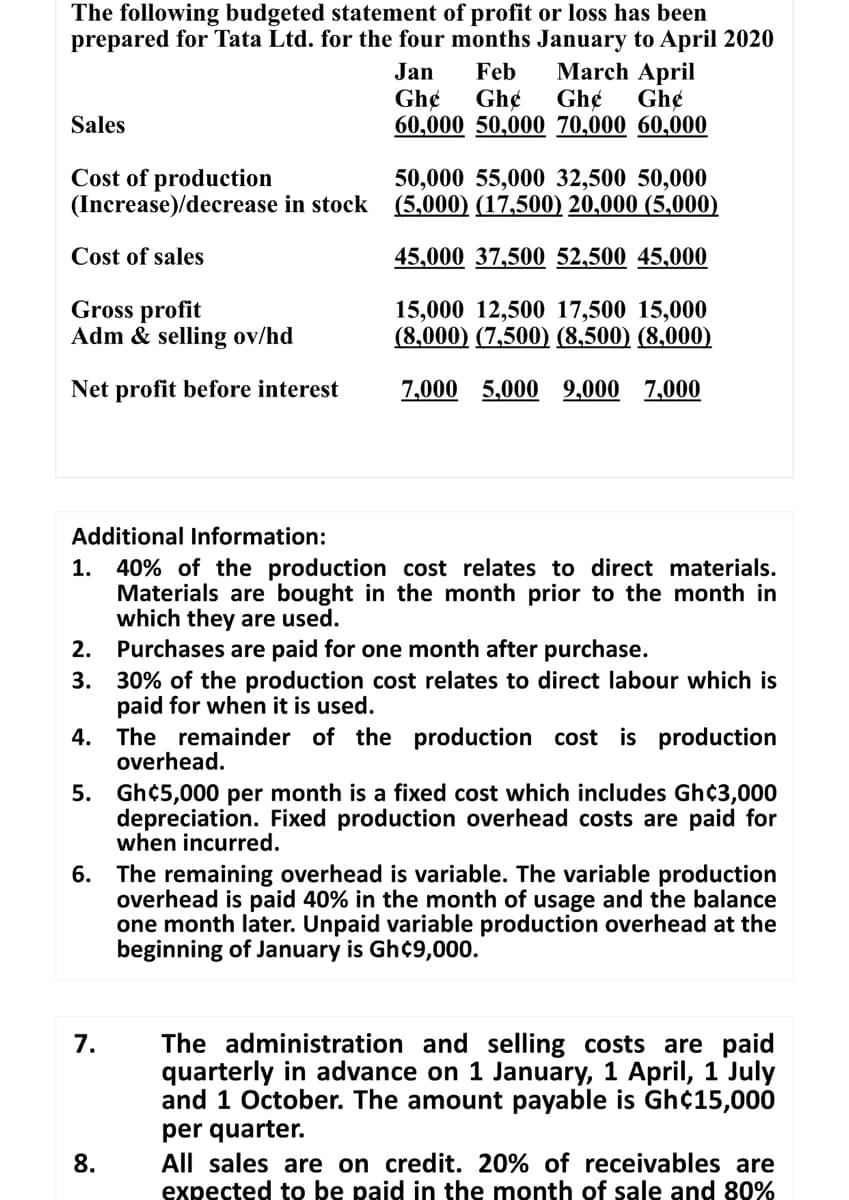

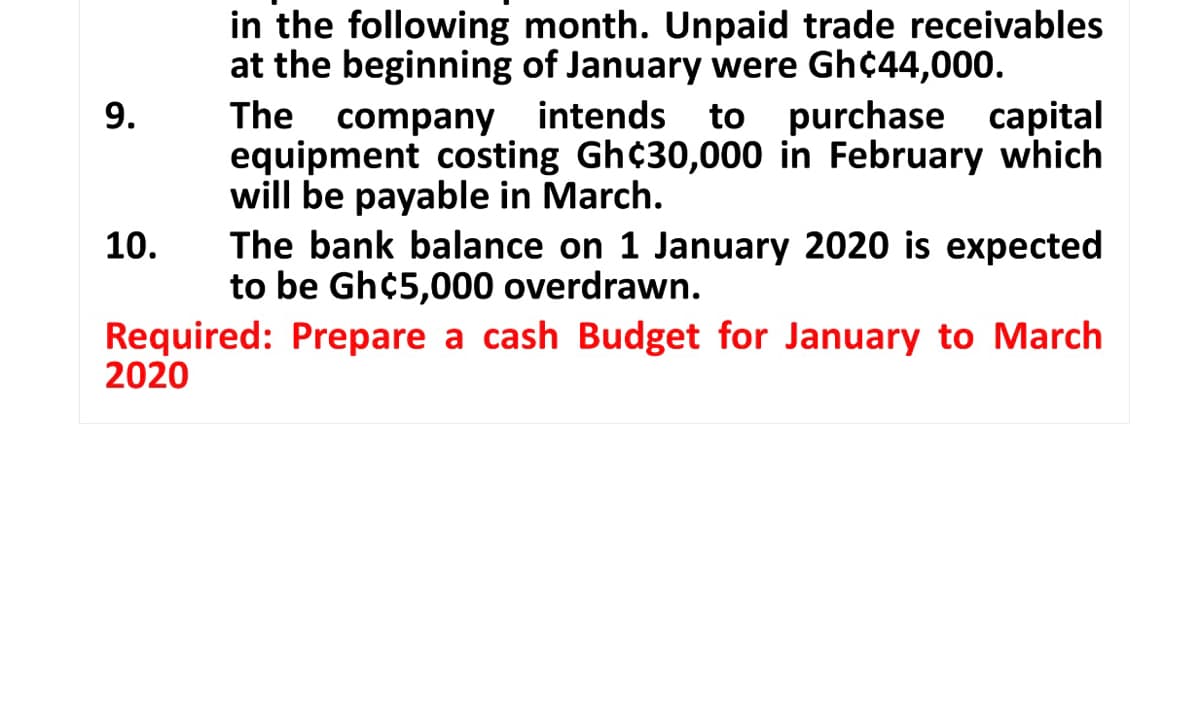

The following budgeted statement of profit or loss has been prepared for Tata Ltd. for the four months January to April 2020 March April Gh¢ Jan Feb Gh¢ Gh¢ 60,000 50,000 70,000 60,000 Gh¢ Sales Cost of production (Increase)/decrease in stock (5,000) (17,500) 20,000 (5,000) 50,000 55,000 32,500 50,000 Cost of sales 45,000 37,500 52,500 45,000 Gross profit Adm & selling ov/hd 15,000 12,500 17,500 15,000 (8,000) (7,500) (8,500) (8,000) Net profit before interest 7,000 5.000 9,000 7,000 Additional Information: 1. 40% of the production cost relates to direct materials. Materials are bought in the month prior to the month in which they are used. 2. Purchases are paid for one month after purchase. 3. 30% of the production cost relates to direct labour which is paid for when it is used. 4. The remainder of the production cost is production overhead. 5. Gh¢5,000 per month is a fixed cost which includes Gh¢3,000 depreciation. Fixed production overhead costs are paid for when incurred. 6. The remaining overhead is variable. The variable production overhead is paid 40% in the month of usage and the balance one month later. Unpaid variable production overhead at the beginning of January is Gh¢9,000. The administration and selling costs are paid quarterly in advance on 1 January, 1 April, 1 July and 1 October. The amount payable is Gh¢15,000 per quarter. All sales are on credit. 20% of receivables are 7. 8.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 3 steps with 2 images