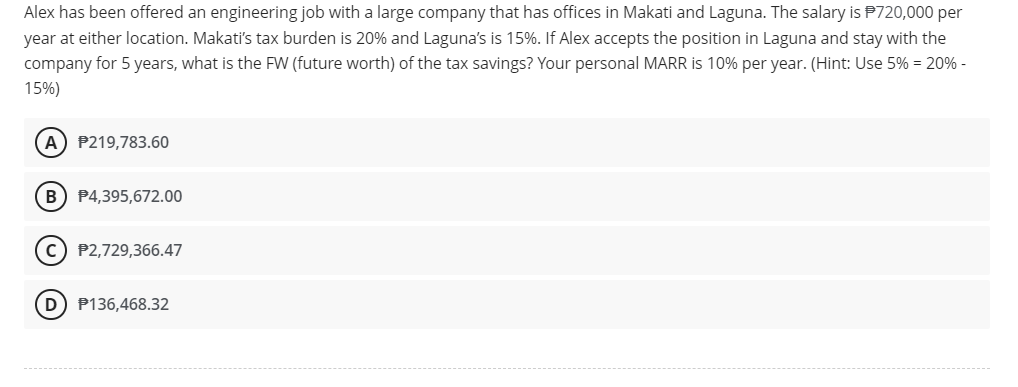

Alex has been offered an engineering job with a large company that has offices in Makati and Laguna. The salary is P720,000 per year at either location. Makati's tax burden is 20% and Laguna's is 15%. If Alex accepts the position in Laguna and stay with the company for 5 years, what is the FW (future worth) of the tax savings? Your personal MARR is 10% per year. (Hint: Use 5% = 20% - 15%) A) P219,783.60 (B) P4,395,672.00 C) P2,729,366.47 (D) P136,468.32

Alex has been offered an engineering job with a large company that has offices in Makati and Laguna. The salary is P720,000 per year at either location. Makati's tax burden is 20% and Laguna's is 15%. If Alex accepts the position in Laguna and stay with the company for 5 years, what is the FW (future worth) of the tax savings? Your personal MARR is 10% per year. (Hint: Use 5% = 20% - 15%) A) P219,783.60 (B) P4,395,672.00 C) P2,729,366.47 (D) P136,468.32

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Alex has been offered an engineering job with a large company that has offices in Makati and Laguna. The salary is P720,000 per

year at either location. Makati's tax burden is 20% and Laguna's is 15%. If Alex accepts the position in Laguna and stay with the

company for 5 years, what is the FW (future worth) of the tax savings? Your personal MARR is 10% per year. (Hint: Use 5% = 20% -

15%)

(A) P219,783.60

(B) P4,395,672.00

C) P2,729,366.47

D) P136,468.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT