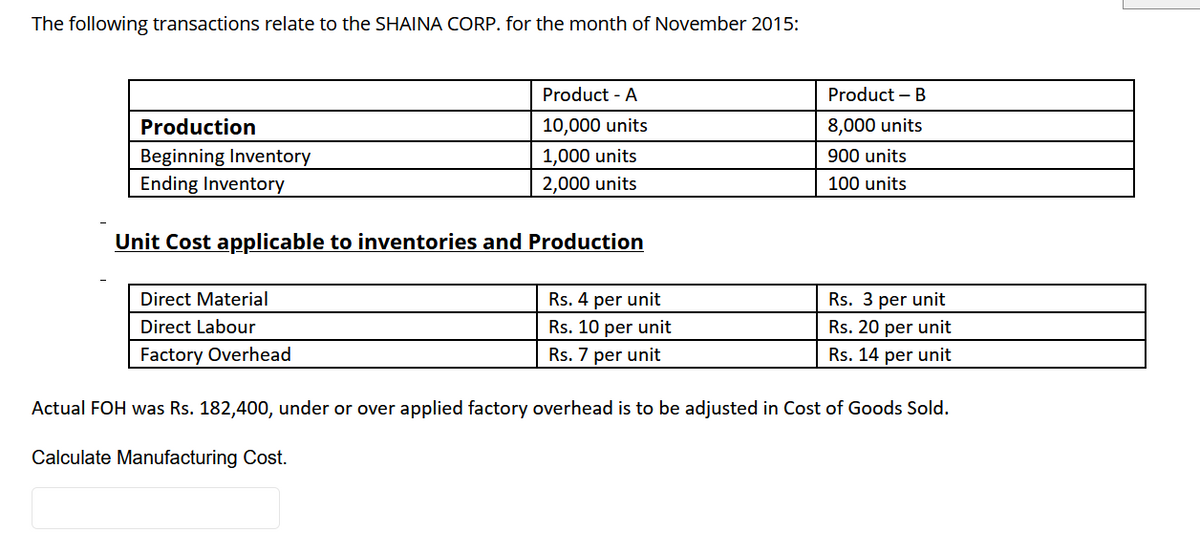

The following transactions relate to the SHAINA CORP. for the month of November 2015: Product - A Product – B Production 10,000 units 8,000 units Beginning Inventory 1,000 units 900 units Ending Inventory 2,000 units 100 units Unit Cost applicable to inventories and Production Direct Material Rs. 4 per unit Rs. 3 per unit Direct Labour Rs. 10 per unit Rs. 20 per unit Factory Overhead Rs. 7 per unit Rs. 14 per unit Actual FOH was Rs. 182,400, under or over applied factory overhead is to be adjusted in Cost of Goods Sold. Calculate Manufacturing Cost.

The following transactions relate to the SHAINA CORP. for the month of November 2015: Product - A Product – B Production 10,000 units 8,000 units Beginning Inventory 1,000 units 900 units Ending Inventory 2,000 units 100 units Unit Cost applicable to inventories and Production Direct Material Rs. 4 per unit Rs. 3 per unit Direct Labour Rs. 10 per unit Rs. 20 per unit Factory Overhead Rs. 7 per unit Rs. 14 per unit Actual FOH was Rs. 182,400, under or over applied factory overhead is to be adjusted in Cost of Goods Sold. Calculate Manufacturing Cost.

Chapter5: Process Costing

Section: Chapter Questions

Problem 9EA: Using the weighted-average method, compute the equivalent units of production if the beginning...

Related questions

Question

The following transactions relate to the SHAINA CORP. for the month of November 2015:

|

|

Product - A |

Product – B |

|

Production |

10,000 units |

8,000 units |

|

Beginning Inventory |

1,000 units |

900 units |

|

Ending Inventory |

2,000 units |

100 units |

Unit Cost applicable to inventories and Production

|

Direct Material |

Rs. 4 per unit |

Rs. 3 per unit |

|

Direct Labour |

Rs. 10 per unit |

Rs. 20 per unit |

|

Factory |

Rs. 7 per unit |

Rs. 14 per unit |

Actual FOH was Rs. 182,400, under or over applied factory overhead is to be adjusted in Cost of Goods Sold.

Calculate Manufacturing Cost.

Transcribed Image Text:The following transactions relate to the SHAINA CORP. for the month of November 2015:

Product - A

Product – B

Production

10,000 units

8,000 units

Beginning Inventory

Ending Inventory

1,000 units

900 units

2,000 units

100 units

Unit Cost applicable to inventories and Production

Direct Material

Rs. 4 per unit

Rs. 3 per unit

Direct Labour

Rs. 10 per unit

Rs. 20 per unit

Factory Overhead

Rs. 7 per unit

Rs. 14 per unit

Actual FOH was Rs. 182,400, under or over applied factory overhead is to be adjusted in Cost of Goods Sold.

Calculate Manufacturing Cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,