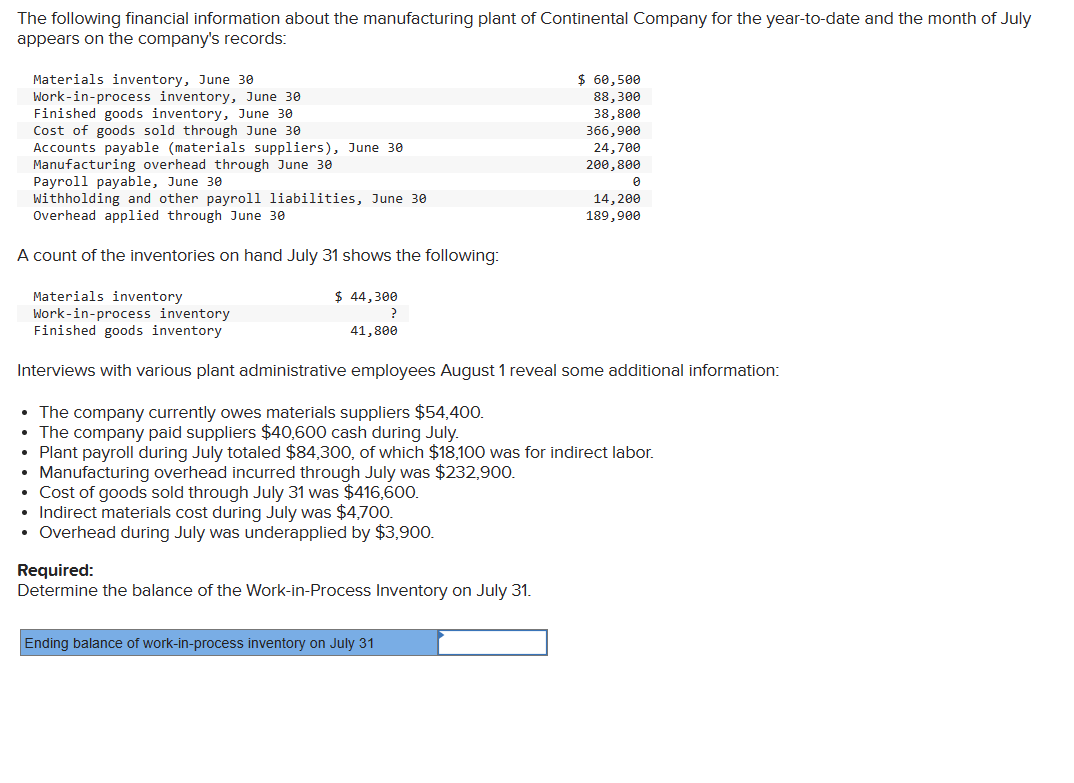

The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 Finished goods inventory, June 30 Cost of goods sold through June 30 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 A count of the inventories on hand July 31 shows the following: $ 44,300 ? 41,800 Materials inventory Work-in-process inventory Finished goods inventory Interviews with various plant administrative employees August 1 reveal some additional information: • The company currently owes materials suppliers $54,400. • The company paid suppliers $40,600 cash during July. Plant payroll during July totaled $84,300, of which $18,100 was for indirect labor. Manufacturing overhead incurred through July was $232,900. • Cost of goods sold through July 31 was $416,600. Indirect materials cost during July was $4,700. • Overhead during July was underapplied by $3,900. Required: Determine the balance of the Work-in-Process Inventory on July 31. $ 60,500 88,300 38,800 366,900 24,700 200,800 Ending balance of work-in-process inventory on July 31 0 14, 200 189,900

The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 Finished goods inventory, June 30 Cost of goods sold through June 30 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 A count of the inventories on hand July 31 shows the following: $ 44,300 ? 41,800 Materials inventory Work-in-process inventory Finished goods inventory Interviews with various plant administrative employees August 1 reveal some additional information: • The company currently owes materials suppliers $54,400. • The company paid suppliers $40,600 cash during July. Plant payroll during July totaled $84,300, of which $18,100 was for indirect labor. Manufacturing overhead incurred through July was $232,900. • Cost of goods sold through July 31 was $416,600. Indirect materials cost during July was $4,700. • Overhead during July was underapplied by $3,900. Required: Determine the balance of the Work-in-Process Inventory on July 31. $ 60,500 88,300 38,800 366,900 24,700 200,800 Ending balance of work-in-process inventory on July 31 0 14, 200 189,900

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12PB: The following data summarize the operations during the year. Prepare a journal entry for each...

Related questions

Question

Do not give image format

Transcribed Image Text:The following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July

appears on the company's records:

Materials inventory, June 30

Work-in-process inventory, June 30

Finished goods inventory, June 30

Cost of goods sold through June 30

Accounts payable (materials suppliers), June 30

Manufacturing overhead through June 30

Payroll payable, June 30

Withholding and other payroll liabilities, June 30

Overhead applied through June 30

A count of the inventories on hand July 31 shows the following:

Materials inventory

Work-in-process inventory

Finished goods inventory

$ 44,300

?

41,800

• Manufacturing overhead incurred through July was $232,900.

• Cost of goods sold through July 31 was $416,600.

Interviews with various plant administrative employees August 1 reveal some additional information:

The company currently owes materials suppliers $54,400.

The company paid suppliers $40,600 cash during July.

• Plant payroll during July totaled $84,300, of which $18,100 was for indirect labor.

• Indirect materials cost during July was $4,700.

Overhead during July was underapplied by $3,900.

Required:

Determine the balance of the Work-in-Process Inventory on July 31.

$ 60,500

88,300

38,800

366,900

24,700

200,800

Ending balance of work-in-process inventory on July 31

0

14,200

189,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,