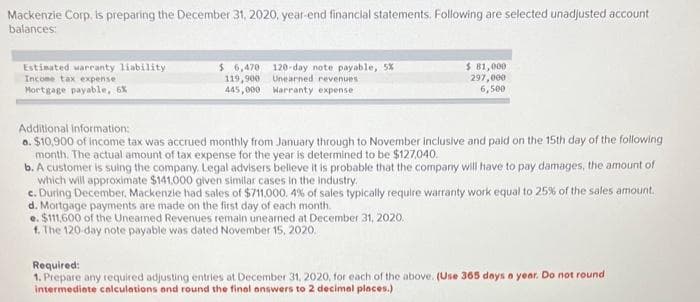

Mackenzie Corp, is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account balances: Estimated warranty liability Income tax expense Mortgage payable, 6% $ 6,470 120-day note payable, 5% Unearned revenues Warranty expense 119,900 445,000 $ 81,000 297,000 6,500 Additional information: a. $10,900 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $127,040. b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of which will approximate $141,000 given similar cases in the industry. c. During December, Mackenzie had sales of $711,000. 4% of sales typically require warranty work equal to 25% of the sales amount. d. Mortgage payments are made on the first day of each month. e. $111,600 of the Unearned Revenues remain unearned at December 31, 2020. f. The 120-day note payable was dated November 15, 2020. Required: 1. Prepare any required adjusting entries at December 31, 2020, for each of the above. (Use 365 days a year. Do not round intermediate calculations and round the final answers to 2 decimal places.)

Mackenzie Corp, is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account balances: Estimated warranty liability Income tax expense Mortgage payable, 6% $ 6,470 120-day note payable, 5% Unearned revenues Warranty expense 119,900 445,000 $ 81,000 297,000 6,500 Additional information: a. $10,900 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $127,040. b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of which will approximate $141,000 given similar cases in the industry. c. During December, Mackenzie had sales of $711,000. 4% of sales typically require warranty work equal to 25% of the sales amount. d. Mortgage payments are made on the first day of each month. e. $111,600 of the Unearned Revenues remain unearned at December 31, 2020. f. The 120-day note payable was dated November 15, 2020. Required: 1. Prepare any required adjusting entries at December 31, 2020, for each of the above. (Use 365 days a year. Do not round intermediate calculations and round the final answers to 2 decimal places.)

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 50P

Related questions

Question

100%

Transcribed Image Text:Mackenzie Corp, is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account

balances:

Estimated warranty liability

Income tax expense

Mortgage payable, 6%

$ 6,470 120-day note payable, 5%

Unearned revenues

Warranty expense

119,900

445,000

$ 81,000

297,000

6,500

Additional information:

a. $10,900 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following

month. The actual amount of tax expense for the year is determined to be $127,040.

b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of

which will approximate $141,000 given similar cases in the industry.

c. During December, Mackenzie had sales of $711,000. 4% of sales typically require warranty work equal to 25% of the sales amount.

d. Mortgage payments are made on the first day of each month.

e. $111,600 of the Unearned Revenues remain unearned at December 31, 2020.

f. The 120-day note payable was dated November 15, 2020.

Required:

1. Prepare any required adjusting entries at December 31, 2020, for each of the above. (Use 365 days a year. Do not round

intermediate calculations and round the final answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT