The following T-accounts represent November activity. Materials Inventory Work-In-Process Inventory 33,200 EB (11/30) 57,000 Finished Goods Inventory Cost of Goods Sold EB (11/30) 98,000 Manufacturing Overhead Control Applied Manufacturing Overhead 265,500 Wages Payable Sales Revenue 644,800 Additional Data • Materials of $115,100 were purchased during the month, and the balance in the Materials Inventory account increased by $10,900. • Overhead is applied at the rate of 150 percent of direct labor cost. Sales are billed at 160 percent of cost of goods sold before the over- or underapplied overhead is prorated. • The balance in the Finished Goods Inventory account decreased by $28,000 during the month before any proration of under-or overapplied overhead. • Total credits to the Wages Payable account amounted to $201,000 for direct and indirect labor. • Factory depreciation totaled $46,730. • Overhead was underapplied by $25,480. Overhead other than indirect labor, indirect materials, and depreciation was $203,150, which required payment in cash. Underapplied overhead is to be allocated. The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation. Required: Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions. BB (11/1) Dir.Materials 87,100

The following T-accounts represent November activity. Materials Inventory Work-In-Process Inventory 33,200 EB (11/30) 57,000 Finished Goods Inventory Cost of Goods Sold EB (11/30) 98,000 Manufacturing Overhead Control Applied Manufacturing Overhead 265,500 Wages Payable Sales Revenue 644,800 Additional Data • Materials of $115,100 were purchased during the month, and the balance in the Materials Inventory account increased by $10,900. • Overhead is applied at the rate of 150 percent of direct labor cost. Sales are billed at 160 percent of cost of goods sold before the over- or underapplied overhead is prorated. • The balance in the Finished Goods Inventory account decreased by $28,000 during the month before any proration of under-or overapplied overhead. • Total credits to the Wages Payable account amounted to $201,000 for direct and indirect labor. • Factory depreciation totaled $46,730. • Overhead was underapplied by $25,480. Overhead other than indirect labor, indirect materials, and depreciation was $203,150, which required payment in cash. Underapplied overhead is to be allocated. The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation. Required: Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions. BB (11/1) Dir.Materials 87,100

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 8SPB

Related questions

Question

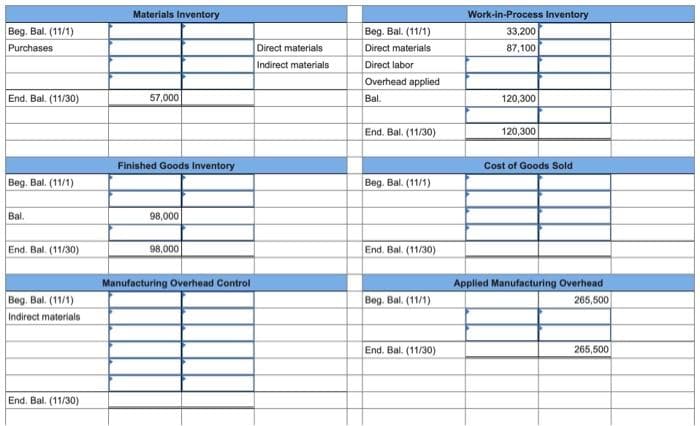

Transcribed Image Text:Beg. Bal. (11/1)

Purchases

End. Bal. (11/30)

Beg. Bal. (11/1)

Bal.

End. Bal. (11/30)

Beg. Bal. (11/1)

Indirect materials

End. Bal. (11/30)

Materials Inventory

57,000

Finished Goods Inventory

98,000

98,000

Manufacturing Overhead Control

Direct materials

Indirect materials

Beg. Bal. (11/1)

Direct materials

Direct labor

Overhead applied

Bal.

End. Bal. (11/30)

Beg. Bal. (11/1)

End. Bal. (11/30)

Beg. Bal. (11/1)

End. Bal. (11/30)

Work-in-Process Inventory

33,200

87,100

120,300

120,300

Cost of Goods Sold

Applied Manufacturing Overhead

265,500

265,500

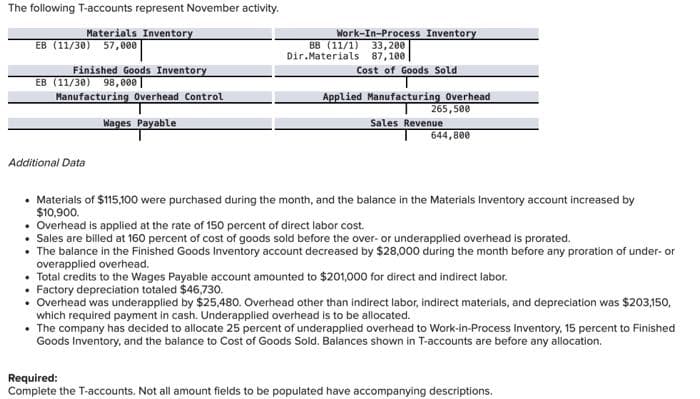

Transcribed Image Text:The following T-accounts represent November activity.

Materials Inventory

Work-In-Process Inventory

33,200

EB (11/30) 57,000

Finished Goods Inventory

Cost of Goods Sold

EB (11/30) 98,000

Manufacturing Overhead Control

Applied Manufacturing Overhead

265,500

Wages Payable

Sales Revenue

644,800

Additional Data

Materials of $115,100 were purchased during the month, and the balance in the Materials Inventory account increased by

$10,900.

• Overhead is applied at the rate of 150 percent of direct labor cost.

Sales are billed at 160 percent of cost of goods sold before the over- or underapplied overhead is prorated.

• The balance in the Finished Goods Inventory account decreased by $28,000 during the month before any proration of under-or

overapplied overhead.

• Total credits to the Wages Payable account amounted to $201,000 for direct and indirect labor.

Factory depreciation totaled $46,730.

• Overhead was underapplied by $25,480. Overhead other than indirect labor, indirect materials, and depreciation was $203,150,

which required payment in cash. Underapplied overhead is to be allocated.

• The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished

Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation.

Required:

Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions.

BB (11/1)

Dir.Materials 87,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning