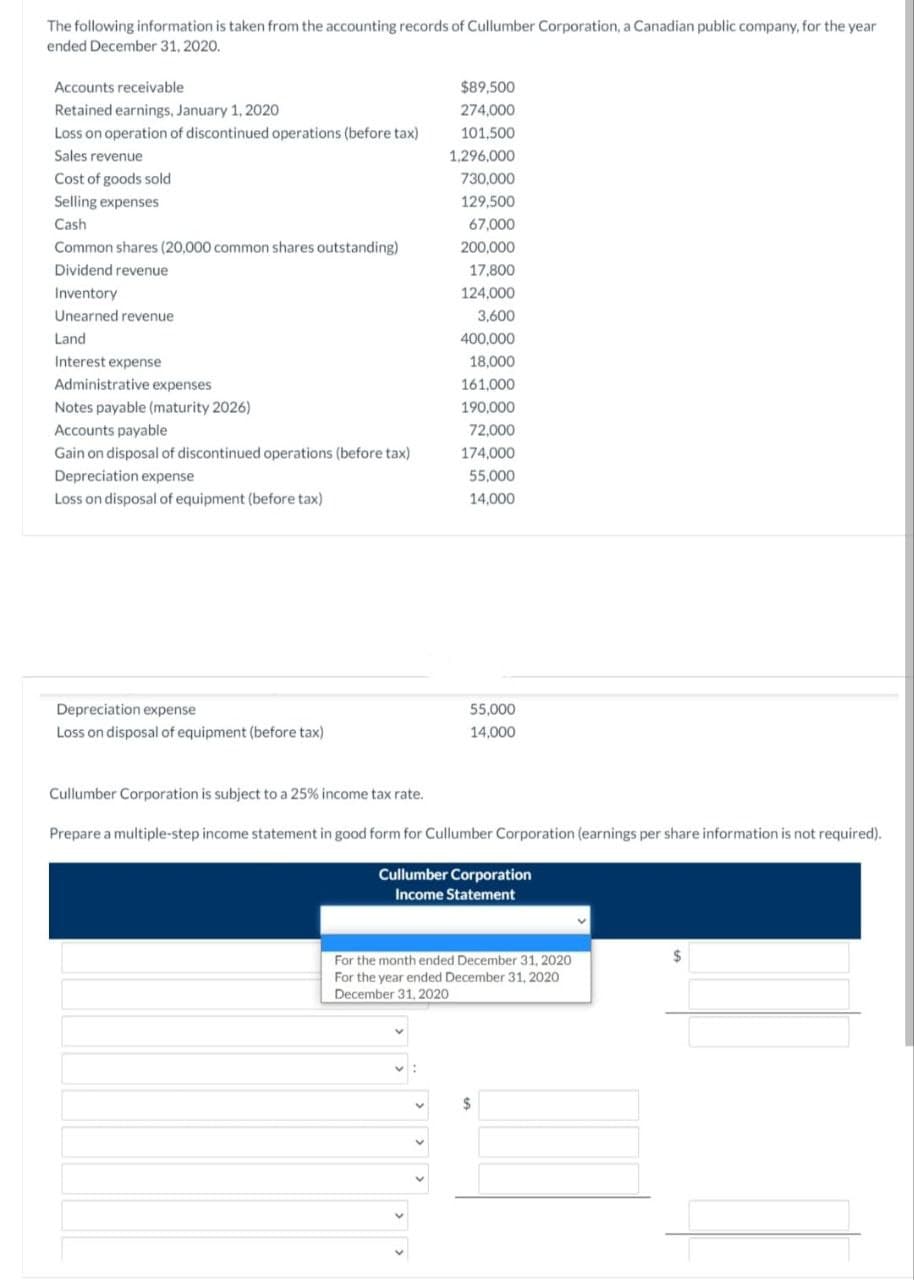

The following information is taken from the accounting records of Cullumber Corporation, a Canadian public company, for the year ended December 31, 2020. Accounts receivable Retained earnings, January 1, 2020 Loss on operation of discontinued operations (before tax) Sales revenue Cost of goods sold Selling expenses Cash Common shares (20,000 common shares outstanding) Dividend revenue Inventory Unearned revenue Land Interest expense Administrative expenses Notes payable (maturity 2026) Accounts payable Gain on disposal of discontinued operations (before tax) Depreciation expense Loss on disposal of equipment (before tax) Depreciation expense Loss on disposal of equipment (before tax) $89,500 274,000 101,500 1,296,000 730,000 129,500 67,000 200,000 17,800 124,000 3,600 400,000 18,000 161,000 190,000 72,000 174,000 55,000 14,000 55,000 14,000 Cullumber Corporation is subject to a 25% income tax rate. Prepare a multiple-step income statement in good form for Cullumber Corporation (earnings per share information is not required). Cullumber Corporation Income Statement For the month ended December 31, 2020 For the year ended December 31, 2020 December 31, 2020 $ $

The following information is taken from the accounting records of Cullumber Corporation, a Canadian public company, for the year ended December 31, 2020. Accounts receivable Retained earnings, January 1, 2020 Loss on operation of discontinued operations (before tax) Sales revenue Cost of goods sold Selling expenses Cash Common shares (20,000 common shares outstanding) Dividend revenue Inventory Unearned revenue Land Interest expense Administrative expenses Notes payable (maturity 2026) Accounts payable Gain on disposal of discontinued operations (before tax) Depreciation expense Loss on disposal of equipment (before tax) Depreciation expense Loss on disposal of equipment (before tax) $89,500 274,000 101,500 1,296,000 730,000 129,500 67,000 200,000 17,800 124,000 3,600 400,000 18,000 161,000 190,000 72,000 174,000 55,000 14,000 55,000 14,000 Cullumber Corporation is subject to a 25% income tax rate. Prepare a multiple-step income statement in good form for Cullumber Corporation (earnings per share information is not required). Cullumber Corporation Income Statement For the month ended December 31, 2020 For the year ended December 31, 2020 December 31, 2020 $ $

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:The following information is taken from the accounting records of Cullumber Corporation, a Canadian public company, for the year

ended December 31, 2020.

Accounts receivable

Retained earnings, January 1, 2020

Loss on operation of discontinued operations (before tax)

Sales revenue

Cost of goods sold

Selling expenses

Cash

Common shares (20,000 common shares outstanding)

Dividend revenue

Inventory

Unearned revenue

Land

Interest expense

Administrative expenses

Notes payable (maturity 2026)

Accounts payable

Gain on disposal of discontinued operations (before tax)

Depreciation expense

Loss on disposal of equipment (before tax)

Depreciation expense

Loss on disposal of equipment (before tax)

Cullumber Corporation is subject to a 25% income tax rate.

$89,500

274,000

101,500

1,296,000

730,000

129,500

67,000

200,000

17,800

124,000

3,600

400,000

18,000

161,000

190,000

72,000

174,000

55,000

14,000

55,000

14,000

Prepare a multiple-step income statement in good form for Cullumber Corporation (earnings per share information is not required).

Cullumber Corporation

Income Statement

For the month ended December 31, 2020

For the year ended December 31, 2020

December 31, 2020

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning