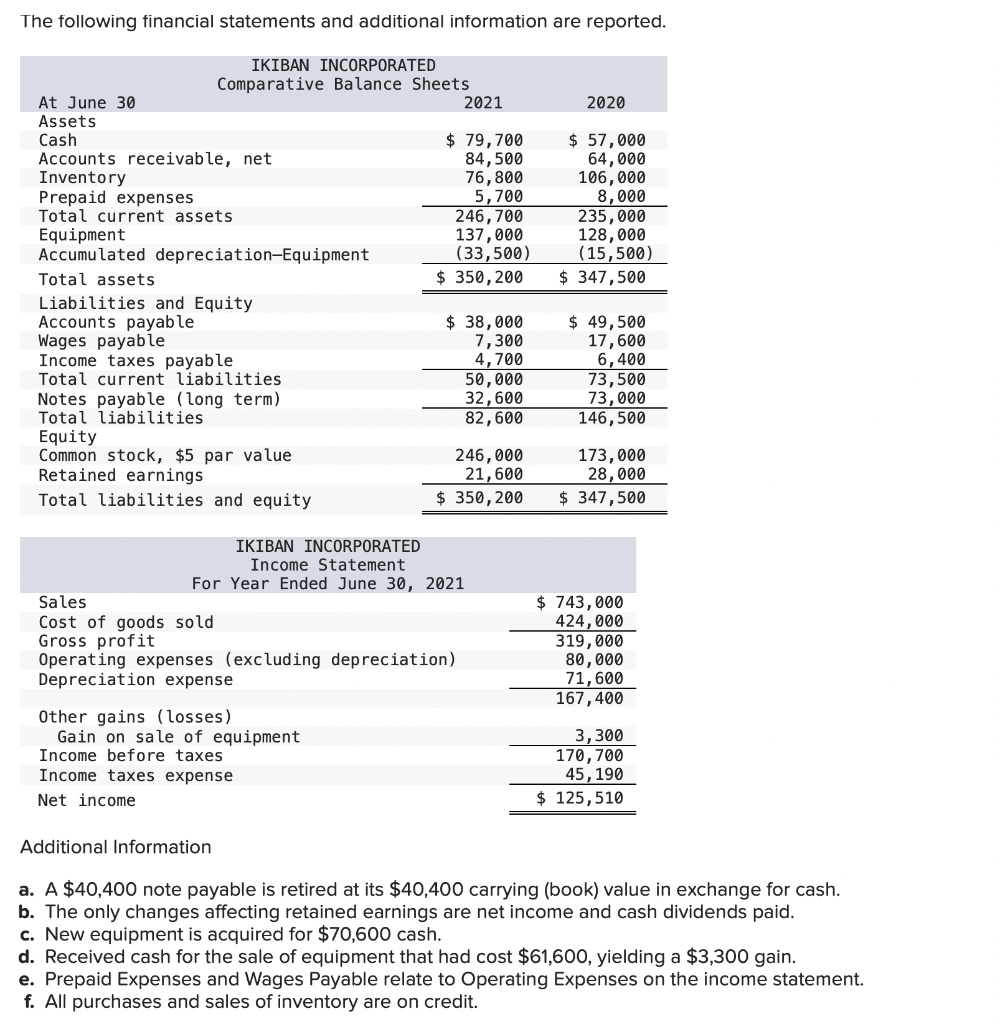

The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets 2021 At June 30 Assets 2020 Cash Accounts receivable, net Inventory Prepaid expenses Total current assets $ 79,700 84,500 76,800 5,700 246,700 137,000 (33,500) $ 350,200 $ 57,000 64,000 106,000 8,000 235,000 128,000 (15,500) $ 347,500 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities $38,000 7,300 4,700 50,000 32,600 82,600 $ 49,500 17,600 6,400 73,500 73,000 146,500 Equity Common stock, $5 par value Retained earnings Total liabilities and equity 246,000 21,600 $ 350,200 173,000 28,000 $ 347,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 $ 743,000 424,000 319,000 80,000 71,600 167,400 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Other gains (losses) Gain on sale of equipment Income before taxes 3,300 170,700 45,190 $ 125,510 Income taxes expense Net income Additional Information a. A $40,400 note payable is retired at its $40,400 carrying (book) value in exchange for b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $70,600 cash. d. Received cash for the sale of equipment that had cost $61,600, yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income sta f. All purchases and sales of inventory are on credit.

The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets 2021 At June 30 Assets 2020 Cash Accounts receivable, net Inventory Prepaid expenses Total current assets $ 79,700 84,500 76,800 5,700 246,700 137,000 (33,500) $ 350,200 $ 57,000 64,000 106,000 8,000 235,000 128,000 (15,500) $ 347,500 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities $38,000 7,300 4,700 50,000 32,600 82,600 $ 49,500 17,600 6,400 73,500 73,000 146,500 Equity Common stock, $5 par value Retained earnings Total liabilities and equity 246,000 21,600 $ 350,200 173,000 28,000 $ 347,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 $ 743,000 424,000 319,000 80,000 71,600 167,400 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Other gains (losses) Gain on sale of equipment Income before taxes 3,300 170,700 45,190 $ 125,510 Income taxes expense Net income Additional Information a. A $40,400 note payable is retired at its $40,400 carrying (book) value in exchange for b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $70,600 cash. d. Received cash for the sale of equipment that had cost $61,600, yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income sta f. All purchases and sales of inventory are on credit.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.17E: Financial statements Each of the following items is shown in the financial statements of ExxonMobil...

Related questions

Topic Video

Question

Transcribed Image Text:The following financial statements and additional information are reported.

IKIBAN INCORPORATED

Comparative Balance Sheets

2021

At June 30

Assets

Cash

Accounts receivable, net

Inventory

Prepaid expenses

Total current assets

2020

$ 79,700

84,500

76,800

5,700

246,700

137,000

(33,500)

$ 350,200

$ 57,000

64,000

106,000

8,000

235,000

128,000

(15,500)

$ 347,500

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Wages payable

Income taxes payable

Total current liabilities

$ 38,000

7,300

4,700

50,000

32,600

82,600

$ 49,500

17,600

6,400

73,500

73,000

146,500

Notes payable (long term)

Total liabilities

Equity

Common stock, $5 par value

Retained earnings

Total liabilities and equity

173,000

28,000

$ 347,500

246,000

21,600

$ 350,200

IKIBAN INCORPORATED

Income Statement

For Year Ended June 30, 2021

$ 743,000

424,000

319,000

80,000

71,600

167,400

Sales

Cost of goods sold

Gross profit

Operating expenses (excluding depreciation)

Depreciation expense

Other gains (losses)

Gain on sale of equipment

Income before taxes

Income taxes expense

3,300

170,700

45,190

$ 125,510

Net income

Additional Information

a. A $40,400 note payable is retired at its $40,400 carrying (book) value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $70,600 cash.

d. Received cash for the sale of equipment that had cost $61,600, yielding a $3,300 gain.

e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement.

f. All purchases and sales of inventory are on credit.

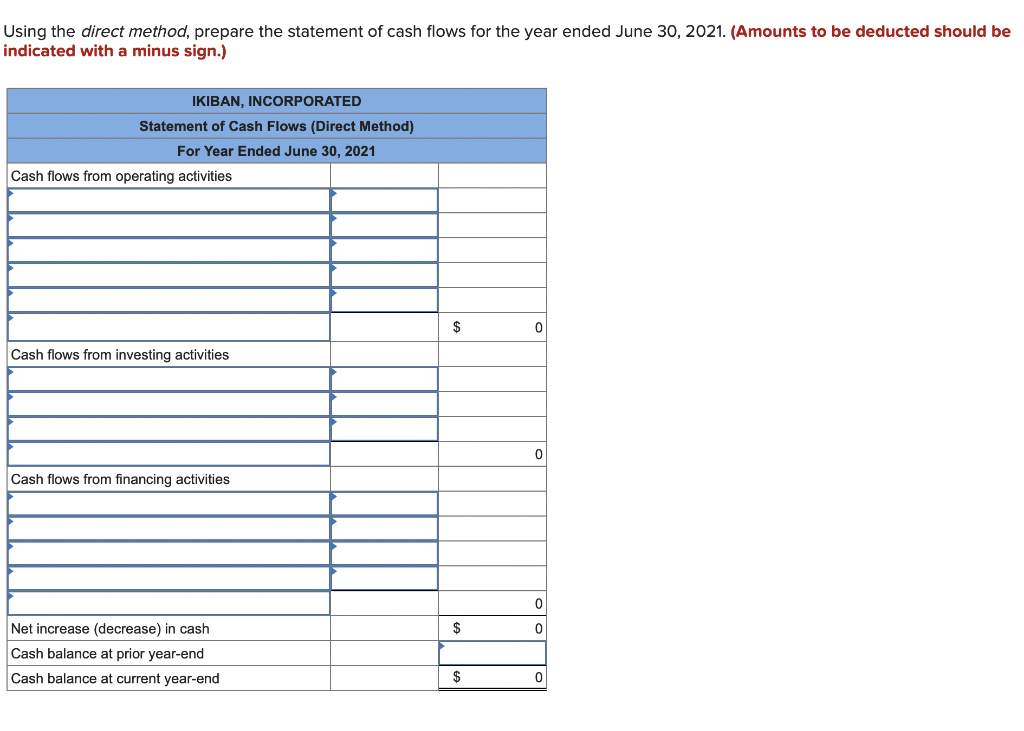

Transcribed Image Text:Using the direct method, prepare the statement of cash flows for the year ended June 30, 2021. (Amounts to be deducted should be

indicated with a minus sign.)

IKIBAN, INCORPORATED

Statement of Cash Flows (Direct Method)

For Year Ended June 30, 2021

Cash flows from operating activities

$

Cash flows from investing activities

Cash flows from financing activities

Net increase (decrease) in cash

$

Cash balance at prior year-end

Cash balance at current year-end

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning