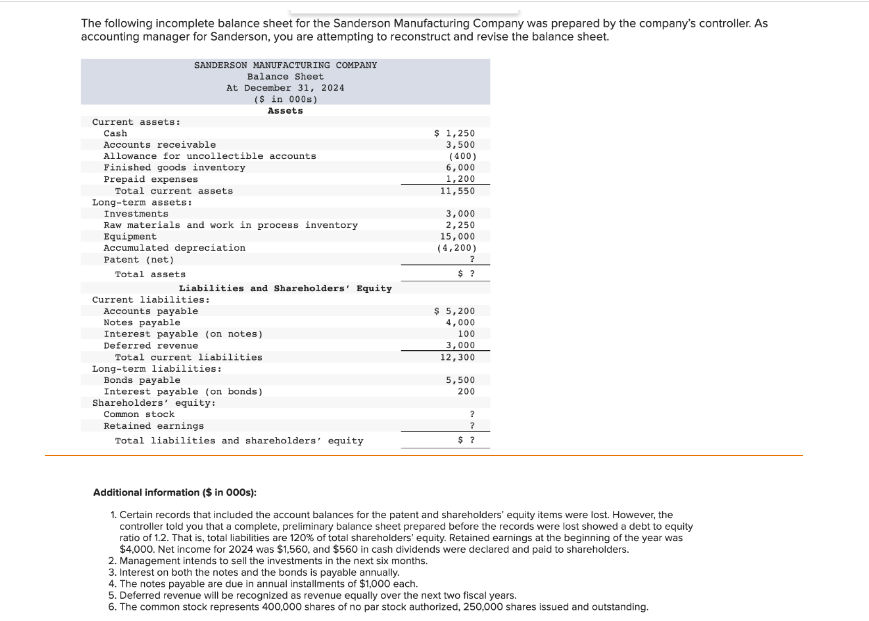

The following incomplete balance sheet for the Sanderson Manufacturing Company was prepared by the company's controller. As accounting manager for Sanderson, you are attempting to reconstruct and revise the balance sheet. Current assets: Cash Accounts receivable Allowance for uncollectible accounts Finished goods inventory SANDERSON MANUFACTURING COMPANY Balance Sheet At December 31, 2024 ($ in 000) Assets Prepaid expenses Total current assets Long-term assets: Investments Raw materials and work in process inventory Equipment Accumulated depreciation Patent (net) Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Interest payable (on notes) Deferred revenue Total current liabilities Long-term liabilities: Bonds payable Interest payable (on bonds) Shareholders' equity: Common stock Retained earnings Total liabilities and shareholders' equity $ 1,250 3,500 (400) 6,000 1,200 11,550 3,000 2,250 15,000 (4,200) ? $? $ 5,200 4,000 100 3,000 12,300 5,500 200 ? ? $? Additional information ($ in 000s): 1. Certain records that included the account balances for the patent and shareholders' equity items were lost. However, the controller told you that a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.2. That is, total liabilities are 120% of total shareholders' equity. Retained earnings at the beginning of the year was $4,000. Net income for 2024 was $1,560, and $560 in cash dividends were declared and paid to shareholders. 2. Management intends to sell the investments in the next six months. 3. Interest on both the notes and the bonds is payable annually. 4. The notes payable are due in annual installments of $1,000 each. 5. Deferred revenue will be recognized as revenue equally over the next two fiscal years. 6. The common stock represents 400,000 shares of no par stock authorized, 250,000 shares issued and outstanding.

The following incomplete balance sheet for the Sanderson Manufacturing Company was prepared by the company's controller. As accounting manager for Sanderson, you are attempting to reconstruct and revise the balance sheet. Current assets: Cash Accounts receivable Allowance for uncollectible accounts Finished goods inventory SANDERSON MANUFACTURING COMPANY Balance Sheet At December 31, 2024 ($ in 000) Assets Prepaid expenses Total current assets Long-term assets: Investments Raw materials and work in process inventory Equipment Accumulated depreciation Patent (net) Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Interest payable (on notes) Deferred revenue Total current liabilities Long-term liabilities: Bonds payable Interest payable (on bonds) Shareholders' equity: Common stock Retained earnings Total liabilities and shareholders' equity $ 1,250 3,500 (400) 6,000 1,200 11,550 3,000 2,250 15,000 (4,200) ? $? $ 5,200 4,000 100 3,000 12,300 5,500 200 ? ? $? Additional information ($ in 000s): 1. Certain records that included the account balances for the patent and shareholders' equity items were lost. However, the controller told you that a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.2. That is, total liabilities are 120% of total shareholders' equity. Retained earnings at the beginning of the year was $4,000. Net income for 2024 was $1,560, and $560 in cash dividends were declared and paid to shareholders. 2. Management intends to sell the investments in the next six months. 3. Interest on both the notes and the bonds is payable annually. 4. The notes payable are due in annual installments of $1,000 each. 5. Deferred revenue will be recognized as revenue equally over the next two fiscal years. 6. The common stock represents 400,000 shares of no par stock authorized, 250,000 shares issued and outstanding.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

prepare a complete corrected classified balance sheet

Transcribed Image Text:The following incomplete balance sheet for the Sanderson Manufacturing Company was prepared by the company's controller. As

accounting manager for Sanderson, you are attempting to reconstruct and revise the balance sheet.

Current assets:

Cash

Accounts receivable

Allowance for uncollectible accounts

Finished goods inventory

Prepaid expenses

Total current assets

Long-term assets:

SANDERSON MANUFACTURING COMPANY

Balance Sheet

At December 31, 2024

($ in 000s)

Assets

Investments

Raw materials and work in process inventory

Equipment

Accumulated depreciation

Patent (net)

Total assets

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable

Notes payable

Interest payable (on notes)

Deferred revenue

Total current liabilities

Long-term liabilities:

Bonds payable

Interest payable (on bonds)

Shareholders' equity:

Common stock

Retained earnings

Total liabilities and shareholders' equity

$ 1,250

3,500

(400)

6,000

1,200

11,550

3,000

2,250

15,000

(4,200)

?

$ ?

$ 5,200

4,000

100

3,000

12,300

5,500

200

?

?

$?

Additional information ($ in 000s):

1. Certain records that included the account balances for the patent and shareholders' equity items were lost. However, the

controller told you that a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity

ratio of 1.2. That is, total liabilities are 120% of total shareholders' equity. Retained earnings at the beginning of the year was

$4,000. Net income for 2024 was $1,560, and $560 in cash dividends were declared and paid to shareholders.

2. Management intends to sell the investments in the next six months.

3. Interest on both the notes and the bonds is payable annually.

4. The notes payable are due in annual installments of $1,000 each.

5. Deferred revenue will be recognized as revenue equally over the next two fiscal years.

6. The common stock represents 400,000 shares of no par stock authorized, 250,000 shares issued and outstanding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning