The estimation of a Cobb-Douglas production function for 20 firms of a given industry yields: q₁ = 16.907 + 0.322k₁ + 2.777l₁ R² = 0.915 DW = 2.032 RSS = 0.461 Use a = 5%

The estimation of a Cobb-Douglas production function for 20 firms of a given industry yields: q₁ = 16.907 + 0.322k₁ + 2.777l₁ R² = 0.915 DW = 2.032 RSS = 0.461 Use a = 5%

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter7: Production Economics

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:Question 6

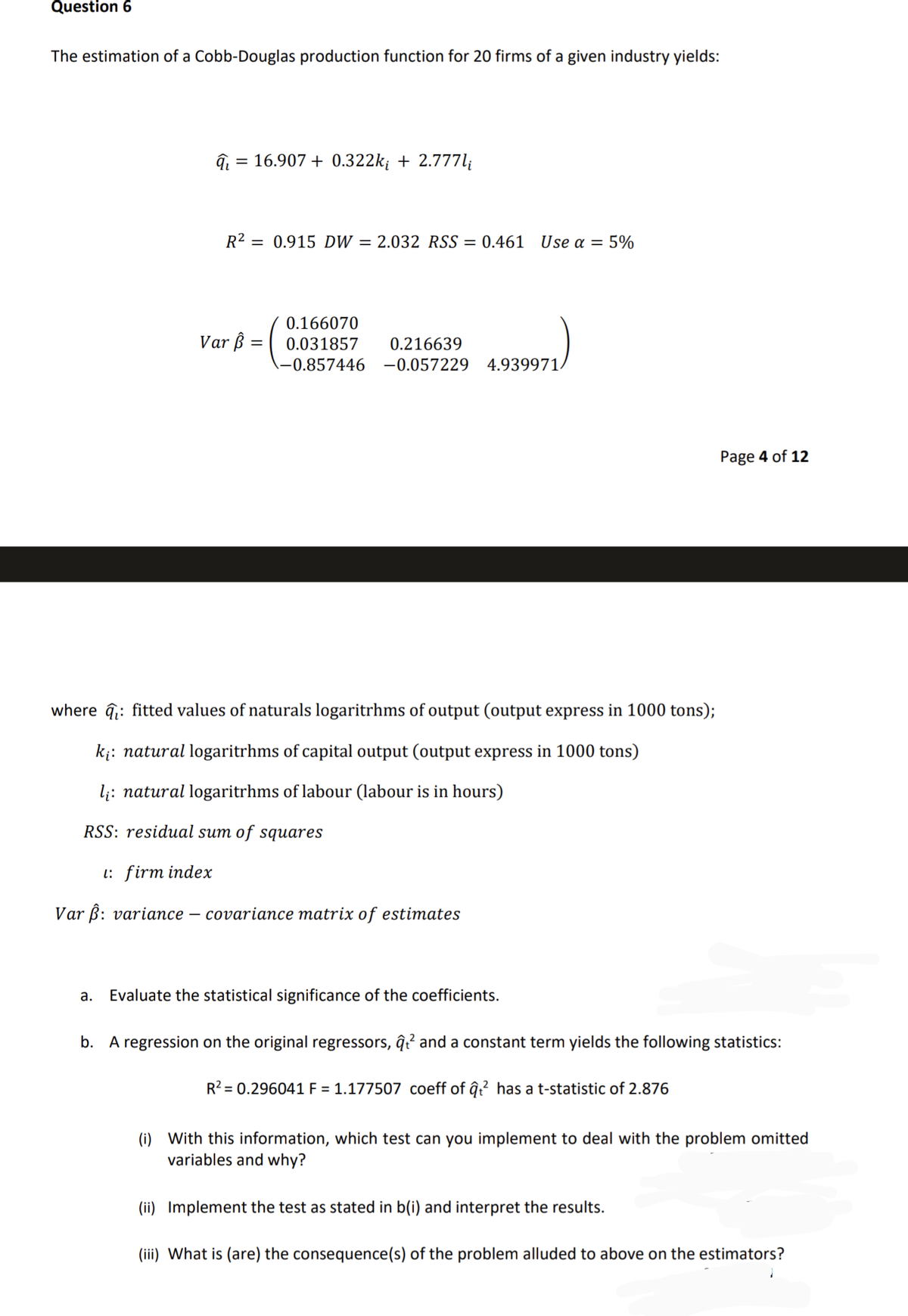

The estimation of a Cobb-Douglas production function for 20 firms of a given industry yields:

=

a.

16.907 + 0.322k; + 2.777lį

R² = 0.915 DW = 2.032 RSS = 0.461 Use a = 5%

Var ß

=

0.166070

0.031857 0.216639

-0.857446 -0.057229 4.939971/

where : fitted values of naturals logaritrhms of output (output express in 1000 tons);

ki: natural logaritrhms of capital output (output express in 1000 tons)

li: natural logaritrhms of labour (labour is in hours)

RSS: residual sum of squares

1: firm index

Var ß: variance covariance matrix of estimates

Evaluate the statistical significance of the coefficients.

Page 4 of 12

b. A regression on the original regressors, q² and a constant term yields the following statistics:

R² = 0.296041 F = 1.177507 coeff of ² has a t-statistic of 2.876

(i) With this information, which test can you implement to deal with the problem omitted

variables and why?

(ii) Implement the test as stated in b(i) and interpret the results.

(iii) What is (are) the consequence(s) of the problem alluded to above on the estimators?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning