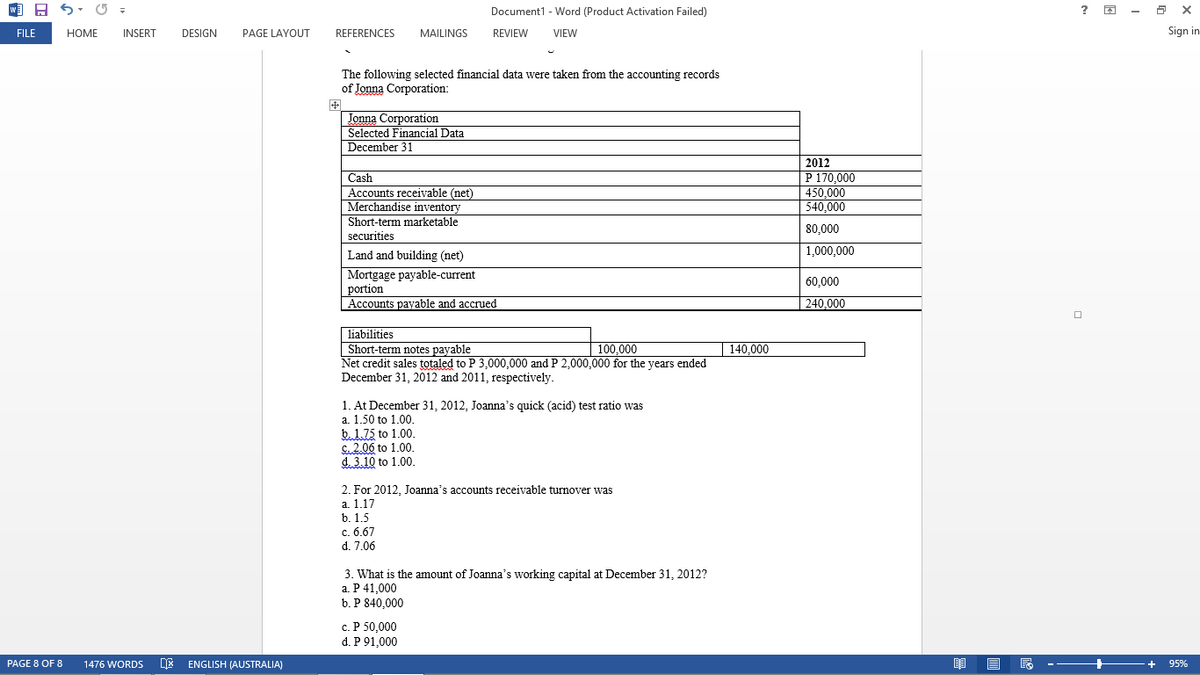

The following selected financial data were taken from the accounting records of Jonna Corporation: Jonna Corporation Selected Financial Data December 31 Cash Accounts receivable (net) Merchandise inventory Short-term marketable securities 2012 |P 170,000 450,000 540,000 80,000 Land and building (net) 1,000,000 | Mortgage payable-current portion Accounts payable and accrued 60,000 240,000 liabilities Short-term notes payable Net credit sales totaled to P 3,000,000 and P 2,000,000 for the years ended December 31, 2012 and 2011, respectively. 100,000 140,000 1. At December 31, 2012, Joanna's quick (acid) test ratio was a. 1.50 to 1.00. b.1.75 to 1.00. C.2.06 to 1.00. d. 3.10 to 1.00. 2. For 2012, Joanna's accounts receivable tumover was а. 1.17 b. 1.5 c. 6.67 d. 7.06 3. What is the amount of Joanna's working capital at December 31, 2012? a. P 41,000 b. P 840,000 c. P 50,000 d. P91,000

The following selected financial data were taken from the accounting records of Jonna Corporation: Jonna Corporation Selected Financial Data December 31 Cash Accounts receivable (net) Merchandise inventory Short-term marketable securities 2012 |P 170,000 450,000 540,000 80,000 Land and building (net) 1,000,000 | Mortgage payable-current portion Accounts payable and accrued 60,000 240,000 liabilities Short-term notes payable Net credit sales totaled to P 3,000,000 and P 2,000,000 for the years ended December 31, 2012 and 2011, respectively. 100,000 140,000 1. At December 31, 2012, Joanna's quick (acid) test ratio was a. 1.50 to 1.00. b.1.75 to 1.00. C.2.06 to 1.00. d. 3.10 to 1.00. 2. For 2012, Joanna's accounts receivable tumover was а. 1.17 b. 1.5 c. 6.67 d. 7.06 3. What is the amount of Joanna's working capital at December 31, 2012? a. P 41,000 b. P 840,000 c. P 50,000 d. P91,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

Questions 1 to 3 are based on the following information.

Transcribed Image Text:Document1 - Word (Product Activation Failed)

FILE

HOME

INSERT

DESIGN

PAGE LAYOUT

REFERENCES

MAILINGS

REVIEW

VIEW

Sign in

The following selected financial data were taken from the accounting records

of Jonna Corporation:

Jonna Corporation

Selected Financial Data

December 31

2012

P 170,000

450,000

540,000

Cash

Accounts receivable (net)

Merchandise inventory

Short-term marketable

80,000

securities

1,000,000

Land and building (net)

Mortgage payable-current

portion

Accounts payable and accrued

60,000

240.000

| liabilities

Short-term notes payable

Net credit sales totaled to P 3,000,000 and P 2,000,000 for the years ended

December 31, 2012 and 2011, respectively.

100,000

| 140,000

1. At December 31, 2012, Joanna's quick

a. 1.50 to 1.00,

test ratio

b. 1.75 to 1.00.

c. 2.06 to 1.00.

d. 3.10 to 1.00.

2. For 2012, Joanna's accounts receivable turnover was

а. 1.17

b. 1.5

c. 6.67

d. 7.06

3. What is the amount of Joanna's working capital at December 31, 2012?

а. Р 41,000

b. P 840,000

c. P 50,000

d. P 91,000

PAGE 8 OF 8

1476 WORDS

ENGLISH (AUSTRALIA)

95%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning