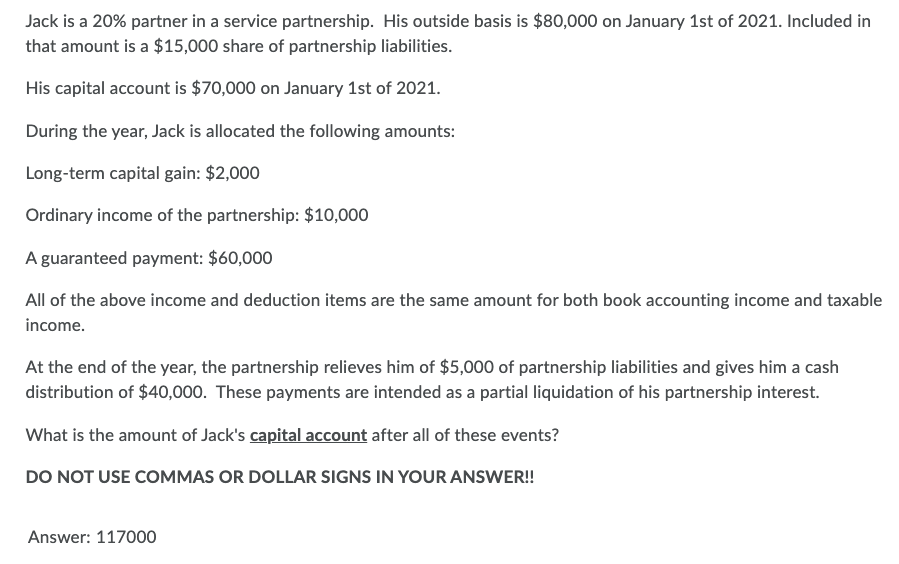

Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2021. Included in that amount is a $15,000 share of partnership liabilities. His capital account is $70,000 on January 1st of 2021. During the year, Jack is allocated the following amounts: Long-term capital gain: $2,000 Ordinary income of the partnership: $10,000 A guaranteed payment: $60,000 All of the above income and deduction items are the same amount for both book accounting income and taxable income. At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest. What is the amount of Jack's capital account after all of these events? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2021. Included in that amount is a $15,000 share of partnership liabilities. His capital account is $70,000 on January 1st of 2021. During the year, Jack is allocated the following amounts: Long-term capital gain: $2,000 Ordinary income of the partnership: $10,000 A guaranteed payment: $60,000 All of the above income and deduction items are the same amount for both book accounting income and taxable income. At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest. What is the amount of Jack's capital account after all of these events? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

This answer is wrong . please give me the right answer.

Transcribed Image Text:Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2021. Included in

that amount is a $15,000 share of partnership liabilities.

His capital account is $70,000 on January 1st of 2021.

During the year, Jack is allocated the following amounts:

Long-term capital gain: $2,000

Ordinary income of the partnership: $10,000

A guaranteed payment: $60,000

All of the above income and deduction items are the same amount for both book accounting income and taxable

income.

At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash

distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest.

What is the amount of Jack's capital account after all of these events?

DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!!

Answer: 117000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you