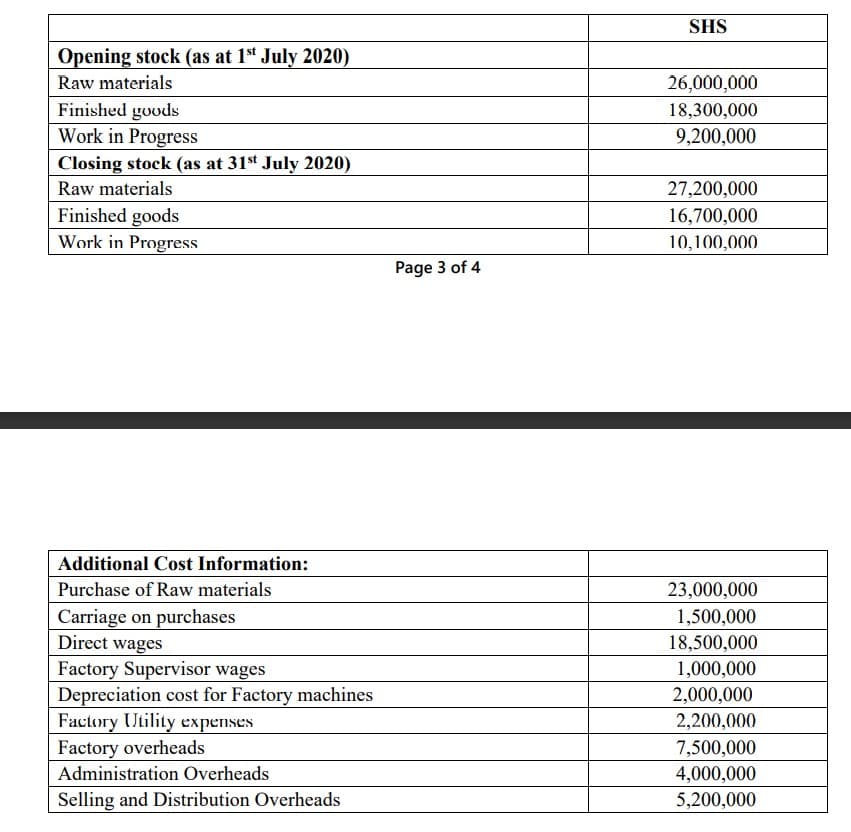

The following information relates to Josma ltd for the month of July 2020.The company uses single/unit costing method. The company expects to produce 1,000 units during the month of July 2020 Additional Information: 1. Some products had some defects which required additional work being carried out in the factory to correct these defects. The cost of correcting these defective products was Shs 250,000. 2. The was a by-product that resulted from the production which was sold generating cash amounting to Shs 480,000 Required:

The following information relates to Josma ltd for the month of July 2020.The company uses

single/unit costing method. The company expects to produce 1,000 units during the month of

July 2020

Additional Information:

1. Some products had some defects which required additional work being carried out in the

factory to correct these defects. The cost of correcting these defective products was Shs

250,000.

2. The was a by-product that resulted from the production which was sold generating cash

amounting to Shs 480,000

Required:

i) Prepare a cost sheet for the company using the single/unit costing method. The cost sheet

should indicate all the totals for all major categories of costs including (Prime Cost;

Works/

ii) Calculate the

the projected revenue is 96,000,000

Step by step

Solved in 3 steps