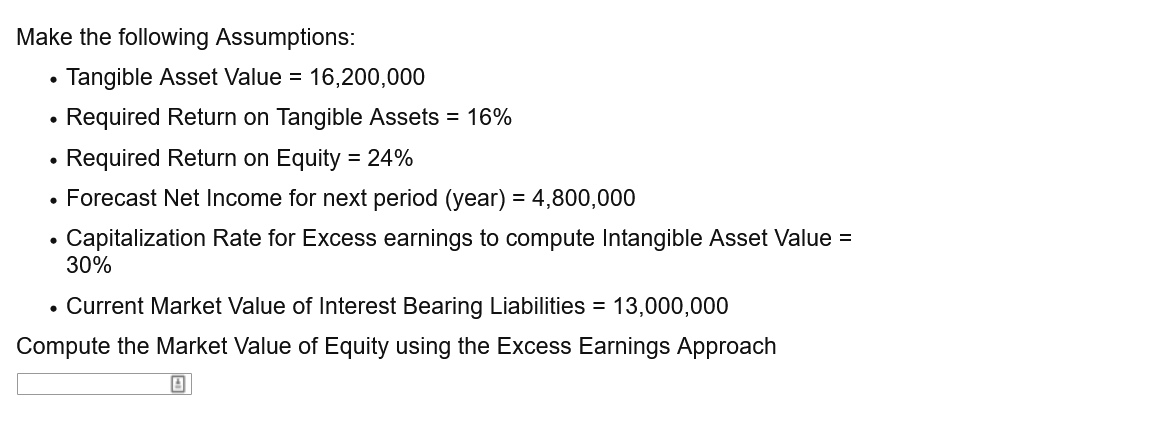

the following Assumptions: Tangible Asset Value = 16,200,000 Required Return on Tangible Assets = 16% Required Return on Equity = 24% Forecast Net Income for next period (year) = 4,800,000 Capitalization Rate for Excess earnings to compute Intangible Asset Value B0% Current Market Value of Interest Bearing Liabilities = 13,000,000 oute the Market Value of Eguity using the Excess Farnings Approach

Q: Pete Corporation and Sol Company agreed to combine their businesses, with Pete Corporation as the…

A:

Q: Given: The 456 Company purchased office supplies from A-One Supplies worth P80,000 on April 04,…

A: Solution: List price of supplies = P80,000 Trade discount = 5%, 2% Cash discount = 5% if paid with…

Q: hè Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: Solution 1: Impact on net income on discontinuing racing bike Particulars Current Total…

Q: On Jan 1, 20X1, ABC Corp received a P450,000 3-year note from a customer. The principal and interest…

A: The note seems a zero-interest note receivable. In a zero-interest note receivable the interest…

Q: 4.) Compute for the Settlement Amount Yield: 5% Coupon Rate: 4% Term: 3 Yrs Frequency: Semi-Annual…

A: Bond Valuation Bond can be valued either par value or in discount value or in premium as well.…

Q: During 2012, Orly company purchased marketable equity securities as short-term investment to be…

A: Introduction Equity shares are the long term financing sources that is issues by company for meeting…

Q: TBA, Inc., manufactures and sells concrete block for residential and commercial building. TBA…

A: Budgeted Statements are prepared to estimate the future figures and calculate the variances by…

Q: Jammer Company uses a weighted average perpetual inventory system and reports the following:…

A: Cost of inventory on August 29 = ($260 + $435) x (5 / 25) = $139

Q: obtain 20X5 accrual basis net income, should these decreases be added to or deducted from cash basis…

A: Accrual basis income is the income which has been earned by the company or the business during the…

Q: A building (a Section 1231 asset that is also a Section 1250 asset) was purchased on March 10, Year…

A: Depreciation is an accounting method for dispersing a tangible or physical asset's cost over its…

Q: The condensed financial statements of Carla Vista Co. for the years 2021 and 2022 are presented…

A: The question is related to the Ratio Analysis. Ratio is the indicated quotient of two mathematical…

Q: s provided the following information: Salaries for his office (including himself at $66,850, a…

A: The answer has been mentioned below.

Q: S Company had the following balances at the time it was acquired by P Company: Cash…

A:

Q: Set out below are the financial statements of Emma, a limited liability company. You have been asked…

A: The cash flow statement assesses a corporation's ability to handle its cash balance, or how…

Q: Required: Discuss what amounts are deductible as specific deductions for Opt Pty Ltd. Assume that…

A: A Legal and other expert costs are not expressly specified as deductible expenses in the Act. As a…

Q: This rate is included in the face of the note: stated rate market rate effective interest yield…

A: Rate of the note determine the payment amount in form of interest to the holder. Interest payment is…

Q: 1)Chester Company reported payroll for the month of January 2022 as follows: Total Wages Income…

A: The payroll tax liability is the total amount of the tax that is company liable for before any…

Q: The IRS audits Pearl's current year individual return and determines that, among other errors, she…

A: A negligence Penalty can be defined as the penalty imposed on the taxpayers in case all income is…

Q: Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven,…

A: The budgets are prepared to estimate the sales revenue, production units, materials purchases or…

Q: During 2012, Honey company purchased marketable equity securities for P3,700,000 to be held as…

A: The unrealized loss is a loss that is recorded by the company when the market value of the…

Q: A home office ships inventory to its branch at 125% of cost. The required balance of the Deferred…

A: Head office means from where the company mainly operate and all branches are controlled from that…

Q: Keshara has the following net § 1231 results for each of the years shown: Tax Year Net § 1231 Loss…

A: Amount treated as long term capital gain = Cumulative total of net 1231 gain - Cumulative total of…

Q: Overhead Budget Johnston Company cleans and applies powder coat paint to metal items on a job-order…

A: The variable overheads are the indirect cost related to the production of a product. The variable…

Q: Direct Materials Purchases Budget FlashKick Company manufactures and sells soccer balls for teams…

A: Direct materials are those materials and supplies used during the manufacturing process of a…

Q: On November 29, 20x1, ABC Co. placed a non-cancellable purchase order for the importation of a…

A: FOB shipping terms says that goods are meant to be shipped or delivered when these are shipped from…

Q: Ping Company provided the following information with respect to its building: The building was…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: DIDAL Company owns a ranch which produces the livestock which it uses in its meat processing…

A: Current Liabilities are those dues and obligations which needs to be settled or being paid out by…

Q: On Jan 1, 20X1, ABC Corp received a P450,000 3-year note from a customer. The principal and interest…

A: Note receivable is one of the current asset of the business. It means note for which amount of cash…

Q: Jax Company provides an incentive compensation plan under which its president received a bonus equal…

A: Amount of the bonus = 10% x income before income tax but after deduction of the bonus…

Q: General Merchandising Co. Selling price is P2,750, Selling expenses is P500 and the Cost to sell s…

A: As per IAS 2 Inventories, Inventory is to be measured at lower of cost or Net Realizable value Net…

Q: Bowie Sporting Goods manufactures sleeping bags. The manufacturing standards per sleeping bag, based…

A: 1 Standard data is calculated by considering budgeted data and using actual data. 2 Variance…

Q: At the end of that time the equipment will be worthless. Assuming an interest rate of three percent,…

A: Net Present Value (NPV) Net Present Value (NPV) is the value of all future cash flows (positive and…

Q: Which of the above should be chosen?

A: As the factor to choose the alternatives is not given, we shall use the NPV method to determine…

Q: Leody Company purchased a machine on December 1, 2020 at an invoice price of P4,500,000 with terms…

A: Accumulated depreciation is the total amount of depreciation which is charged on the machine.…

Q: The Walton Toy Company manufactures a line of dolls and a sewing kit. Demand for the company's…

A: As per the norms of Bartleby, in case of multiple sub parts been asked per question, the answer to…

Q: Pretax financial income $480,000 Estimated litigation expense 325,000 Installment sales (220,000)…

A: GIVEN Pretax financial income $ 480,000 Estimated litigation expense 325,000 Installment sales…

Q: Ending Finished Goods Inventory Budget Play-Disc makes Frisbee-type plastic discs. Each 12-inch…

A:

Q: The ABD Company began operations several years ago. The company purchased a building and, since only…

A:

Q: Assume the following information for one of a company's variable expenses: • The actual amount of…

A: Activity Variance= Flexible Budget- Planned Budget where, Planned Budget = Actual amount of expense…

Q: Piedmont Company sells one cell phone for $500. The contribution margin is $300. What is the…

A: Lets understand the basics. Contribution margin ratio indicates contribution generated compare to…

Q: can you please explain this adjusting entry that occured per letter (letter A, B, C) i kind of dont…

A: Adjusting entries are those journal entries which are passed at the end of the period in order to…

Q: Define the position of a net creditor

A: After reconciling all of the financial transactions conducted between it and the rest of the world,…

Q: BELOW ARE SOME DATA OF THE INCOME STATEMENT ACCOUNTS OF WISHING WELL COMPANY FOR THE YEAR ENDED DEC…

A: Hi student Since there are multiple questions, we will answer only first question. Since first…

Q: Given the following information, compute the current ratio Cash $ 120,000 Accounts receivable…

A: Introduction: Current ratio : Current ratio tells the ability of the company to company its short…

Q: Billa Corporation bases its predetermined overhead rate on variable manufacturing overhead cost of…

A: Predetermined overhead rate is calculated by dividing total manufacturing cost overhead cost by…

Q: Account title in General Ledger of this transaction? -

A: In accounting, account title refers to a unique name given to a particular account for its…

Q: On July 1, 20X1, ABC Corp received a P450,000 10% 3-year note from a customer. The principal and…

A:

Q: Cliff Company traded in an old truck for a new one. The old truck had a cost of $77,000 and…

A: Note: When there is commercial substance exist in the exchange of assets transaction, then new…

Q: Crescent Company produces stuffed toy animals; one of these is “Arabeau the Cow.” Each Arabeau takes…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Department A of Forbidden Company furnishes you with the following data: Started in process- 20,000…

A: Solution: Equivalent units of material = Units completed and transferred out + Units in ending WIP *…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Financial leverage MicrosoCortrepotied (MSFT) reported the following data (in millions) for a tern year Compute the profit margin, asset turnover, and financial leverage metrics using the expandedDuPont formula. Round profit margin, asset turnover, and financial leverage to two decimalplaces.Round return on stockholders’ equity to one decimal place.Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 60%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 40%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of the firm vary under each policy?Make the following Assumptions: Tangible Asset Value = 16,200,000 Required Return on Tangile Assets = 16% Required Return on Equity = 24% Forecast Net Income for next period (year) = 4,800,000 Capitalization Rate for Excess earnings to compute Intangible Asset Value = 30% Current Market Value of Interest Bearing Liabilities = 12,000,000 Compute the Market Value of Equity using the Excess Earnings Approach

- Consider the following informationYear Profit Ending book value of assets Ending book value of debt1 $100 $1 030 $7202 $120 $1 060 $7403 $60 $1 000 $800At the end of year t, the company’s book value of assets and debt are $1 000 and $700, respectively. The analyst expects that after year t+3 profit will be $0 and the book values of assets and debts will not change from the prior year. The cost of equity (WACC) is 10 per cent. Calculate the present value of free cash flows for the end of each year.Q1) Omani Industrial Company has the following data which is extracting from its financial statements at the beginning 2020. Calculate the following ratios :-( Note; -Write all Equations). Return on Equity (ROE). Total Asset Turnover (TAT). Debt Ratio. Net Profit Margin 12% Sales 2000 Thousand (OMR) Financial Leverage Multiplier 2.5 Times Return on Asset (ROA) 10 %For the year ended December 31, 2022, Settles Incorporated earned an ROI of 10.5%. Sales for the year were $9 million, and average asset turnover was 2.1. Average stockholders' equity was $2.8 million. Required: Calculate Settles Incorporated's margin and net income. Note: Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000. Calculate Settles Incorporated's return on equity. Note: Round your answer to 1 decimal place.

- Year-to-date, Company O had earned a −2.10 percent return. During the same time period, Company V earned 8.00 percent and Company M earned 6.25 percent. If you have a portfolio made up of 40 percent Company O, 30 percent Company V, and 30 percent Company M, what is your portfolio return? A firm has EBIT of $1,000,000 and depreciation expense of $400,000. Fixed charges total $600,000. Interest expense totals $70,000. What is the firm's cash coverage ratio? Linda invested $100 in a bank account earning 2% compounded annually. How much was her balance at the end of five years? Enter your answer in dollars and cents, without the $.Q1) Omani Industrial Company has the following data which is extracting from its financial statements at the beginning 2020. Calculate the following ratios :-( Note; -Write all Equations). Return on Equity (ROE). Total Asset Turnover (TAT). Debt Ratio. Net Profit Margin 12% Sales 2000 (OMR) Financial Leverage Multiplier 2.5 Times Return on Asset (ROA) 10 %Calculate the projected price/earnings ratio and market/book ratio. Explain whether these ratios indicate that investors will be expected to have a high or low opinion of the company. Computron's Balance Sheets (Millions of Dollars) 2019 2020 Assets Cash and equivalents $ 60 $ 50 Short-term investments 100 10 Accounts receivable 400 520 Inventories 620 820 Total current assets $ 1,180 $ 1,400 Gross fixed assets $ 3,900 $ 4,820 Less: Accumulated depreciation 1,000 1,320 Net fixed assets $ 2,900 $ 3,500 Total assets $ 4,080 $ 4,900 Liabilities and equity Accounts payable $ 300 $ 400 Notes payable 50 250 Accruals 200 240 Total current liabilities $ 550 $ 890 Long-term bonds 800 1,100 Total liabilities $ 1,350 $ 1,990 Common stock 1,000 1,000 Retained earnings 1,730 1,910 Total equity $ 2,730 $ 2,910 Total liabilities and equity $ 4,080 $ 4,900…

- If the net working capital required is 83.3 and the difference between current assets and current liabilities is 70, then what is the contingency rate? Select one: a. 0.190 b. 1.190 c. 0.160 d. All the given choices are not correct e. 0.27 Use the following information from Salalah Mills Company to calculate Compounded Annual Growth Rate (CAGR). Beginning value=OMR. 590, End of Year 1= OMR 610, End of Year 2=OMR 640, End of Year 3=OMR 660, End of Year 4= OMR 680. Select one: a. None of the options b. 3.61% c. 2.35% d. 2.50% e. 3.10%What is the net asset value of an investment company with $10,100,000 in assets, $630,000 in current liabilities, and 1,150,000 shares outstanding? Round your answer to the nearest cent. A- Percentage return %? B-The annual compound rate of return %?From the following forecast the Balance sheet for the year 2021Balance sheet as of 31/12/2020Liabilities& Equity AmountAssetsAmountEquity33,000 Plant and machinery 10,000Retained earnings 10,000 Land Property20.000Accounts payable 7,000 Accounts receivables 3.000Inventories10.000Cash in hand2000Cash at Bank5.00050,00050,0001. It is expected that the company will make a net income of10% of forecasted sales2. The company will purchase additional 5000 OMR worthmachines by taking an additional loan of 5000 OMR3. Forecasted sales OMR 100,0004. Dividend payout will be 50%5. The following estimates are also given;Accounts payable 10,000Accounts receivable 6,000Inventories 15,000Cash in hand 6.000Cash at bank 1,000