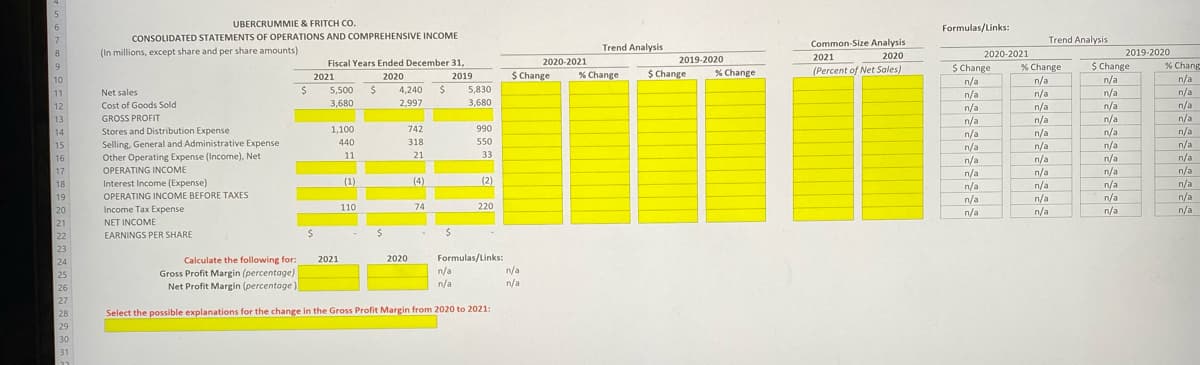

UBERCRUMMIE & FRITCH CO. Formulas/Links: CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME Trend Analysis Trend Analysis Common-Size Analysis (In millions, except share and per share amounts) 2019-2020 % Chang n/a n/a n/a 8. 2019-2020 2021 2020 2020-2021 Fiscal Years Ended December 31, 2019 2020-2021 S Change S Change %Change $Change % Change S Change % Change (Percent of Net Sales) 2021 2020 n/a n/a 10 n/a n/a r/a n/a 11 Net sales 5,500 4,240 5,830 /a n/a n/a n/a 12 Cost of Goods Sold 3,680 2,997 3,680 n/a GROSS PROFIT n/a n/a n/a n/a n/a /a n/a n/a n/a n/a n/a 13 n/a Stores and Distribution Expense 1,100 742 990 n/a n/a n/a n/a n/a n/a 14 Selling. General and Administrative Expense Other Operating Expense (Income), Net OPERATING INCOME 440 318 550 15 16 n/a n/a r/a /a n/a n/a 11 21 33 n/a n/a n/a n/a n/a 17 (2) 18 19 Interest Income (Expense) (1) (4) OPERATING INCOME BEFORE TAXES 20 Income Tax Expense 110 74 220 n/a 21 NET INCOME 22 EARNINGS PER SHARE 23 Calculate the following for: Gross Profit Margin (percentage) Net Profit Margin (percentoge) Formulas/Links: n/a 24 2021 2020 n/a 25 n/a n/a 26 27 28 Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021: 29 30 31

UBERCRUMMIE & FRITCH CO. Formulas/Links: CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME Trend Analysis Trend Analysis Common-Size Analysis (In millions, except share and per share amounts) 2019-2020 % Chang n/a n/a n/a 8. 2019-2020 2021 2020 2020-2021 Fiscal Years Ended December 31, 2019 2020-2021 S Change S Change %Change $Change % Change S Change % Change (Percent of Net Sales) 2021 2020 n/a n/a 10 n/a n/a r/a n/a 11 Net sales 5,500 4,240 5,830 /a n/a n/a n/a 12 Cost of Goods Sold 3,680 2,997 3,680 n/a GROSS PROFIT n/a n/a n/a n/a n/a /a n/a n/a n/a n/a n/a 13 n/a Stores and Distribution Expense 1,100 742 990 n/a n/a n/a n/a n/a n/a 14 Selling. General and Administrative Expense Other Operating Expense (Income), Net OPERATING INCOME 440 318 550 15 16 n/a n/a r/a /a n/a n/a 11 21 33 n/a n/a n/a n/a n/a 17 (2) 18 19 Interest Income (Expense) (1) (4) OPERATING INCOME BEFORE TAXES 20 Income Tax Expense 110 74 220 n/a 21 NET INCOME 22 EARNINGS PER SHARE 23 Calculate the following for: Gross Profit Margin (percentage) Net Profit Margin (percentoge) Formulas/Links: n/a 24 2021 2020 n/a 25 n/a n/a 26 27 28 Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021: 29 30 31

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 99.2C

Related questions

Question

Help

Transcribed Image Text:5

6

UBERCRUMMIE & FRITCH CO.

Formulas/Links

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

Trend Analysis

Common-Size Analysis

2021

(Percent of Net Sales)

Trend Analysis

8

(In millions, except share and per share amounts)

2019-2020

2020-2021

$ Change

n/a

n/a

n/a

2020

Fiscal Years Ended December 31,

2020-2021

2019-2020

9

% Change

%$ Change

% Chang

2021

2020

$ Change

% Change

$ Change

% Change

2019

n/a

n/a

n/a

n/a

n/a

n/a

10

n/a

n/a

n/a

11

Net sales

5,500

4,240

$4

5,830

12

Cost of Goods Sold

3,680

2,997

3,680

n/a

n/a

n/a

n/a

n/a

n/a

n/a

13

GROSS PROFIT

n/a

n/a

n/a

14

Stores and Distribution Expense

1,100

742

990

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

318

550

Selling, General and Administrative Expense

Other Operating Expense (Income), Net

15

440

n/a

n/a

n/a

n/a

n/a

n/a

n/a

11

21

33

n/a

n/a

n/a

16

17

OPERATING INCOME

(2)

Interest Income (Expense)

OPERATING INCOME BEFORE TAXES

18

(1)

(4)

19

n/a

n/a

110

74

220

Income Tax Expense

NET INCOME

20

n/a

n/a

21

22

EARNINGS PER SHARE

23

Calculate the following for:

Gross Profit Margin (percentage)

Net Profit Margin (percentage)

Formulas/Links:

n/a

n/a

2021

2020

24

n/a

n/a

25

26

27

28

Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021:

29

30

31

Transcribed Image Text:Nathan Jackson

P Search (Alt+ Q)

AutoSave Oon H

M3 P (2)

Page Layout Formulas Data Review View Help

5 Autosum - Ay O

Home

Insert Draw

X cut

- 11 - A A

8 Wrap Text

Percentage

E Fill

Calibri

Sort & Find &

Analyze

Conditional Format as

Formatting Table Styles

Cell

Insert Delete Format

$ - % > 8 48

Filter Select

Data

LG Copy

E Merge & Center

O Clear

Paste

BIUv

S Format Painter

Celis

Editing

Analyuis

Number

Styles

Alignment

Font

Cipboard

P

R.

K.

D

E

F

G

H

A

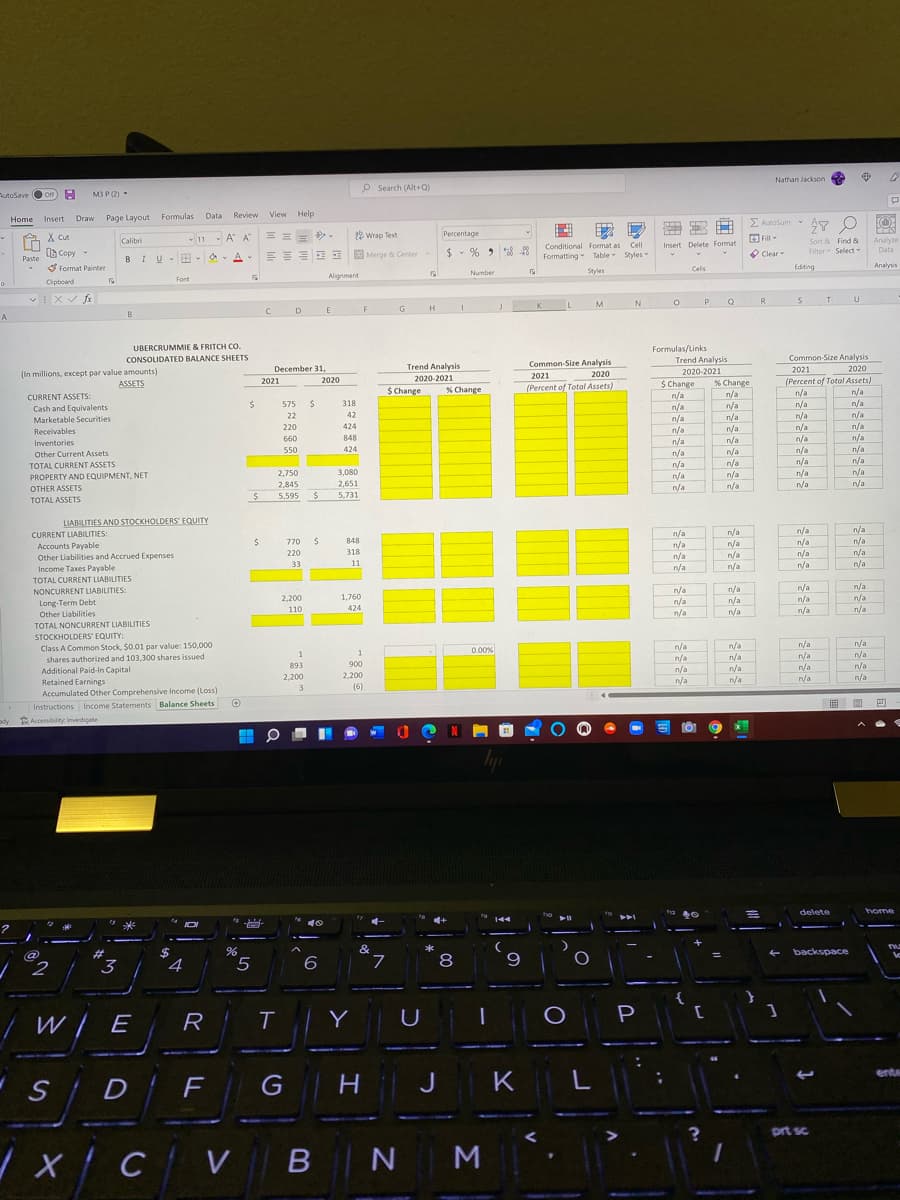

Formulas/Links

Trend Analysis

2020-2021

UBERCRUMMIE & FRITCH CO.

Common-Size Analysis

2020

(Percent of Total Assets)

n/a

CONSOLIDATED BALANCE SHEETS

Common-Size Analysis

December 31,

Trend Analysis

2021

(In millions, except par value amounts)

ASSETS

2021

2020

2021

2020

2020-2021

$ Change

n/a

n/a

% Change

n/a

n/a

$ Change

(Percent of Total Assets)

% Change

n/a

CURRENT ASSETS:

575

318

n/a

n/a

Cash and Equivalents

Marketable Securities

22

42

n/a

n/a

n/a

n/a

220

424

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

Receivables

660

848

n/a

n/a

Inventories

424

n/a

n/a

n/a

n/a

550

n/a

Other Current Assets

TOTAL CURRENT ASSETS

n/a

n/a

2,750

3,080

n/a

n/a

n/a

PROPERTY AND EQUIPMENT, NET

n/a

2,845

2,651

n/a

OTHER ASSETS

n/a

5,595

5,731

TOTAL ASSETS

LIABILITIES AND STOCKHOLDERS' EQUITY

n/a

n/a

n/a

CURRENT LIABILITIES:

Accounts Payable

Other Liabilities and Accrued Expenses

Income Taxes Payable

n/a

n/a

n/a

n/a

n/a

770

848

n/a

n/a

n/a

n/a

220

318

n/a

n/a

n/a

33

11

n/a

TOTAL CURRENT LIABILITIES

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

NONCURRENT LIABILITIES:

2,200

1,760

Long-Term Debt

Other Liabilities

110

424

TOTAL NONCURRENT LIABILITIES

STOCKHOLDERS' EQUITY:

Class A Common Stock, $0.01 par value: 150,000

shares authorized and 103,300 shares issued

Additional Paid-In Capital

Retained Earnings

Accumulated Other Comprehensive Income (Loss)

n/a

n/a

0.00%

n/a

n/a

n/a

n/a

n/a

n/a

893

900

/a

n/a

n/a

n/a

n/a

2.200

2,200

n/a

n/a

n/a

3.

(6)

|画 ■ 四

Instructions Income Statements Balance Sheets

dy Accessibility Investigate

delete

home

-

#

&

backspace

3.

6

7.

6.

{

/ W/ E

R

Y

U

P

erte

S D

G

H

J

K

L

prt sc

/x/CV B NM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning