? (Assume that the relevant federal income tax rate is 31.13%) * The pre-tax yield on the state perpetuity will be______________% * The pre-tax yield on the federal perpetuity will be_______________%

- Please do your own work, don't copy from the internet Q3) (For the first 20 bond problems, assume interest payments are on an annual basis.) Bond value (LO10-3) The Lone Star Company has $1,000 par value bonds outstanding at 10 percent interest. The bonds will mature in 20 years. Compute the current price of the bonds if the present yield to maturity is 6 percent. 9 percent.Consider the market for a bond which has a face value of $2,000, pays a coupon of $100, and matures in 1 year (that is, you will get the face value and one coupon payment next year). Suppose the demand for such bonds is given by P=4,000-2Q, and that the supply of such bonds is given by P=1,000+Q. What is the yield to maturity if one were to purchase the bond at the equilibrium price? 5% .05% 10% .10%The demand D (in billions of £) for a bond with coupon rate 5% and face value FV = 1000, andtwo years to maturity as a function of its price P is D = 4000 − 2P. The supply in (billions of£) as a function of the price of the bond is S = 2P + 400. b) Suppose that the yield to maturity of the bond is i = 0.05. What is the quantitydemanded/supplied at this interest rate? What happens to the demand/supply of the bond asthe interest rate increases? Explain why. c) What is the equilibrium interest rate?

- The demand D (in billions of £) for a bond with coupon rate 5% and face value FV = 1000, andtwo years to maturity as a function of its price P is D = 4000 − 2P. The supply in (billions of£) as a function of the price of the bond is S = 2P + 400. b) Suppose that the yield to maturity of the bond is i = 0.05. What is the quantitydemanded/supplied at this interest rate? What happens to the demand/supply of the bond asthe interest rate increases? Explain why. c) What is the equilibrium interest rate? d) Suppose that the bond trades at premium. Is there excess demand or supply? Explain.e) There is a business cycle expansion, so both supply and demand shifts. After the shift, thenew demand curve is given by: D = 4000 + X − 2P, whereas the new supply curve is S =2P + 200. For which values of X will the interest increase/decrease? Which values of X arein line with empirical data?A semiannual payment bond with a $1,000 par has a 7 percent quoted coupon rate, a 7 percent promised YTM, and 10 years to maturity. What is the bond's duration? If interest rates are expected to rise by one half of a percent, by how much would you expect the price to change using the modified duration equation? How much would you expect the price to change using convexity? You need to use the bond duration and convexity calculator to answer this question.Suppose that you are obtaining a personal loan from your uncle in the amount of $20,000 (now) to be repaid in two years to cover some of your college expenses. If your uncle usually earns minimum 8% profit (annually) on his money, which is invested in various sources. 1) What minimum lump-sum payment two years from now would make your uncle happy? 2) If you pay yearly, how much should you pay each year? 3) If you pay every six months, how much should you pay every six months?

- 108.) If a General Motors bond brings a 7% annual return, the nominal return on a US Treasury bond that is not inflation indexed is 4%, and the real interest rate is 2%, what is the expected annual inflation rate and default risk on General Motors bond, respectively? 2%, 3% 2%, 2% 4%, 1% 3%, 4%3. Suppose the investment yield on a 91-day T-bill is 3%. What is its discount- basis yield? Show your solutiond)Assume that all the information given previously is the same and the defaultrisk premium for corporate bonds rated AAA is 1.5 percent, whereas it is4 percent for corporate bonds rated B. Compute the interest rates onAAA- and B-rated corporate bonds with maturities equal to one year, twoyears, three years, four years, five years, 10 years, 20 years, and 30 years.