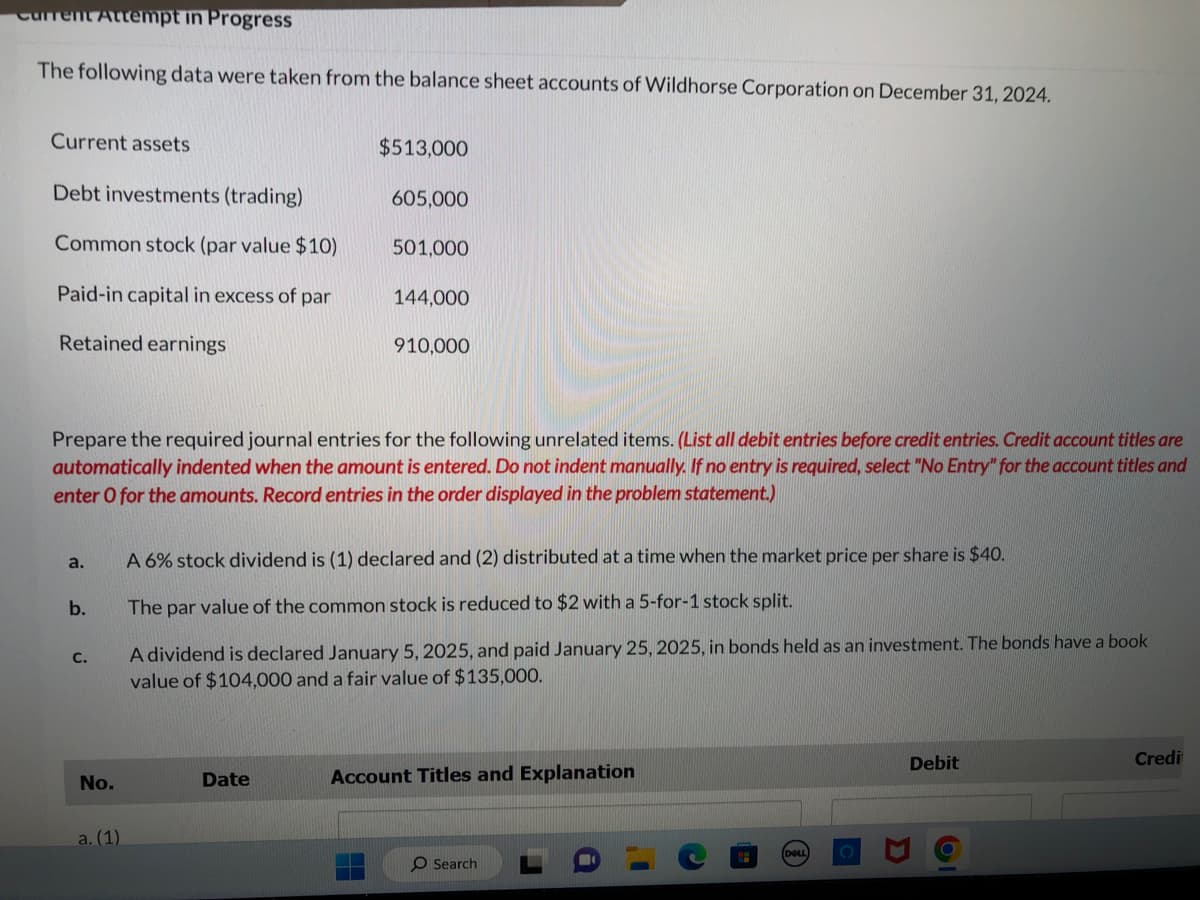

The following data were taken from the balance sheet accounts of Wildhorse Corporation on December 31, 2024. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings a. b. $513,000 C. 605,000 501,000 Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit account titles an automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles an enter o for the amounts. Record entries in the order displayed in the problem statement.) 144,000 910,000 A 6% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $40. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds have a book value of $104,000 and a fair value of $135,000.

The following data were taken from the balance sheet accounts of Wildhorse Corporation on December 31, 2024. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings a. b. $513,000 C. 605,000 501,000 Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit account titles an automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles an enter o for the amounts. Record entries in the order displayed in the problem statement.) 144,000 910,000 A 6% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $40. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds have a book value of $104,000 and a fair value of $135,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 17P: Comprehensive: Income Statement and Supporting Schedules The following s a partial list of the...

Related questions

Topic Video

Question

100%

Transcribed Image Text:current Attempt in Progress

The following data were taken from the balance sheet accounts of Wildhorse Corporation on December 31, 2024.

Current assets

Debt investments (trading)

Common stock (par value $10)

Paid-in capital in excess of par

Retained earnings

a.

b.

C.

No.

Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter o for the amounts. Record entries in the order displayed in the problem statement.)

a. (1)

$513,000

605,000

Date

501,000

144,000

910,000

A 6% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $40.

The par value of the common stock is reduced to $2 with a 5-for-1 stock split.

A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds have a book

value of $104,000 and a fair value of $135,000.

Account Titles and Explanation

O Search

DELL

Debit

Credi

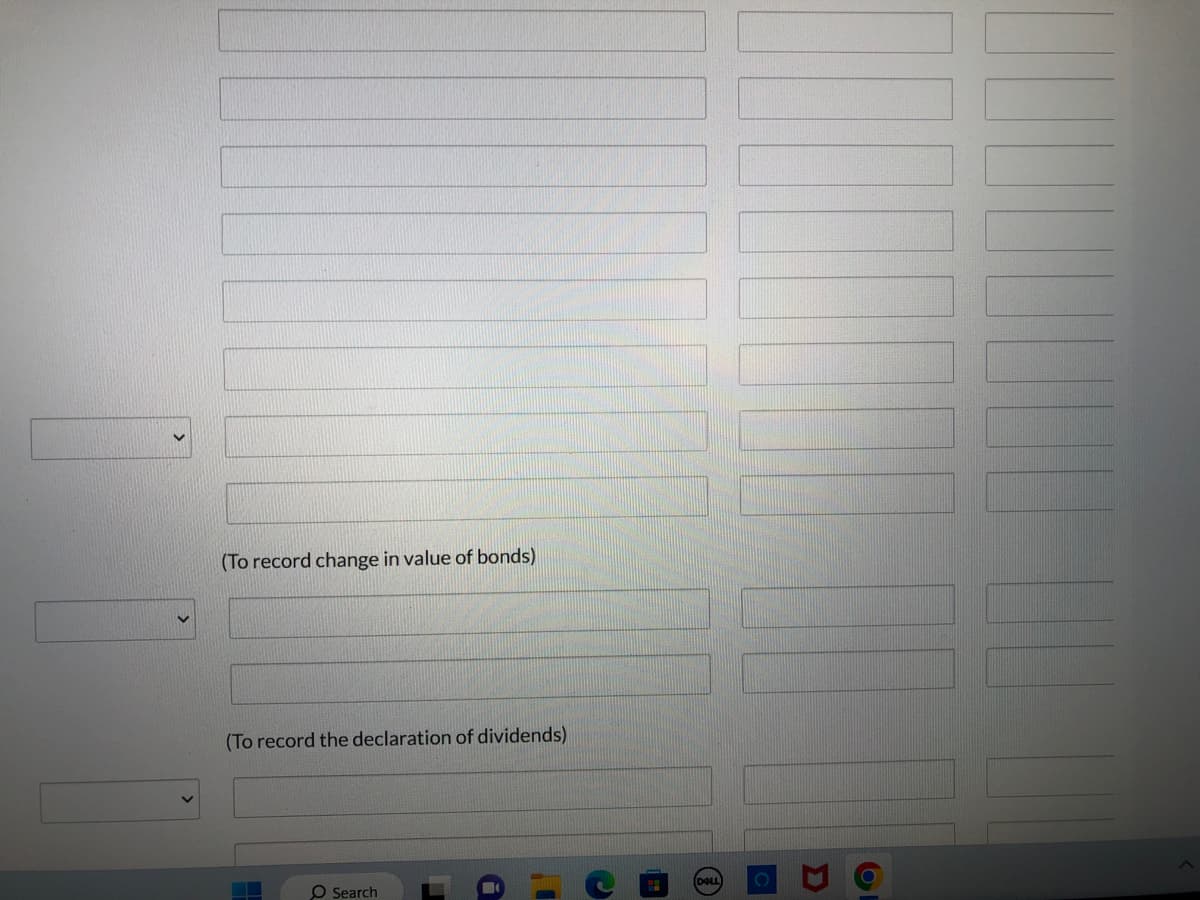

Transcribed Image Text:(To record change in value of bonds)

(To record the declaration of dividends)

H

O Search

1

C

DELL

11

D

o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub