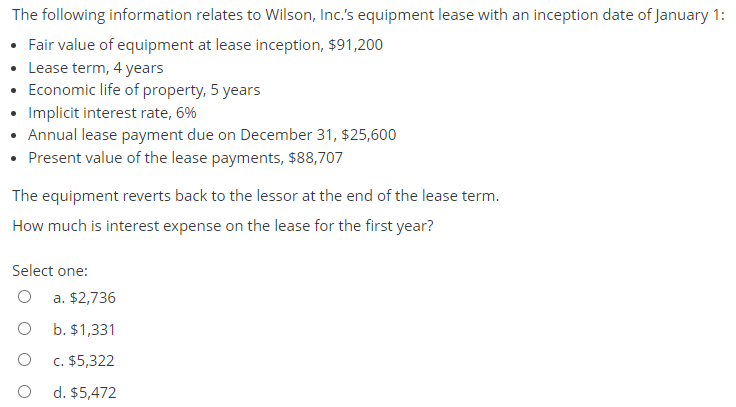

The following information relates to Wilson, Inc.'s equipment lease with an inception date of January 1 Fair value of equipment at lease inception, $91,200 • Lease term, 4 years - Economic life of property, 5 years •Implicit interest rate, 6% • Annual lease payment due on December 31, $25,600 • Present value of the lease payments, $88,707 The equipment reverts back to the lessor at the end of the lease term. How much is interest expense on the lease for the first year? Select one: a. $2,736 O b. $1,331 c. $5,322 O d. $5,472

Q: Based on the following information, which of the following is closest to days' sales outstanding? •R...

A: The number of days in receivable indicates the total days between trade sale and the payment receive...

Q: Tim, a single taxpayer, operates a business as a single-member LLC. In 2021, his LLC reports busines...

A: a) Calculation of Excess loss An excess business loss is the amount by which the total deductions at...

Q: Last period Hartig Corporation sold 40.000 units, total sales were $303,000, total variable expenses...

A: Given that: No of units sold = 40000 Sales = $303,000 Variable expenses = $227250 Fixed Expense = $3...

Q: Sycamore, Inc. purchased P100,000 of 8 percent bonds of Alvarado Industries on January 1, 2022, at a...

A: Bond Valuation In the bond valuation it uses either in par value or in discount or in premium on bon...

Q: Green Corporation has the following capital structure since the incorporation on January 1. 2016:

A: Preference shares are generally known as preferred stock and these type of shares gets preference as...

Q: According to the islam (2000) article "Comparative Advantage and Trade Balance in U.S. Agricultural ...

A: In the case of agriculture, the United States has a comparative advantage. We are the world's larges...

Q: 13. Not all increases to cash represent revenues. True O False O O

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: . He paid the monthly rent of the office, Php9,500. a. Debit cash, Credit J. Ilagan, Capital b. Deb...

A: According to double entry system, every transaction affects atleast two accounts, one on debit side ...

Q: John's Tree Service depreciation for the month is $500. The adjusting journal entry is: O A. Depreci...

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as d...

Q: Outline the anti-avoidance provisions as they relate to the transfer of property to a child, a trust...

A: General Anti-avoidance Rule (GAAR) is a concept which generally empowers the Revenue Authority in a ...

Q: In June 2016, Goslyn Corporation issued a three-year non-interest-bearing note with a face value of ...

A: Given: Non-interest-bearing note of 3 years with a face value of $15,000. Received $11,025.00 cash ...

Q: double-entry bookkeeping system which of the following may be used as basis for ecognizing income an...

A: Double entry bookkeeping system is the system of accounting in which every transaction has effect on...

Q: Use the following information to calculate total ending cash and equivalents: Beginning Cash and Equ...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements. ...

Q: 10 Under IFRS 9, which of the following is correct regarding reclassification of investments? Group...

A: When an entity reclassifies a financial asset so that it is measured at fair value, its fair value i...

Q: 19. The heading of income statement might include the line "As of December 31, 2020". True False

A: Since you have posted multiple questions , we will do the first one for you . To get the other quest...

Q: Additional data for Required c, d, and e. Division A is considering buying a new equipment to improv...

A: The net present value helps the management to make the decision whether to go for the project or not...

Q: Actual Costing Production Cost, Unit Cost, Net Income and Inventories 2. CABADBARAN CORP., produces ...

A: Using throughput costing method, the direct materials cost is treated a variable cost and other manu...

Q: Accounting for Income Taxes Dunkin, Inc. reported revenues of $150,000 and expenses of $70,000 in ea...

A: Here in this question, we are required to calculate tax expense as per GAAP and as per taxation. For...

Q: Bon cap 720,000 Bien cap 700,000 The partnership is to be liquidated on installment. First sale of n...

A: Partnership When two or more people joined together to operate the business and share profits and lo...

Q: Hal, Dal, & Stal Dairy Farmers, Inc., produces whole milk, 2% milk, and cream. The joint cost of...

A: Under Market Value method, joint costs are allocated on the basis of joint costs of all products pro...

Q: Outline the anti-avoidance provisions as they relate to dealings in security

A: Anti avoidance provisions means a cluster of statutory provisions designed to stop certain arrangeme...

Q: The following information describes transactions for Morgenstern Advertising Company during July:a. ...

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are inc...

Q: Problem 4-4A Preparing closing entries, financial statements, and ratios c3 Q A1G P2 The adjusted tr...

A: The financial statements are prepared at year end including income statement, balance sheet, stateme...

Q: May 21st Transaction: Bought a laptop, paying $15751 cash as a down payment and signed a 8 month $52...

A:

Q: Melissa Company, which was organized in January 2020, recorded the following transactions during the...

A: In this question, we compute: a. Prepare an entry as of December 31, 2020, to reclassify the ite...

Q: 16. Revenue cannot be recognized unless delivery of goods has occurred or services have been rendere...

A: 16. Revenue can be recognized as soon as the rights and property in goods has been transferred, the ...

Q: A payment that a corporation makes to its shareholders out of the profits of a corporation is called...

A: When a corporation earns a profit or surplus, it is able to pay a proportion of the profit as a divi...

Q: The NiceWay Corporation's statement of financial position shows the total stockholders' equity of P5...

A: Stockholder's equity: Stockholder's equity refers to the net asset of the company available to the s...

Q: In the Augie Company, sales were $750,000, sales returns and allowances were $30,000, and cost of go...

A: In accounting gross profit refers to the profit that a business earns from selling its products afte...

Q: Given the following list of accounts with normal balances, what are the trial balance totals of the ...

A: Trial balance is a method of confirming that the debit and credit amounts recorded in the different ...

Q: The manufacturing company of Wellington has collected the given information to develop predetermined...

A: Lets understand the meaning of plantwide overhead rate and departmental overhead rate. In plantwide ...

Q: Explain how bushfire calamities may affect a bank's loan portfolio. Carefully consider direct and in...

A: The loan portfolio seems to be the total value of all loans given by the bank to persons and compani...

Q: A business operated at 100% of capacity during its first month and incurred the following costs: Pro...

A: Under variable costing system, the inventory would consist of only variable expenses.

Q: On November 1, 2022, Dayrit Corporation purchased P800,000 face value, 10-year, 8% term bonds dated ...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: old X, Inc. uses the following information when preparing their flexible budget: direct materials of...

A: Solution: Flexible budget is the budget which represents budgeted cost at different levels of produc...

Q: Use the percentage method to compute the federal income taxes to withhold from the wages or salaries...

A: In absence of any information regarding year , 2019 withholding rates have been used here .

Q: Matcha Company asks you to review its Dec. 31, 2022, inventory values and prepare the necessary adju...

A: Note: In the given question, Total 7 points are given. No point is missed from my side. Thank You Jo...

Q: 4. Emmanuel, Inc. reported the following items in its December 31, 2021 trial balance: Accounts paya...

A: Total liabilities mean the sum of the amount an entity owes.

Q: Which function of money allows individuals to make payment now in return for goods and services? A. ...

A: Medium of exchange : Money serves as a medium of exchange. Money facilitates exchange of goods witho...

Q: If P250,000 is invested for two years, what is the maturity value (disregard withholding tax for #s ...

A: Future Value = Present Value x (1 + r)^n

Q: An invoice of OMR 15000 with the terms 6/10, 3/15, n/30 is dated on June 15. The goods are received ...

A: Given: OMR 15000 invoice terms 6/10, 3/15, n/30 dated 15 June. June 23, such goods were received. B...

Q: Explain differential analysis

A: Differential Analysis involves understanding the purpose of different costs that may arise from diff...

Q: Required: Briefly explain whether the $7,000 and the $180,000 receipts constitutes ordinary income' ...

A: The answer for the question on ordinary income is discussed hereunder: What is ordinary income? Inc...

Q: Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa- tion,...

A: The process of relating a firm's revenue profit to the profit of a single product is known as produc...

Q: 10. An increase in an expense is always recorded as a debit. True O False 11. An account balance is ...

A: 10. An increase in expense is always recorded as a debit. 11. An account balance is the difference b...

Q: From the following data, you are required to calculate- 1)P/V Ratio 2) Break even sales with the ...

A: The ratio which shows the proportion of fixed expenses and profit in total sales figure is called as...

Q: eremiah Sugar Company has the policy of valuing inventory at lower of cost and net realizable value....

A: Inventory is value at lower of cost or net realizable value (NRV). NRV is calculated as selling pric...

Q: Applegate Industries is planning to expand its production facility in a few years. New plant ...

A: Future Value = Present Value x Future Value Factor

Q: Sanjay Company has monthly fixed costs of $112,000. The variable costs are $5.00 per unit. The sales...

A: Formula: Sales revenue = Sales price per unit x Number of units sold

Q: On July 1, 2016, Rotan Corporation paid $72,000 cash for a three year insurance premium. What adjust...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.

- Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. Assume that Garvey is required to make payments on December 31 each year.Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line method