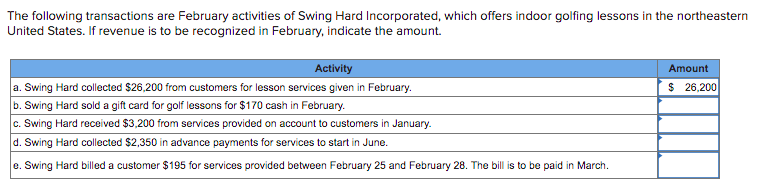

The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If revenue is to be recognized in February, indicate the amount. Activity Amount a. Swing Hard collected $26,200 from customers for lesson services given in February. b. Swing Hard sold a gift card for golf lessons for $170 cash in February. c. Swing Hard received $3,200 from services provided on account to customers in January. d. Swing Hard collected $2,350 in advance payments for services to start in June. $ 26,200 e. Swing Hard blled a customer $195 for services provided between February 25 and February 28. The bill is to be paid in March.

The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern United States. If revenue is to be recognized in February, indicate the amount. Activity Amount a. Swing Hard collected $26,200 from customers for lesson services given in February. b. Swing Hard sold a gift card for golf lessons for $170 cash in February. c. Swing Hard received $3,200 from services provided on account to customers in January. d. Swing Hard collected $2,350 in advance payments for services to start in June. $ 26,200 e. Swing Hard blled a customer $195 for services provided between February 25 and February 28. The bill is to be paid in March.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 4PB: In March, T. Carter established Carter Delivery Service. The account headings are presented below....

Related questions

Question

Transcribed Image Text:The following transactions are February activities of Swing Hard Incorporated, which offers indoor golfing lessons in the northeastern

United States. If revenue is to be recognized in February, indicate the amount.

Activity

Amount

a. Swing Hard collected $26,200 from customers for lesson services given in February.

b. Swing Hard sold a gift card for golf lessons for $170 cash in February.

c. Swing Hard received $3,200 from services provided on account to customers in January.

d. Swing Hard collected $2,350 in advance payments for services to start in June.

$ 26,200

e. Swing Hard billed a customer $195 for services provided between February 25 and February 28. The bill is to be paid in March.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub