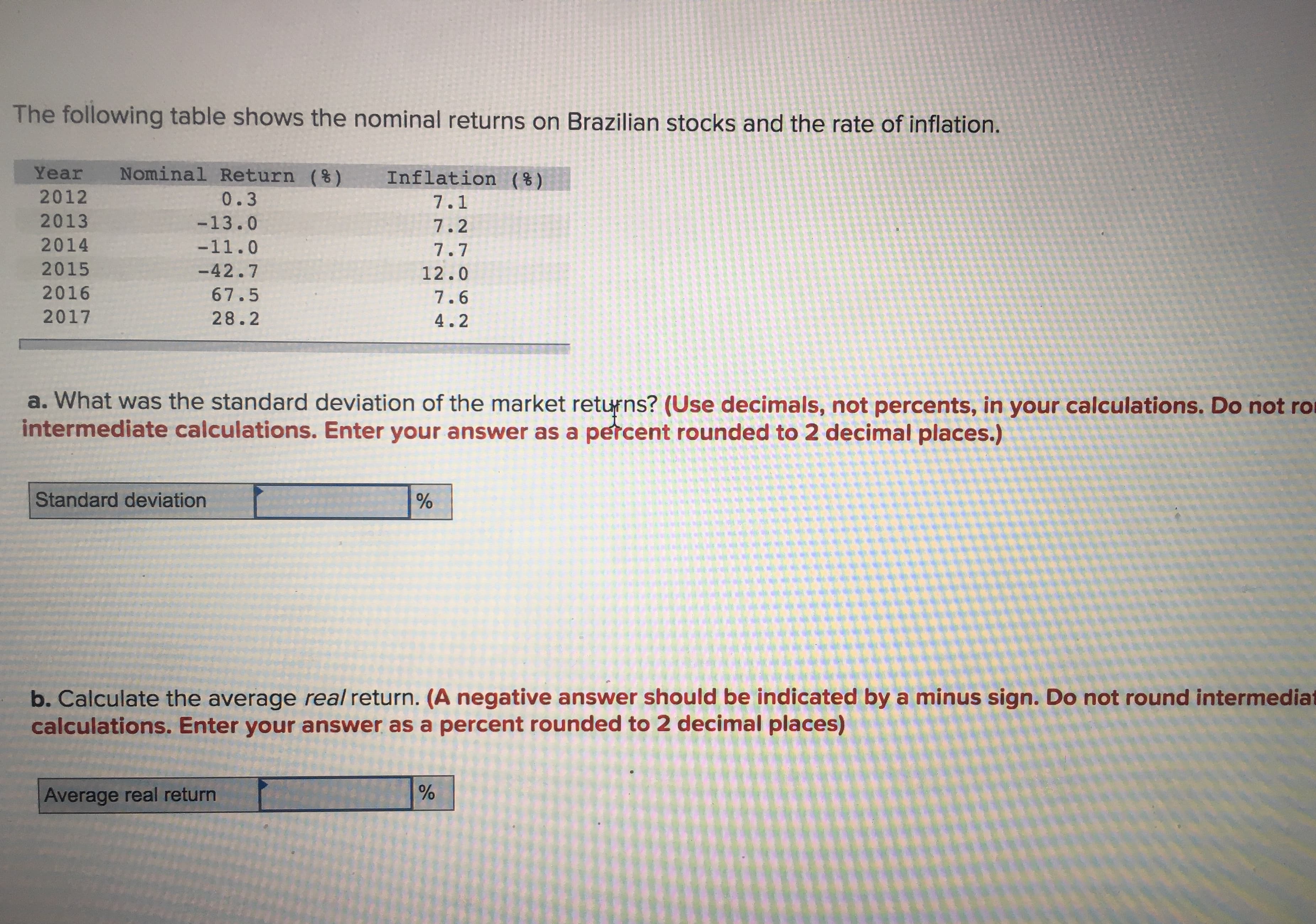

The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Nominal Return (%) Year Inflation (%) 2012 0.3 7.1 2013 -13.0 7.2 2014 -11.0 7.7 2015 -42.7 12.0 2016 67.5 7.6 2017 28.2 4.2 a. What was the standard deviation of the market retuns? (Use decimals, not percents, in your calculations. Do not ro intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Standard deviation b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediat calculations. Enter your answer as a percent rounded to 2 decimal places) Average real return

The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Nominal Return (%) Year Inflation (%) 2012 0.3 7.1 2013 -13.0 7.2 2014 -11.0 7.7 2015 -42.7 12.0 2016 67.5 7.6 2017 28.2 4.2 a. What was the standard deviation of the market retuns? (Use decimals, not percents, in your calculations. Do not ro intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Standard deviation b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediat calculations. Enter your answer as a percent rounded to 2 decimal places) Average real return

Chapter10: Measuring Exposure To Exchange Rate Fluctuations

Section: Chapter Questions

Problem 41QA

Related questions

Question

Transcribed Image Text:The following table shows the nominal returns on Brazilian stocks and the rate of inflation.

Nominal Return (%)

Year

Inflation (%)

2012

0.3

7.1

2013

-13.0

7.2

2014

-11.0

7.7

2015

-42.7

12.0

2016

67.5

7.6

2017

28.2

4.2

a. What was the standard deviation of the market retuns? (Use decimals, not percents, in your calculations. Do not ro

intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Standard deviation

b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediat

calculations. Enter your answer as a percent rounded to 2 decimal places)

Average real return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Recommended textbooks for you