c. What will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Cash Fixed assets Equity Total Total

c. What will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Cash Fixed assets Equity Total Total

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 4FPE: The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million...

Related questions

Question

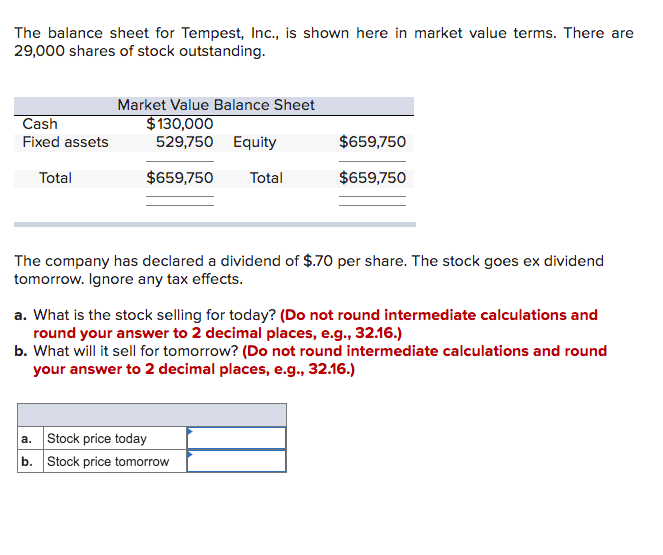

Transcribed Image Text:The balance sheet for Tempest, Inc., is shown here in market value terms. There are

29,000 shares of stock outstanding.

Market Value Balance Sheet

Cash

$130,000

529,750 Equity

Fixed assets

$659,750

Total

$659,750

Total

$659,750

The company has declared a dividend of $.70 per share. The stock goes ex dividend

tomorrow. Ignore any tax effects.

a. What is the stock selling for today? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

b. What will it sell for tomorrow? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

a. Stock price today

b. Stock price tomorrow

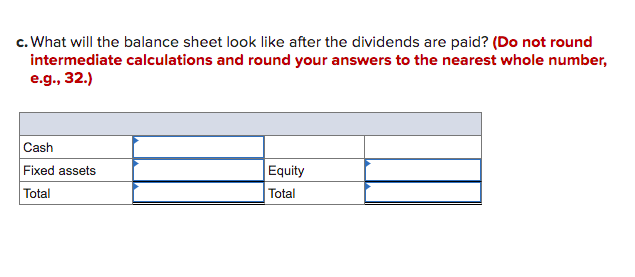

Transcribed Image Text:c. What will the balance sheet look like after the dividends are paid? (Do not round

intermediate calculations and round your answers to the nearest whole number,

e.g., 32.)

Cash

Fixed assets

Equity

Total

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT