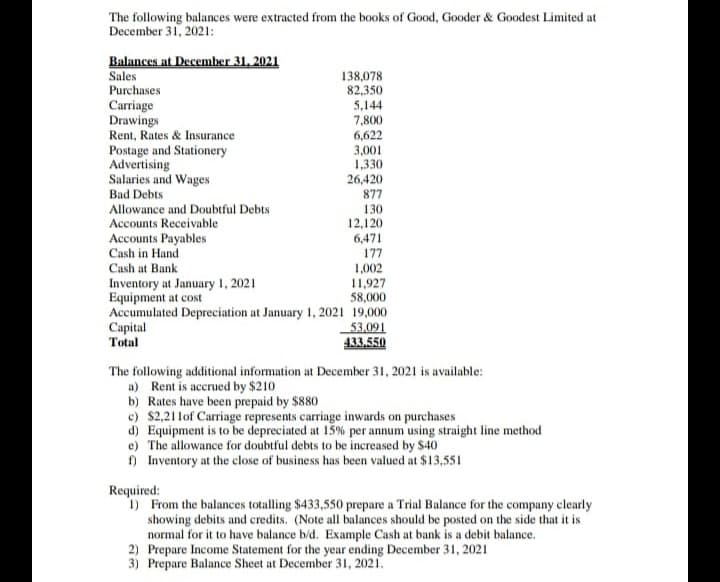

The following balances were extracted from the books of Good, Gooder & Goodest Limited at December 31, 2021: Balances at December 31, 2021 Sales 138,078 Purchases 82,350 Carriage 5,144 Drawings 7,800 Rent, Rates & Insurance 6,622 3,001 Postage and Stationery Advertising 1,330 Salaries and Wages 26,420 Bad Debts 877 Allowance and Doubtful Debts 130 Accounts Receivable 12,120 Accounts Payables 6,471 Cash in Hand 177 Cash at Bank 1,002 Inventory at January 1, 2021 11,927 Equipment at cost 58,000 Accumulated Depreciation at January 1, 2021 19,000 Capital 53,091 Total 433.550 The following additional information at December 31, 2021 is available: a) Rent is accrued by $210 b) Rates have been prepaid by $880 c) $2,211 of Carriage represents carriage inwards on purchases d) Equipment is to be depreciated at 15% per annum using straight line method e) The allowance for doubtful debts to be increased by $40 f) Inventory at the close of business has been valued at $13,551 Required: 1) From the balances totalling $433,550 prepare a Trial Balance for the company clearly showing debits and credits. (Note all balances should be posted on the side that it is normal for it to have balance b/d. Example Cash at bank is a debit balance. 2) Prepare Income Statement for the year ending December 31, 2021 3) Prepare Balance Sheet at December 31, 2021.

The following balances were extracted from the books of Good, Gooder & Goodest Limited at December 31, 2021: Balances at December 31, 2021 Sales 138,078 Purchases 82,350 Carriage 5,144 Drawings 7,800 Rent, Rates & Insurance 6,622 3,001 Postage and Stationery Advertising 1,330 Salaries and Wages 26,420 Bad Debts 877 Allowance and Doubtful Debts 130 Accounts Receivable 12,120 Accounts Payables 6,471 Cash in Hand 177 Cash at Bank 1,002 Inventory at January 1, 2021 11,927 Equipment at cost 58,000 Accumulated Depreciation at January 1, 2021 19,000 Capital 53,091 Total 433.550 The following additional information at December 31, 2021 is available: a) Rent is accrued by $210 b) Rates have been prepaid by $880 c) $2,211 of Carriage represents carriage inwards on purchases d) Equipment is to be depreciated at 15% per annum using straight line method e) The allowance for doubtful debts to be increased by $40 f) Inventory at the close of business has been valued at $13,551 Required: 1) From the balances totalling $433,550 prepare a Trial Balance for the company clearly showing debits and credits. (Note all balances should be posted on the side that it is normal for it to have balance b/d. Example Cash at bank is a debit balance. 2) Prepare Income Statement for the year ending December 31, 2021 3) Prepare Balance Sheet at December 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 6E: Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown...

Related questions

Question

Transcribed Image Text:The following balances were extracted from the books of Good, Gooder & Goodest Limited at

December 31, 2021:

Balances at December 31, 2021

Sales

138,078

Purchases

82,350

Carriage

5,144

Drawings

7,800

Rent, Rates & Insurance.

6,622

3,001

Postage and Stationery

Advertising

1,330

Salaries and Wages

26,420

Bad Debts

877

Allowance and Doubtful Debts

130

Accounts Receivable

12,120

Accounts Payables

Cash in Hand

6,471

177

Cash at Bank

1,002

Inventory at January 1, 2021

11,927

Equipment at cost

58,000

Accumulated Depreciation at January 1, 2021 19,000

Capital

53,091

Total

433.550

The following additional information at December 31, 2021 is available:

a) Rent is accrued by $210

b) Rates have been prepaid by $880

c) $2,211 of Carriage represents carriage inwards on purchases

d) Equipment is to be depreciated at 15% per annum using straight line method

e) The allowance for doubtful debts to be increased by $40

f) Inventory at the close of business has been valued at $13,551

Required:

1) From the balances totalling $433,550 prepare a Trial Balance for the company clearly

showing debits and credits. (Note all balances should be posted on the side that it is

normal for it to have balance b/d. Example Cash at bank is a debit balance.

2) Prepare Income Statement for the year ending December 31, 2021

3) Prepare Balance Sheet at December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning