The following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) of Nicanor, a purely compensation income earner: Gross compensation income Php 400,000.00 13th month pay and other benefits 40,000.00 Amount of taxes withheld (by the employer) 30,000.00 Commission 50,000.00 Pagibig contributions 10,000.00 Philhealth contributions 10,000.00 10,000.00 Union dues 10,000.00 Question: The total non-taxable portion to be deducted from gross compensation income of Nicanor is:

The following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) of Nicanor, a purely compensation income earner: Gross compensation income Php 400,000.00 13th month pay and other benefits 40,000.00 Amount of taxes withheld (by the employer) 30,000.00 Commission 50,000.00 Pagibig contributions 10,000.00 Philhealth contributions 10,000.00 10,000.00 Union dues 10,000.00 Question: The total non-taxable portion to be deducted from gross compensation income of Nicanor is:

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

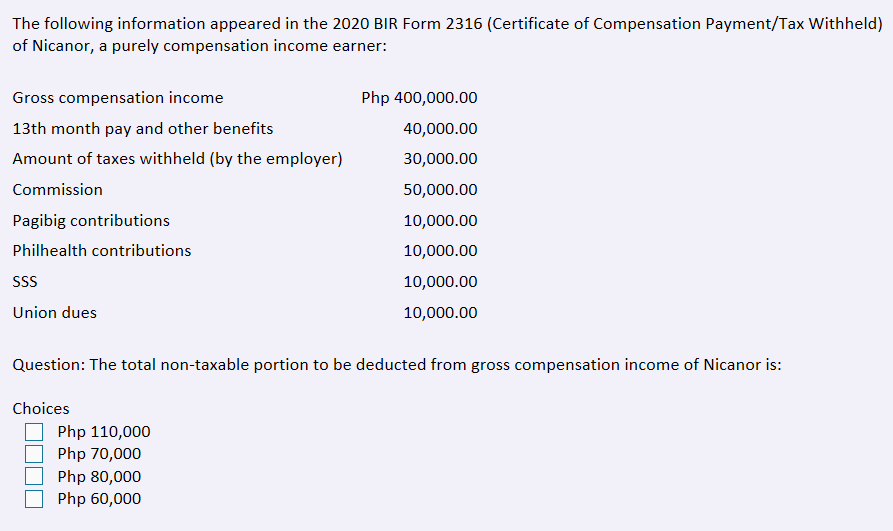

Transcribed Image Text:The following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld)

of Nicanor, a purely compensation income earner:

Gross compensation income

Php 400,000.00

13th month pay and other benefits

40,000.00

Amount of taxes withheld (by the employer)

30,000.00

Commission

50,000.00

Pagibig contributions

10,000.00

Philhealth contributions

10,000.00

SS

10,000.00

Union dues

10,000.00

Question: The total non-taxable portion to be deducted from gross compensation income of Nicanor is:

Choices

Php 110,000

Php 70,000

Php 80,000

Php 60,000

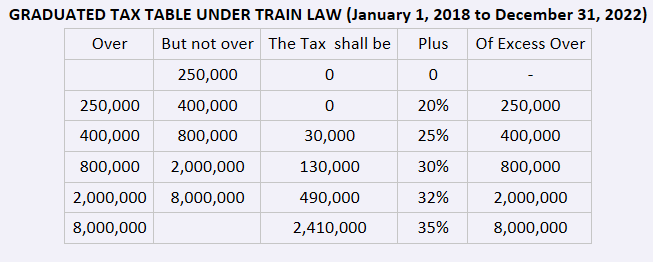

Transcribed Image Text:GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022)

Over

But not over The Tax shall be

Plus

Of Excess Over

250,000

250,000

400,000

20%

250,000

400,000

800,000

30,000

25%

400,000

800,000

2,000,000

130,000

30%

800,000

2,000,000 8,000,000

490,000

32%

2,000,000

8,000,000

2,410,000

35%

8,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT