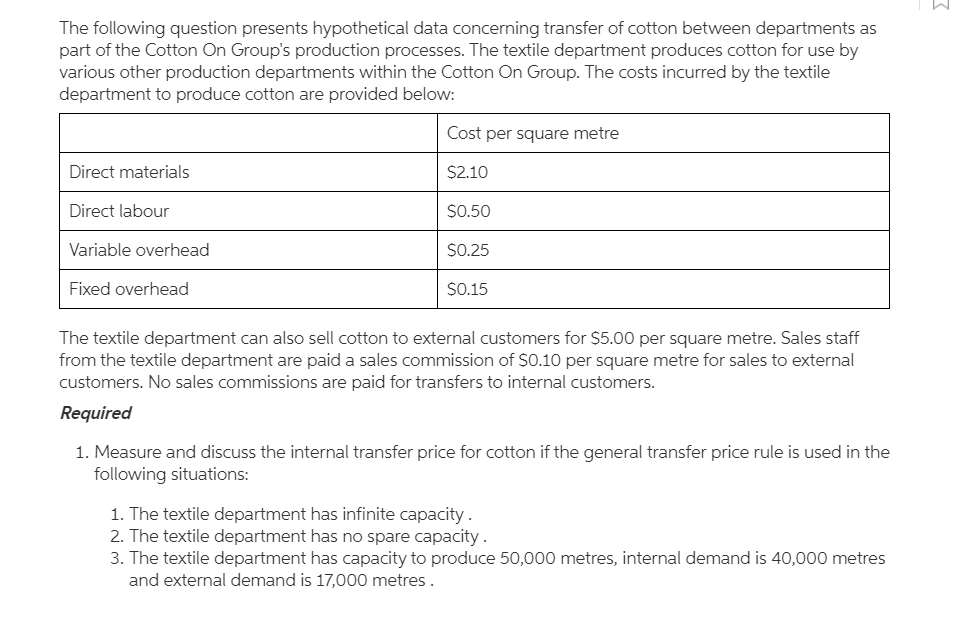

The following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's production processes. The textile department produces cotton for use by various other production departments within the Cotton On Group. The costs incurred by the textile department to produce cotton are provided below: Cost per square metre Direct materials $2.10 Direct labour $0.50 Variable overhead $0.25 Fixed overhead $0.15 The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff from the textile department are paid a sales commission of SO.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required 1. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the following situations: 1. The textile department has infinite capacity. 2. The textile department has no spare capacity . 3. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres.

The following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's production processes. The textile department produces cotton for use by various other production departments within the Cotton On Group. The costs incurred by the textile department to produce cotton are provided below: Cost per square metre Direct materials $2.10 Direct labour $0.50 Variable overhead $0.25 Fixed overhead $0.15 The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff from the textile department are paid a sales commission of SO.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required 1. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the following situations: 1. The textile department has infinite capacity. 2. The textile department has no spare capacity . 3. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 6E: Davis Snowflake Co. produces Christmas stockings in its Cutting and Sewing departments. The...

Related questions

Question

Transcribed Image Text:The following question presents hypothetical data concerning transfer of cotton between departments as

part of the Cotton On Group's production processes. The textile department produces cotton for use by

various other production departments within the Cotton On Group. The costs incurred by the textile

department to produce cotton are provided below:

Cost per square metre

Direct materials

$2.10

Direct labour

$0.50

Variable overhead

$0.25

Fixed overhead

$0.15

The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff

from the textile department are paid a sales commission of SO.10 per square metre for sales to external

customers. No sales commissions are paid for transfers to internal customers.

Required

1. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the

following situations:

1. The textile department has infinite capacity.

2. The textile department has no spare capacity .

3. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres

and external demand is 17,000 metres.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College