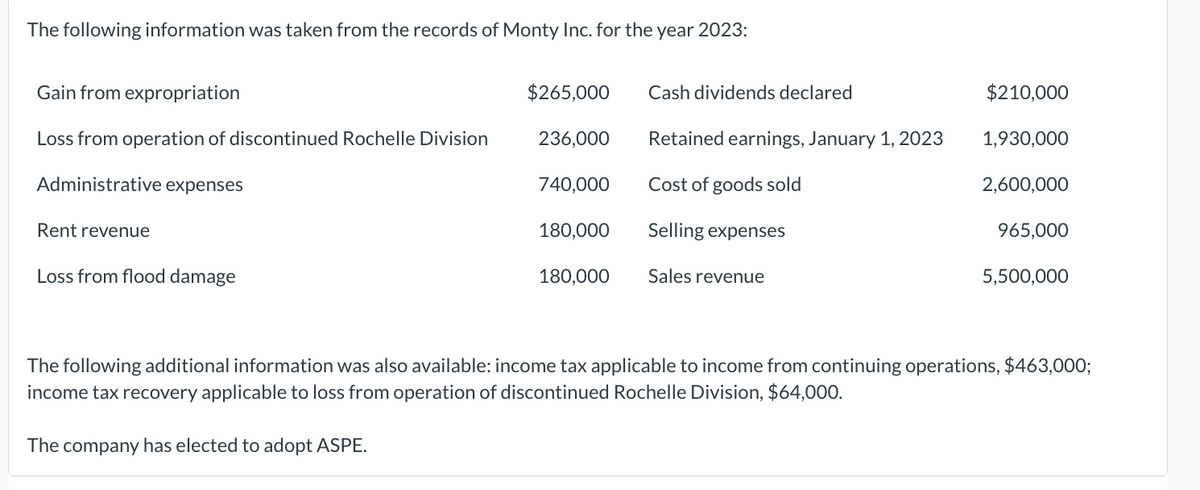

The following information was taken from the records of Monty Inc. for the year 2023: Gain from expropriation Loss from operation of discontinued Rochelle Division Administrative expenses Rent revenue Loss from flood damage $265,000 236,000 740,000 180,000 180,000 Cash dividends declared Retained earnings, January 1, 2023 Cost of goods sold Selling expenses Sales revenue $210,000 1,930,000 2,600,000 965,000 5,500,000 The following additional information was also available: income tax applicable to income from continuing operations, $463,000; income tax recovery applicable to loss from operation of discontinued Rochelle Division, $64,000. The company has elected to adopt ASPE.

The following information was taken from the records of Monty Inc. for the year 2023: Gain from expropriation Loss from operation of discontinued Rochelle Division Administrative expenses Rent revenue Loss from flood damage $265,000 236,000 740,000 180,000 180,000 Cash dividends declared Retained earnings, January 1, 2023 Cost of goods sold Selling expenses Sales revenue $210,000 1,930,000 2,600,000 965,000 5,500,000 The following additional information was also available: income tax applicable to income from continuing operations, $463,000; income tax recovery applicable to loss from operation of discontinued Rochelle Division, $64,000. The company has elected to adopt ASPE.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.6AP: Single-Step Income Statement The following income statement items, arranged in alphabetical order,...

Related questions

Question

pls answer thanks

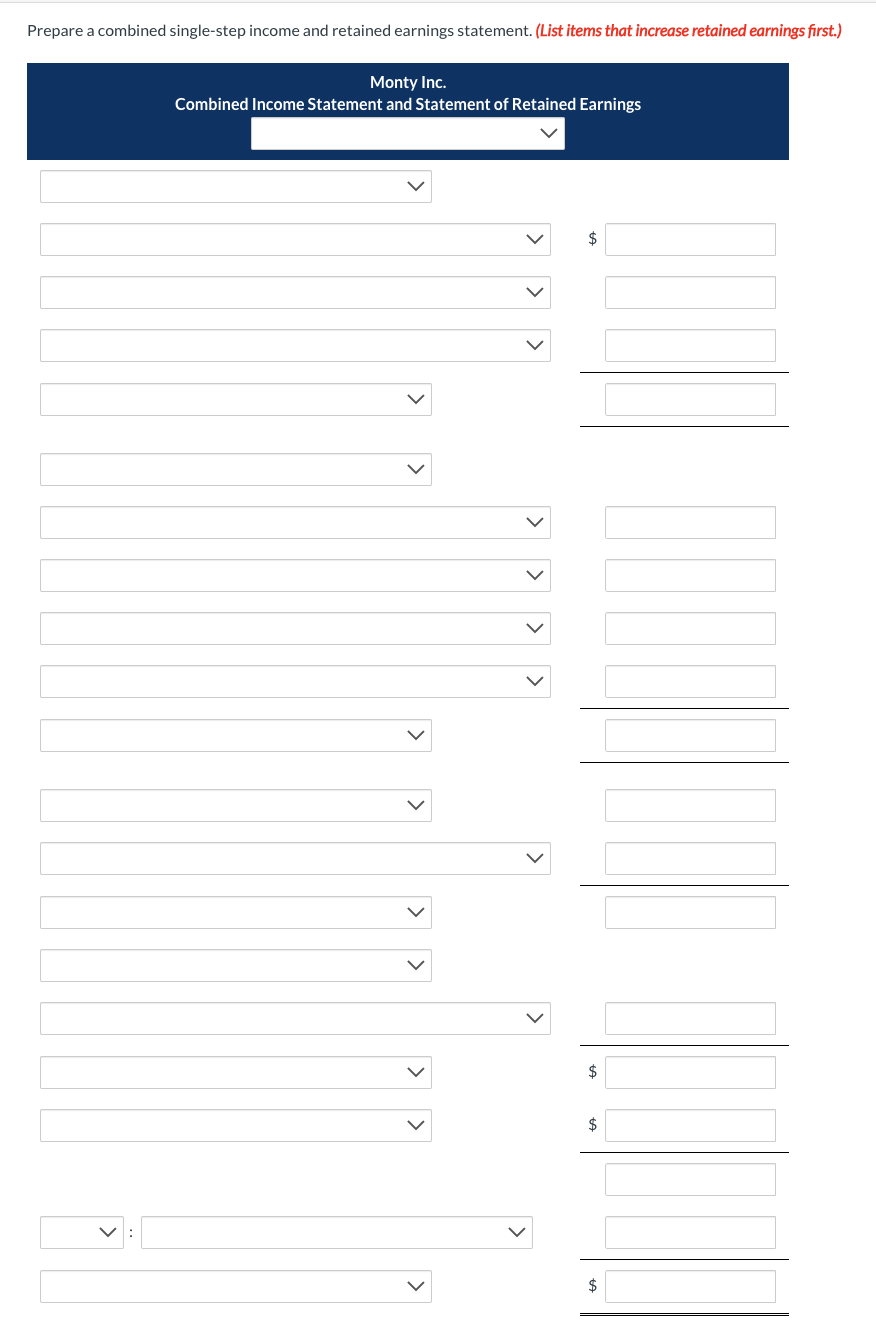

Transcribed Image Text:Prepare a combined single-step income and retained earnings statement. (List items that increase retained earnings first.)

Monty Inc.

Combined Income Statement and Statement of Retained Earnings

>

>

>

>

$

$

$

$

Transcribed Image Text:The following information was taken from the records of Monty Inc. for the year 2023:

Gain from expropriation

Loss from operation of discontinued Rochelle Division

Administrative expenses

Rent revenue

Loss from flood damage

$265,000

236,000

740,000

180,000

180,000

Cash dividends declared

Retained earnings, January 1, 2023

Cost of goods sold

Selling expenses

Sales revenue

$210,000

1,930,000

2,600,000

965,000

5,500,000

The following additional information was also available: income tax applicable to income from continuing operations, $463,000;

income tax recovery applicable to loss from operation of discontinued Rochelle Division, $64,000.

The company has elected to adopt ASPE.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning