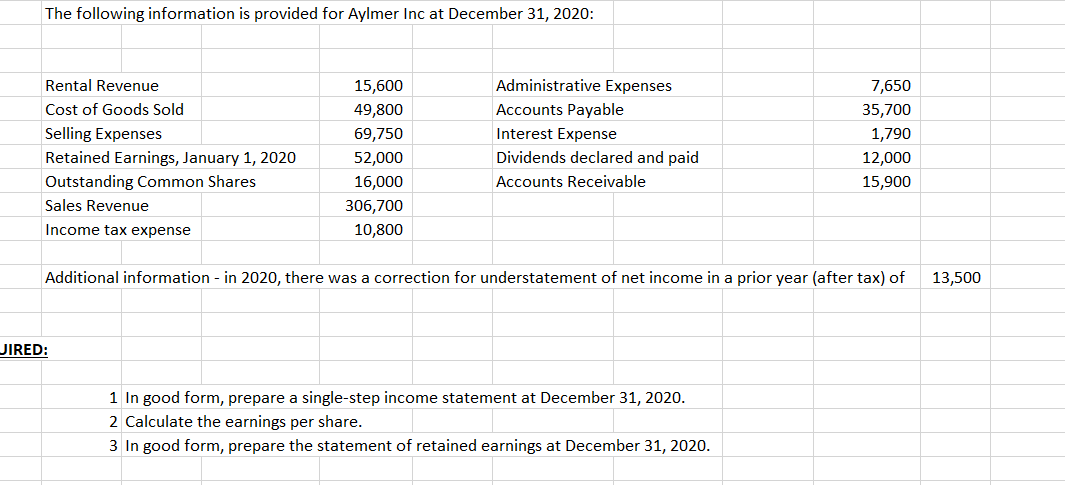

The following information is provided for Aylmer Inc at December 31, 2020: Rental Revenue 15,600 Administrative Expenses 7,650 Cost of Goods Sold 49,800 Accounts Payable 35,700 Selling Expenses 69,750 Interest Expense 1,790 Retained Earnings, January 1, 2020 52,000 Dividends declared and paid 12,000 Outstanding Common Shares 16,000 Accounts Receivable 15,900 Sales Revenue 306,700 Income tax expense 10,800 Additional information - in 2020, there was a correction for understatement of net income in a prior year (after tax) of 13,500 1 In good form, prepare a single-step income statement at December 31, 2020. 2 Calculate the earnings per share. 3 In good form, prepare the statement of retained earnings at December 31, 2020.

The following information is provided for Aylmer Inc at December 31, 2020: Rental Revenue 15,600 Administrative Expenses 7,650 Cost of Goods Sold 49,800 Accounts Payable 35,700 Selling Expenses 69,750 Interest Expense 1,790 Retained Earnings, January 1, 2020 52,000 Dividends declared and paid 12,000 Outstanding Common Shares 16,000 Accounts Receivable 15,900 Sales Revenue 306,700 Income tax expense 10,800 Additional information - in 2020, there was a correction for understatement of net income in a prior year (after tax) of 13,500 1 In good form, prepare a single-step income statement at December 31, 2020. 2 Calculate the earnings per share. 3 In good form, prepare the statement of retained earnings at December 31, 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Thanks in advance.

Transcribed Image Text:The following information is provided for Aylmer Inc at December 31, 2020:

Rental Revenue

15,600

Administrative Expenses

7,650

Cost of Goods Sold

49,800

Accounts Payable

35,700

Selling Expenses

69,750

Interest Expense

1,790

Retained Earnings, January 1, 2020

52,000

Dividends declared and paid

12,000

Outstanding Common Shares

16,000

Accounts Receivable

15,900

Sales Revenue

306,700

Income tax expense

10,800

Additional information - in 2020, there was a correction for understatement of net income in a prior year (after tax) of

13,500

JIRED:

1 In good form, prepare a single-step income statement at December 31, 2020.

2 Calculate the earnings per share.

3 In good form, prepare the statement of retained earnings at December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub