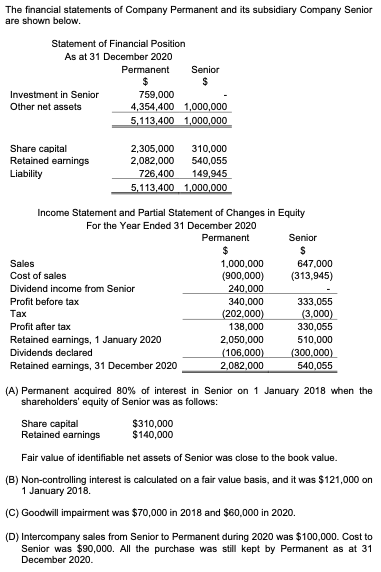

The financial statements of Company Permanent and its subsidiary Company Senior are shown below. Statement of Financial Position As at 31 December 2020 Permanent Senior Investment in Senior 759,000 Other net assets 4,354,400 1,000,000 5,113,400 1,000,000 2,305,000 2,082,000 Share capital 310,000 Retained earnings Liability 540,055 726,400 149,945 5.113,400 1,000,000 Income Statement and Partial Statement of Changes in Equity For the Year Ended 31 December 2020 Permanent Senior Sales Cost of sales 1,000,000 647,000 (900,000) (313,945) Dividend income from Senior 240,000 340,000 (202,000) 138,000 2,050,000 (106,000). 2,082,000 Profit before tax Тах 333,055 _(3,000) 330,055 Profit after tax Retained earnings, 1 January 2020 Dividends declared Retained earnings, 31 December 2020 510,000 (300,000) 540,055 A) Permanent acquired 80% of interest in Senior on 1 January 2018 when the shareholders' equity of Senior was as follows: Share capital Retained earnings $310,000 $140,000 Fair value of identifiable net assets of Senior was close to the book value. B) Non-controlling interest is calculated on a fair value basis, and it was $121,000 on 1 January 2018. C) Goodwill impairment was $70,000 in 2018 and S60,000 in 2020. D) Intercompany sales from Senior to Permanent during 2020 was $100,000. Cost to Senior was $90,000. All the purchase was still kept by Permanent as at 31 December 2020.

The financial statements of Company Permanent and its subsidiary Company Senior are shown below. Statement of Financial Position As at 31 December 2020 Permanent Senior Investment in Senior 759,000 Other net assets 4,354,400 1,000,000 5,113,400 1,000,000 2,305,000 2,082,000 Share capital 310,000 Retained earnings Liability 540,055 726,400 149,945 5.113,400 1,000,000 Income Statement and Partial Statement of Changes in Equity For the Year Ended 31 December 2020 Permanent Senior Sales Cost of sales 1,000,000 647,000 (900,000) (313,945) Dividend income from Senior 240,000 340,000 (202,000) 138,000 2,050,000 (106,000). 2,082,000 Profit before tax Тах 333,055 _(3,000) 330,055 Profit after tax Retained earnings, 1 January 2020 Dividends declared Retained earnings, 31 December 2020 510,000 (300,000) 540,055 A) Permanent acquired 80% of interest in Senior on 1 January 2018 when the shareholders' equity of Senior was as follows: Share capital Retained earnings $310,000 $140,000 Fair value of identifiable net assets of Senior was close to the book value. B) Non-controlling interest is calculated on a fair value basis, and it was $121,000 on 1 January 2018. C) Goodwill impairment was $70,000 in 2018 and S60,000 in 2020. D) Intercompany sales from Senior to Permanent during 2020 was $100,000. Cost to Senior was $90,000. All the purchase was still kept by Permanent as at 31 December 2020.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

Prepare the consolidation adjustment and elimination entries for the year ended 31 December 2020. Show all relevant workings. Worksheets are not required.

Transcribed Image Text:The financial statements of Company Permanent and its subsidiary Company Senior

are shown below.

Statement of Financial Position

As at 31 December 2020

Permanent

24

Senior

Investment in Senior

759,000

Other net assets

4,354,400 1,000,000

5,113,400 1,000,000

2,305,000

Share capital

Retained earnings

310,000

540,055

149,945

2,082,000

Liability

726,400

5,113,400 1,000,000

Income Statement and Partial Statement of Changes in Equity

For the Year Ended 31 December 2020

Permanent

Senior

2$

Sales

1,000,000

(900,000)

240,000

340,000

647.000

Cost of sales

(313,945)

Dividend income from Senior

Profit before tax

333,055

Тах

(202,000)

138,000

(3,000)

330,055

Profit after tax

Retained earnings, 1 January 2020

2,050,000

510,000

(300,000)

540,055

Dividends declared

(106,000)

Retained earnings, 31 December 2020

2,082,000

(A) Permanent acquired 80% of interest in Senior on 1 January 2018 when the

shareholders' equity of Senior was as follows:

Share capital

Retained earnings

$310,000

$140,000

Fair value of identifiable net assets of Senior was close to the book value.

(B) Non-controlling interest is calculated on a fair value basis, and it was $121,000 on

1 January 2018.

(C) Goodwill impairment was $70,000 in 2018 and $60,000 in 2020.

(D) Intercompany sales from Senior to Permanent during 2020 was $100,000. Cost to

Senior was $90,000. All the purchase was still kept by Permanent as at 31

December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College