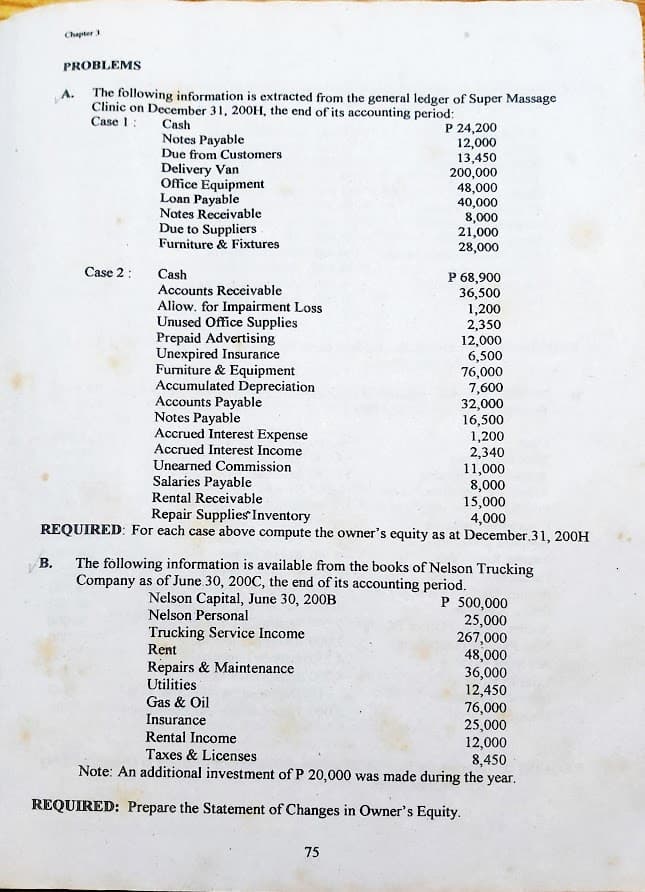

The following information is extracted from the general ledger of Super Massage Clinic on December 31, 200H, the end of its accounting period: Case 1: A. Cash Notes Payable Due from Customers Delivery Van Ofice Équipment Loan Payable Nates Receivable Due to Suppliers Furniture & Fixtures P 24,200 12,000 13,450 200,000 48,000 40,000 8,000 21,000 28,000 Case 2: Cash Accounts Receivable Aliow. for Impairment Loss Unused Office Supplies Prepaid Advertising Unexpired Insurance Furniture & Equipment Accumulated Depreciation Accounts Payable Notes Payable Accrued Interest Expense Accrued Interest Income Unearned Commission Salaries Payable Rental Receivable P 68,900 36,500 1,200 2,350 12,000 6,500 76,000 7,600 32,000 16,500 1,200 2,340 11,000 8,000 15,000 4,000 Repair Supplies Inventory REQUIRED: For each case above compute the owner's equity as at December.31, 200H В. The following information is available from the books of Nelson Trucking Company as of June 30, 200C, the end of its accounting period. P 500,000 25,000 267,000 48,000 36,000 12,450 76,000 25,000 12,000 8,450 Note: An additional investment of P 20,000 was made during the year. Nelson Capital, June 30, 200B Nelson Personal Trucking Service Income Rent Repairs & Maintenance Utilities Gas & Oil Insurance Rental Income Taxes & Licenses REQUIRED: Prepare the Statement of Changes in Owner's Equity.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 2 steps