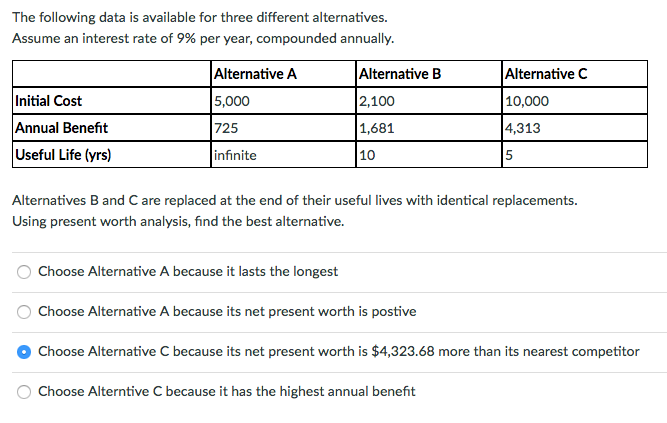

The following data is available for three different alternatives. Assume an interest rate of 9% per year, compounded annually. Alternative A 5,000 725 infinite Initial Cost Annual Benefit Useful Life (yrs) Alternative B Choose Alternative A because it lasts the longest 2,100 1,681 10 Alternative C 10,000 4,313 5 Alternatives B and C are replaced at the end of their useful lives with identical replacements. Using present worth analysis, find the best alternative.

The following data is available for three different alternatives. Assume an interest rate of 9% per year, compounded annually. Alternative A 5,000 725 infinite Initial Cost Annual Benefit Useful Life (yrs) Alternative B Choose Alternative A because it lasts the longest 2,100 1,681 10 Alternative C 10,000 4,313 5 Alternatives B and C are replaced at the end of their useful lives with identical replacements. Using present worth analysis, find the best alternative.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

Please no written by hand solution

Transcribed Image Text:The following data is available for three different alternatives.

Assume an interest rate of 9% per year, compounded annually.

Alternative A

5,000

725

infinite

Initial Cost

Annual Benefit

Useful Life (yrs)

Alternative B

2,100

1,681

10

Choose Alternative A because it lasts the longest

Alternatives B and C are replaced at the end of their useful lives with identical replacements.

Using present worth analysis, find the best alternative.

Alternative C

10,000

4,313

5

Choose Alternative A because its net present worth is postive

Choose Alternative C because its net present worth is $4,323.68 more than its nearest competitor

Choose Alterntive C because it has the highest annual benefit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning