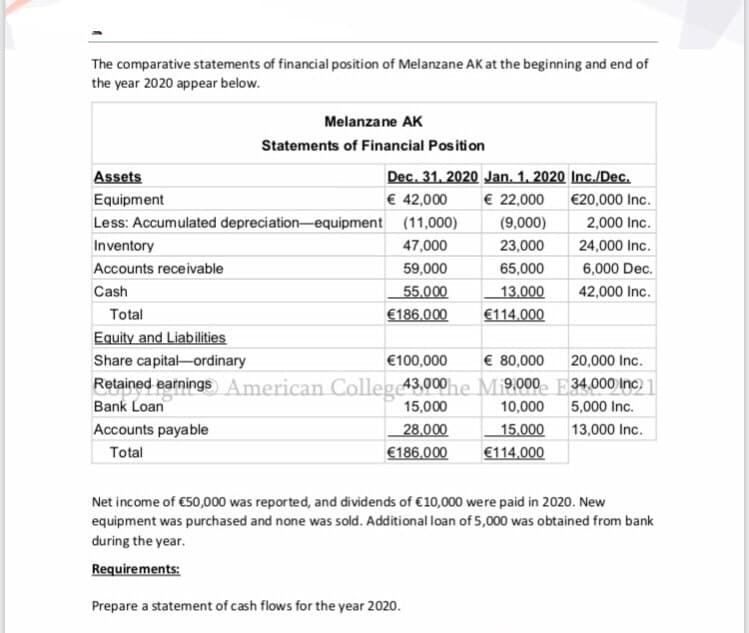

The comparative statements of financial position of Melanzane AK at the beginning and end of the year 2020 appear below. Melanzane AK Statements of Financial Position Dec. 31. 2020 Jan. 1. 2020 Inc./Dec. € 42,000 Assets Equipment € 22,000 €20,000 Inc. Less: Accumulated depreciation-equipment (11,000) (9,000) 2,000 Inc. Inventory 47,000 23,000 24,000 Inc. Accounts receivable 59,000 65,000 6,000 Dec. Cash 55.000 13.000 42,000 Inc. Total €186.000 €114.000 Equity and Liabilities Share capital-ordinary €100,000 € 80,000 20,000 Inc. Retained earnings American Colleg 43,000he Mi9000 E34.000 Inc) Bank Loan 15,000 10,000 5,000 Inc. Accounts payable 28.000 15.000 13,000 Inc. Total €186,000 €114,000 Net income of €50,000 was reported, and dividends of €10,000 were paid in 2020. New equipment was purchased and none was sold. Additional loan of 5,000 was obtained from bank during the year. Requirements: Prepare a statement of cash flows for the year 2020.

The comparative statements of financial position of Melanzane AK at the beginning and end of the year 2020 appear below. Melanzane AK Statements of Financial Position Dec. 31. 2020 Jan. 1. 2020 Inc./Dec. € 42,000 Assets Equipment € 22,000 €20,000 Inc. Less: Accumulated depreciation-equipment (11,000) (9,000) 2,000 Inc. Inventory 47,000 23,000 24,000 Inc. Accounts receivable 59,000 65,000 6,000 Dec. Cash 55.000 13.000 42,000 Inc. Total €186.000 €114.000 Equity and Liabilities Share capital-ordinary €100,000 € 80,000 20,000 Inc. Retained earnings American Colleg 43,000he Mi9000 E34.000 Inc) Bank Loan 15,000 10,000 5,000 Inc. Accounts payable 28.000 15.000 13,000 Inc. Total €186,000 €114,000 Net income of €50,000 was reported, and dividends of €10,000 were paid in 2020. New equipment was purchased and none was sold. Additional loan of 5,000 was obtained from bank during the year. Requirements: Prepare a statement of cash flows for the year 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Please make sure the answer is correct 100%

Transcribed Image Text:The comparative statements of financial position of Melanzane AK at the beginning and end of

the year 2020 appear below.

Melanzane AK

Statements of Financial Position

Dec. 31. 2020 Jan. 1. 2020 Inc./Dec.

€ 42,000

Assets

Equipment

€ 22,000

€20,000 Inc.

Less: Accumulated depreciation-equipment (11,000)

(9,000)

2,000 Inc.

Inventory

47,000

23,000

24,000 Inc.

Accounts receivable

59,000

65,000

6,000 Dec.

Cash

55,000

13.000

42,000 Inc.

Total

€186,000

€114.000

Equity and Liabilities

Share capital-ordinary

€100,000

€ 80,000

20,000 Inc.

Retained earnings American Colleg 43,000he Mi9000. E34,000)|Inc)

Bank Loan

15,000

10,000

5,000 Inc.

Accounts payable

28.000

15,000

13,000 Inc.

Total

€186.000

€114.000

Net income of €50,000 was reported, and dividends of €10,000 were paid in 2020. New

equipment was purchased and none was sold. Additional loan of 5,000 was obtained from bank

during the year.

Requirements:

Prepare a statement of cash flows for the year 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning