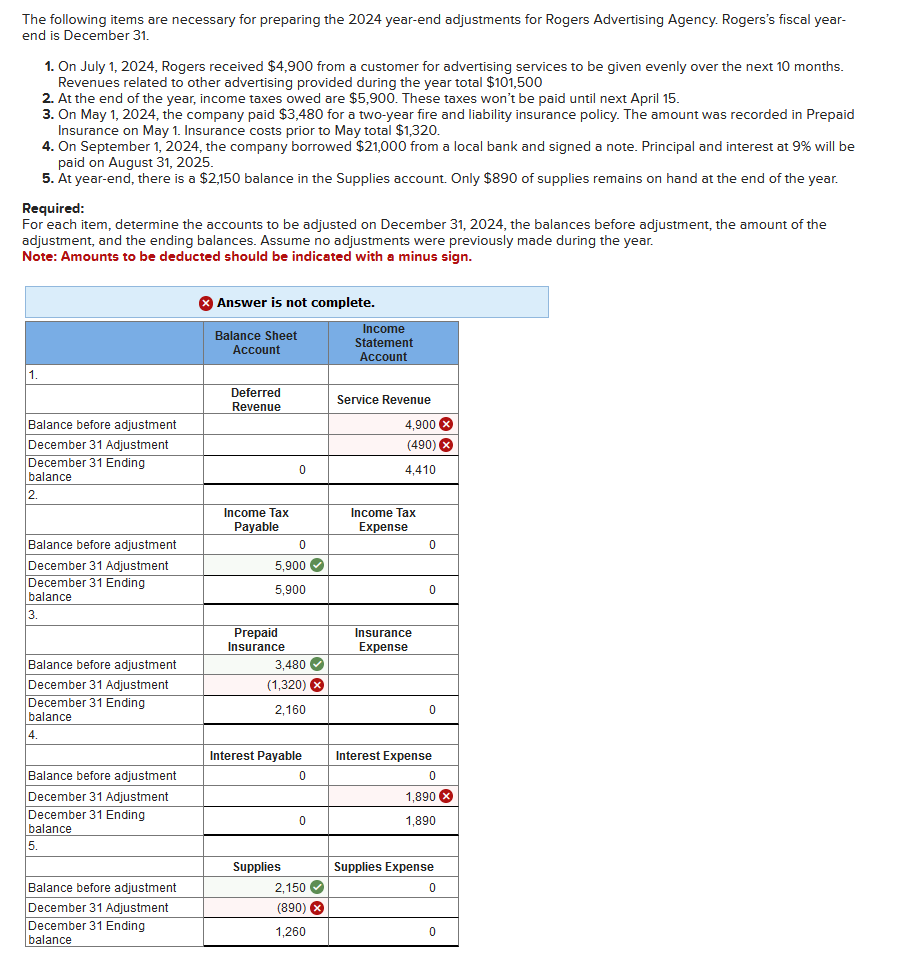

The following items are necessary for preparing the 2024 year-end adjustments for Rogers Advertising Agency. Rogers's fiscal year- end is December 31. 1. On July 1, 2024, Rogers received $4,900 from a customer for advertising services to be given evenly over the next 10 months. Revenues related to other advertising provided during the year total $101,500 2. At the end of the year, income taxes owed are $5,900. These taxes won't be paid until next April 15. 3. On May 1, 2024, the company paid $3,480 for a two-year fire and liability insurance policy. The amount was recorded in Prepaid Insurance on May 1. Insurance costs prior to May total $1,320. 4. On September 1, 2024, the company borrowed $21,000 from a local bank and signed a note. Principal and interest at 9% will be paid on August 31, 2025. 5. At year-end, there is a $2,150 balance in the Supplies account. Only $890 of supplies remains on hand at the end of the year. Required: For each item, determine the accounts to be adjusted on December 31, 2024, the balances before adjustment, the amount of the adjustment, and the ending balances. Assume no adjustments were previously made during the year. Note: Amounts to be deducted should be indicated with a minus sign. 1. Balance before adjustment December 31 Adjustment December 31 Ending balance 2. Balance before adjustment December 31 Adjustment December 31 Ending balance 3. Balance before adjustment December 31 Adjustment December 31 Ending balance 4. Balance before adjustment December 31 Adjustment December 31 Ending balance 5. Answer is not complete. Balance Sheet Account Deferred Revenue Income Tax Payable 0 5,900 5,900 Prepaid Insurance 0 3,480 (1,320) ► 2,160 Interest Payable 0 Supplies 0 Income Statement Account Service Revenue 4,900 (490) X 4,410 Income Tax Expense Insurance Expense 0 0 0 Interest Expense 0 1,890 1,890 Supplies Expense

The following items are necessary for preparing the 2024 year-end adjustments for Rogers Advertising Agency. Rogers's fiscal year- end is December 31. 1. On July 1, 2024, Rogers received $4,900 from a customer for advertising services to be given evenly over the next 10 months. Revenues related to other advertising provided during the year total $101,500 2. At the end of the year, income taxes owed are $5,900. These taxes won't be paid until next April 15. 3. On May 1, 2024, the company paid $3,480 for a two-year fire and liability insurance policy. The amount was recorded in Prepaid Insurance on May 1. Insurance costs prior to May total $1,320. 4. On September 1, 2024, the company borrowed $21,000 from a local bank and signed a note. Principal and interest at 9% will be paid on August 31, 2025. 5. At year-end, there is a $2,150 balance in the Supplies account. Only $890 of supplies remains on hand at the end of the year. Required: For each item, determine the accounts to be adjusted on December 31, 2024, the balances before adjustment, the amount of the adjustment, and the ending balances. Assume no adjustments were previously made during the year. Note: Amounts to be deducted should be indicated with a minus sign. 1. Balance before adjustment December 31 Adjustment December 31 Ending balance 2. Balance before adjustment December 31 Adjustment December 31 Ending balance 3. Balance before adjustment December 31 Adjustment December 31 Ending balance 4. Balance before adjustment December 31 Adjustment December 31 Ending balance 5. Answer is not complete. Balance Sheet Account Deferred Revenue Income Tax Payable 0 5,900 5,900 Prepaid Insurance 0 3,480 (1,320) ► 2,160 Interest Payable 0 Supplies 0 Income Statement Account Service Revenue 4,900 (490) X 4,410 Income Tax Expense Insurance Expense 0 0 0 Interest Expense 0 1,890 1,890 Supplies Expense

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 16E: Dudley Company failed to recognize the following accruals. It also recorded the prepaid expenses and...

Related questions

Question

Please Introduction and show work please without plagiarism please

Transcribed Image Text:The following items are necessary for preparing the 2024 year-end adjustments for Rogers Advertising Agency. Rogers's fiscal year-

end is December 31.

1. On July 1, 2024, Rogers received $4,900 from customer for advertising services to be given evenly over the next 10 months.

Revenues related to other advertising provided during the year total $101,500

2. At the end of the year, income taxes owed are $5,900. These taxes won't be paid until next April 15.

3. On May 1, 2024, the company paid $3,480 for a two-year fire and liability insurance policy. The amount was recorded in Prepaid

Insurance on May 1. Insurance costs prior to May total $1,320.

4. On September 1, 2024, the company borrowed $21,000 from a local bank and signed a note. Principal and interest at 9% will be

paid on August 31, 2025.

5. At year-end, there is a $2,150 balance in the Supplies account. Only $890 of supplies remains on hand at the end of the year.

Required:

For each item, determine the accounts to be adjusted on December 31, 2024, the balances before adjustment, the amount of the

adjustment, and the ending balances. Assume no adjustments were previously made during the year.

Note: Amounts to be deducted should be indicated with a minus sign.

1.

Balance before adjustment

December 31 Adjustment

December nding

balance

2.

Balance before adjustment

December 31 Adjustment

December 31 Ending

balance

3.

Balance before adjustment

December 31 Adjustment

December 31 Ending

balance

4.

Balance before adjustment

December 31 Adjustment

December 31 Ending

balance

5.

Balance before adjustment

December 31 Adjustment

December 31 Ending

balance

Answer is not complete.

Balance Sheet

Account

Deferred

Revenue

Income Tax

Payable

0

5,900✔

5,900

Prepaid

Insurance

0

3,480✔

(1,320) X

2,160

Interest Payable

Supplies

0

0

2,150

(890) X

1,260

Income

Statement

Account

Service Revenue

4,900 X

(490) x

4,410

Income Tax

Expense

Insurance

Expense

0

0

0

Interest Expense

0

1,890 X

1,890

Supplies Expense

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning