The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANY Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) 2021 2020 Assets Cash Accounts receivable Short-term investment Inventory Land Buildings and equipment Less: Accumulated depreciation $ $ 167 64 168 126 785 149 125 170 25 165 155 590 (229) (170) $1,230 1,060 Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings 50 $ 54 4 3 10 39 290 368 460 390 219 195 119 74 $1,230 $1,060 WRIGHT COMPANY Income Statement For Year Ended December 31, 2021 ($ in thousands) Revenues: Sales revenue $680 Expenses: Cost of goods sold Salaries expense Depreciation $320 90 59 expense Interest expense Loss on sale of land Income tax expense 11 97 580 Net income $100 Additional information from the accounting records: a. Land that originally cost $29,000 was sold for $26,000. b. The common stock of Microsoft Corporation was purchased for $39,000 as a short-term investment not classified as a cash equivalent. c. New equipment was purchased for $195,000 cash. d. A $39,000 note was paid at maturity on January 1. e. On January 1, 2021, bonds were sold at their $78,000 face value. f. Common stock ($70,000 par) was sold for $94,000. g. Net income was $100,000 and cash dividends of $55,000 were paid to shareholders.

The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANY Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) 2021 2020 Assets Cash Accounts receivable Short-term investment Inventory Land Buildings and equipment Less: Accumulated depreciation $ $ 167 64 168 126 785 149 125 170 25 165 155 590 (229) (170) $1,230 1,060 Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings 50 $ 54 4 3 10 39 290 368 460 390 219 195 119 74 $1,230 $1,060 WRIGHT COMPANY Income Statement For Year Ended December 31, 2021 ($ in thousands) Revenues: Sales revenue $680 Expenses: Cost of goods sold Salaries expense Depreciation $320 90 59 expense Interest expense Loss on sale of land Income tax expense 11 97 580 Net income $100 Additional information from the accounting records: a. Land that originally cost $29,000 was sold for $26,000. b. The common stock of Microsoft Corporation was purchased for $39,000 as a short-term investment not classified as a cash equivalent. c. New equipment was purchased for $195,000 cash. d. A $39,000 note was paid at maturity on January 1. e. On January 1, 2021, bonds were sold at their $78,000 face value. f. Common stock ($70,000 par) was sold for $94,000. g. Net income was $100,000 and cash dividends of $55,000 were paid to shareholders.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 15E

Related questions

Question

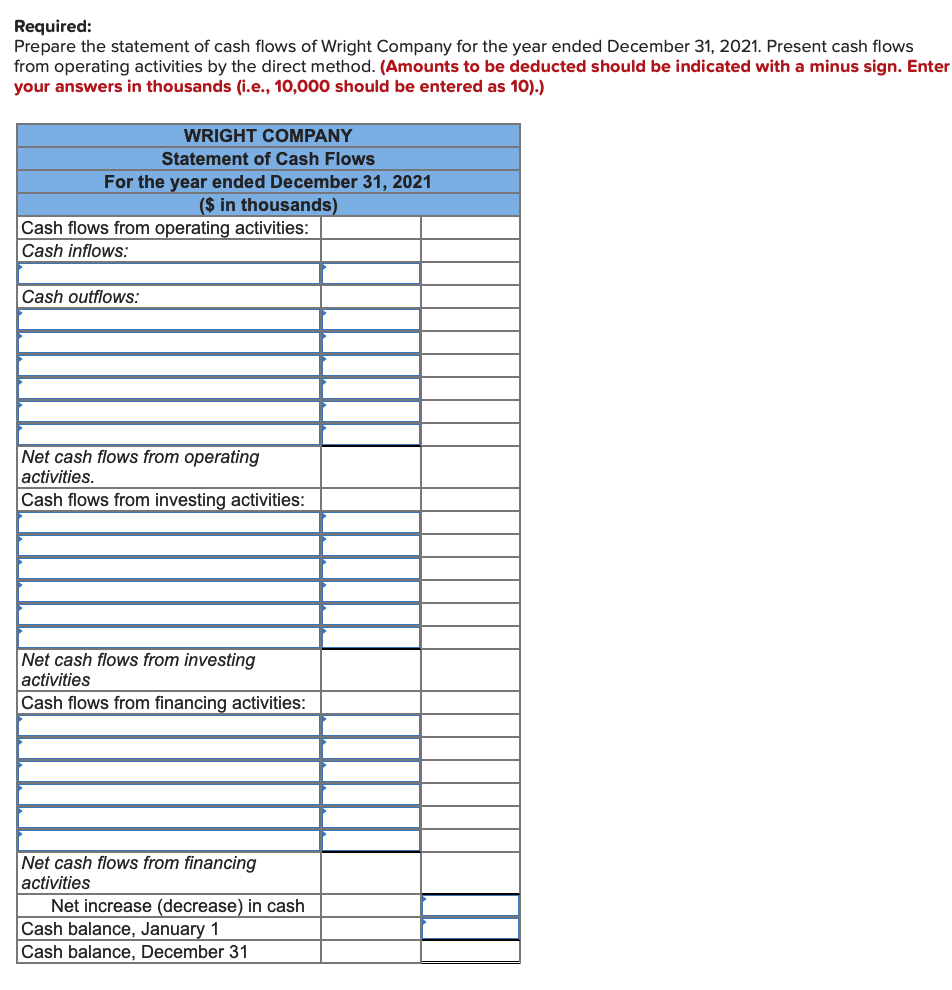

Transcribed Image Text:Required:

Prepare the statement of cash flows of Wright Company for the year ended December 31, 2021. Present cash flows

from operating activities by the direct method. (Amounts to be deducted should be indicated with a minus sign. Enter

your answers in thousands (i.e., 10,000 should be entered as 10).)

WRIGHT COMPANY

Statement of Cash Flows

For the year ended December 31, 2021

($ in thousands)

Cash flows from operating activities:

Cash inflows:

Cash outflows:

Net cash flows from operating

activities.

Cash flows from investing activities:

Net cash flows from investing

activities

Cash flows from financing activities:

Net cash flows from financing

activities

Net increase (decrease) in cash

Cash balance, January 1

Cash balance, December 31

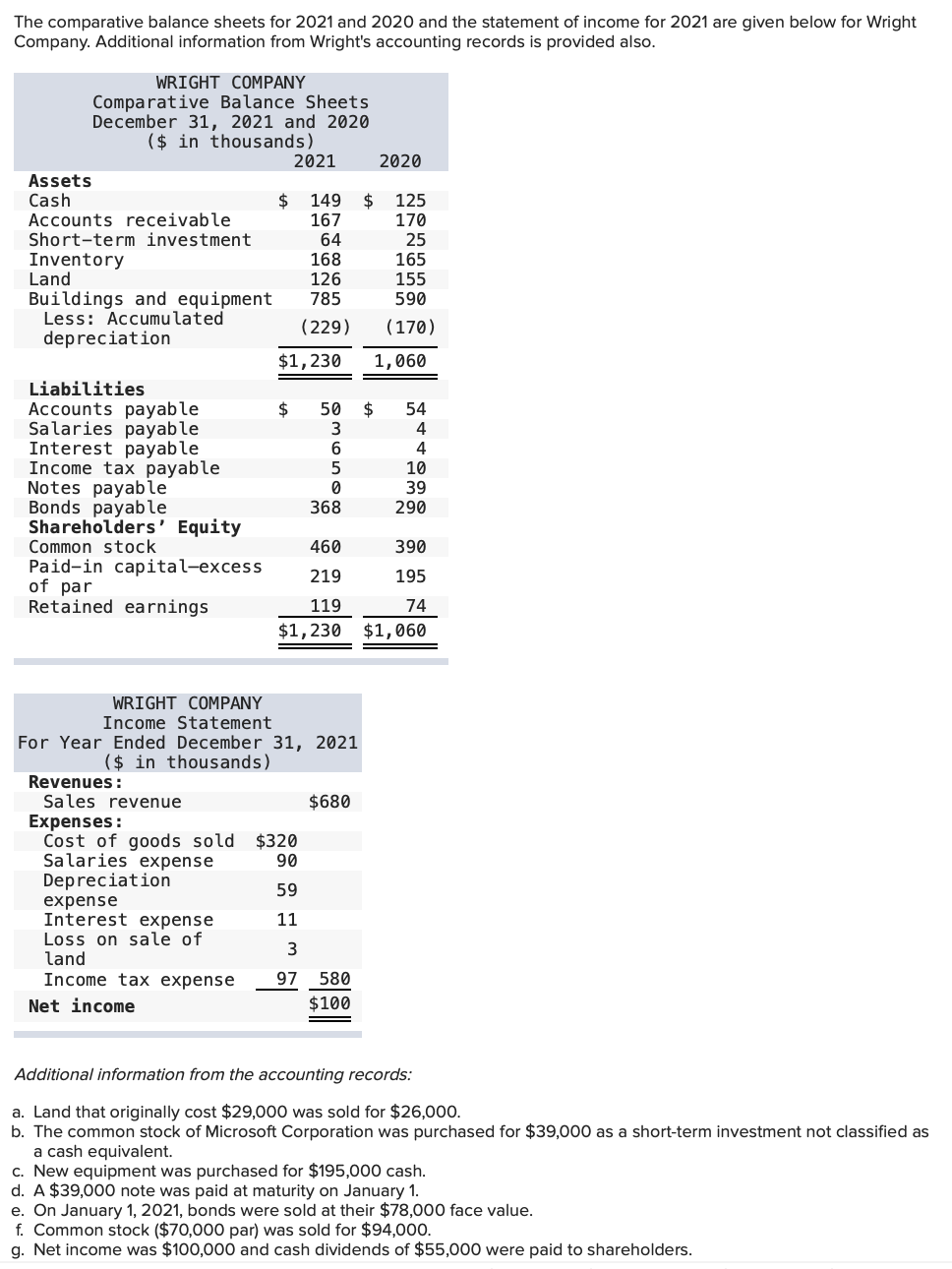

Transcribed Image Text:The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright

Company. Additional information from Wright's accounting records is provided also.

WRIGHT COMPANY

Comparative Balance Sheets

December 31, 2021 and 2020

($ in thousands)

2021

2020

Assets

$ 125

Cash

Accounts receivable

Short-term investment

$

149

167

170

64

25

Inventory

Land

Buildings and equipment

Less: Accumulated

168

165

126

155

590

785

(229)

(170)

depreciation

$1,230

1,060

Liabilities

Accounts payable

Salaries payable

Interest payable

Income tax payable

Notes payable

Bonds payable

Shareholders' Equity

Common stock

Paid-in capital-excess

of par

Retained earnings

2$

50

$

54

4

6.

4

10

39

368

290

460

390

219

195

119

74

$1,230

$1,060

WRIGHT COMPANY

Income Statement

For Year Ended December 31, 2021

($ in thousands)

Revenues:

Sales revenue

$680

Expenses:

Cost of goods sold

Salaries expense

Depreciation

expense

Interest expense

Loss on sale of

land

Income tax expense

$320

59

11

3

97

580

Net income

$100

Additional information from the accounting records:

a. Land that originally cost $29,000 was sold for $26,000.

b. The common stock of Microsoft Corporation was purchased for $39,000 as a short-term investment not classified as

a cash equivalent.

c. New equipment was purchased for $195,000 cash.

d. A $39,000 note was paid at maturity on January 1.

e. On January 1, 2021, bonds were sold at their $78,000 face value.

f. Common stock ($70,000 par) was sold for $94,000.

g. Net income was $100,000 and cash dividends of $55,000 were paid to shareholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning