The individual financial statements for the two companies as well as consolidated totals for 2021 follow (credit balances indicated by parentheses): Parson Consolidated Syber Company $(558,000) 360,000 94,000 Totals Company 2$ $(1,281,000) 668,000 187,900 Sales Cost of goods sold Operating expenses Income of Syber (880,000) 455,000 92,000 (73,680) Separate company net income 2$ (406,680) $(104,000) (425,100) 18,420 Consolidated net income 2$ Net income attributable to noncontrolling interest $ ( 406,680) Net income attributable to Parson Company Retained earnings, 1/1/21 Net income (above) (535,760) (406,680) 71,000 $(310,000) (104,000) 32,000 (535,760) (406,680) 71,000 2$ 2$ Dividends declared Retained earnings, 12/31/21 $ (871,440) $(382,000) 2$ (871,440) $ 78,000 147,000 Cash and receivables 280,000 192,000 371,760 388,000 2$ 333,000 319,000 $ Inventory Investment in Syber Company Land, buildings, and equipment Trademarks 745,000 24,700 $ 1,421,700 357,000 Total assets $ 1,231,760 $ 582,000 (198,320) (130,000) (32,000) $(122,000) (78,000) Liabilities 2$ (295,320) 2$ (130,000) (32,000) (92,940) (871,440) Common stock Additional paid-in capital Noncontrolling interest in Syber Retained earnings (above) (871,440) (382,000) Total liabilities and equities $(1,231,760) $(582,000) $(1,421,700) a. What method does Parson use to account for investment in Syber? b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period? c. What amount was originally allocated to the trademarks? d. What is the amount of the current-year intra-entity inventory sales? e. Were the intra-entity inventory sales made upstream or downstream? f. What is the balance of the intra-entity liability at the end of the current year? g. What amount of intra-entity gross profit was deferred from the preceding period and recognized in the current period? h. What was the ending Noncontrolling Interest in Syber Company computed? i. With a tax rate of 21 percent, what income tax journal entry is recorded if the companies prepare a consolidated tax return? j. With a tax rate of 21 percent, what income tax journal entry is recorded if these two companies prepare separate tax returns?

The individual financial statements for the two companies as well as consolidated totals for 2021 follow (credit balances indicated by parentheses): Parson Consolidated Syber Company $(558,000) 360,000 94,000 Totals Company 2$ $(1,281,000) 668,000 187,900 Sales Cost of goods sold Operating expenses Income of Syber (880,000) 455,000 92,000 (73,680) Separate company net income 2$ (406,680) $(104,000) (425,100) 18,420 Consolidated net income 2$ Net income attributable to noncontrolling interest $ ( 406,680) Net income attributable to Parson Company Retained earnings, 1/1/21 Net income (above) (535,760) (406,680) 71,000 $(310,000) (104,000) 32,000 (535,760) (406,680) 71,000 2$ 2$ Dividends declared Retained earnings, 12/31/21 $ (871,440) $(382,000) 2$ (871,440) $ 78,000 147,000 Cash and receivables 280,000 192,000 371,760 388,000 2$ 333,000 319,000 $ Inventory Investment in Syber Company Land, buildings, and equipment Trademarks 745,000 24,700 $ 1,421,700 357,000 Total assets $ 1,231,760 $ 582,000 (198,320) (130,000) (32,000) $(122,000) (78,000) Liabilities 2$ (295,320) 2$ (130,000) (32,000) (92,940) (871,440) Common stock Additional paid-in capital Noncontrolling interest in Syber Retained earnings (above) (871,440) (382,000) Total liabilities and equities $(1,231,760) $(582,000) $(1,421,700) a. What method does Parson use to account for investment in Syber? b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period? c. What amount was originally allocated to the trademarks? d. What is the amount of the current-year intra-entity inventory sales? e. Were the intra-entity inventory sales made upstream or downstream? f. What is the balance of the intra-entity liability at the end of the current year? g. What amount of intra-entity gross profit was deferred from the preceding period and recognized in the current period? h. What was the ending Noncontrolling Interest in Syber Company computed? i. With a tax rate of 21 percent, what income tax journal entry is recorded if the companies prepare a consolidated tax return? j. With a tax rate of 21 percent, what income tax journal entry is recorded if these two companies prepare separate tax returns?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 11P

Related questions

Question

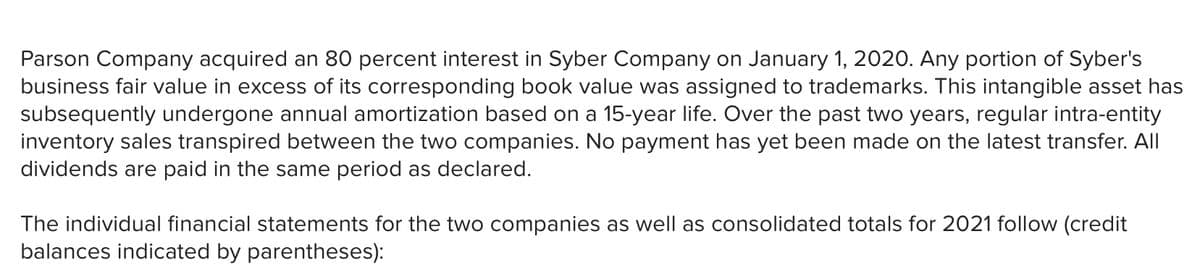

Transcribed Image Text:Parson Company acquired an 80 percent interest in Syber Company on January 1, 2020. Any portion of Syber's

business fair value in excess of its corresponding book value was assigned to trademarks. This intangible asset has

subsequently undergone annual amortization based on a 15-year life. Over the past two years, regular intra-entity

inventory sales transpired between the two companies. No payment has yet been made on the latest transfer. All

dividends are paid in the same period as declared.

The individual financial statements for the two companies as well as consolidated totals for 2021 follow (credit

balances indicated by parentheses):

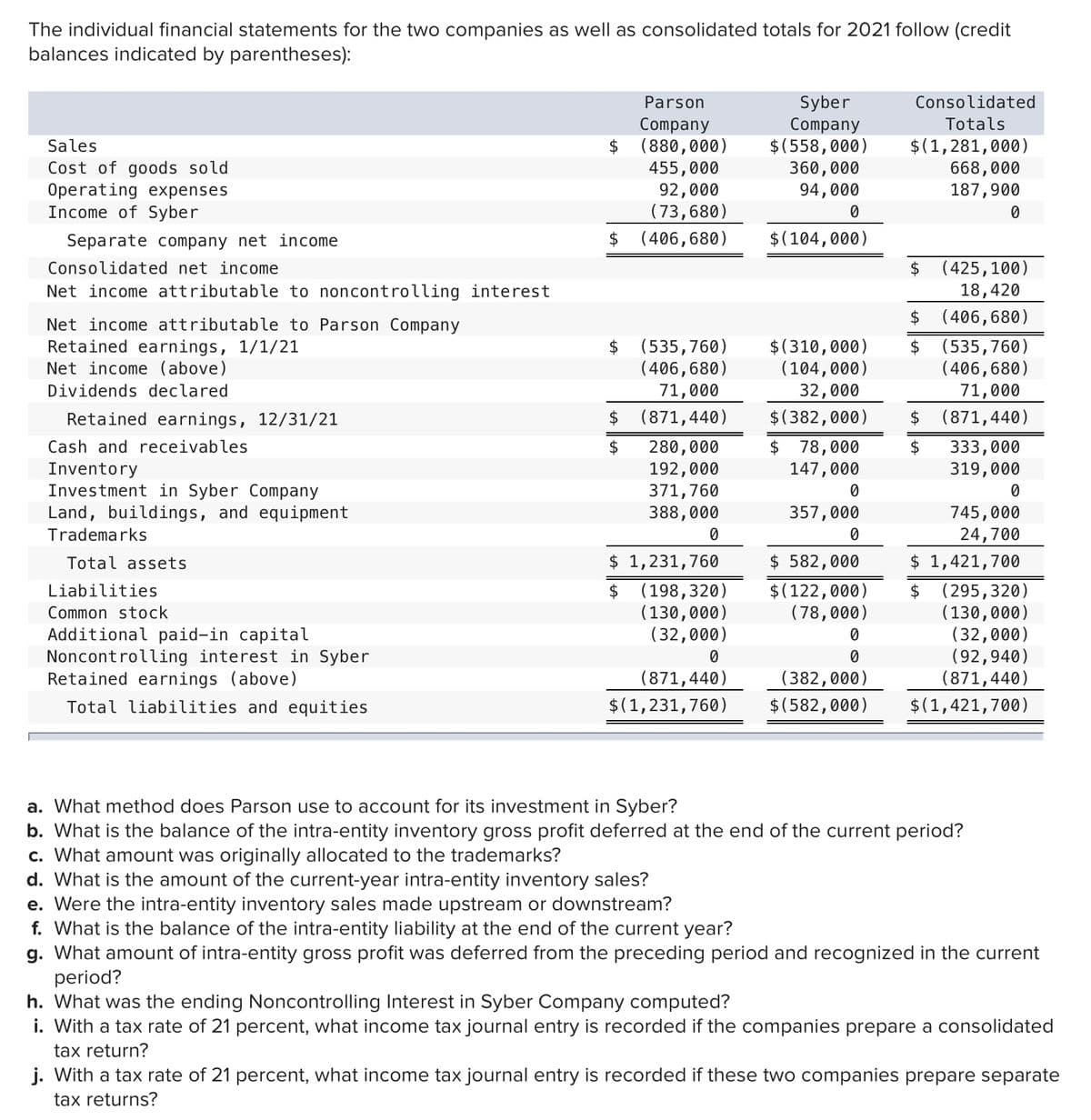

Transcribed Image Text:The individual financial statements for the two companies as well as consolidated totals for 2021 follow (credit

balances indicated by parentheses):

Consolidated

Syber

Company

$(558,000)

360,000

94,000

Parson

Company

$(880,000)

455,000

92,000

Totals

$(1,281,000)

668,000

187,900

Sales

Cost of goods sold

Operating expenses

Income of Syber

(73,680)

Separate company net income

2$

(406,680)

$(104,000)

Consolidated net income

$(425,100)

18,420

$ (406,680)

Net income attributable to noncontrolling interest

Net income attributable to Parson Company

Retained earnings, 1/1/21

Net income (above)

$ (535,760)

(406,680)

71,000

(871,440)

(535,760)

(406,680)

71,000

(871,440)

$(310,000)

(104,000)

Dividends declared

32,000

Retained earnings, 12/31/21

2$

$(382,000)

$

Cash and receivables

$

280,000

192,000

371,760

388,000

$

78,000

$

333,000

Inventory

Investment in Syber Company

Land, buildings, and equipment

Trademarks

147,000

319,000

357,000

745,000

24,700

Total assets

$ 1,231,760

$ 582,000

$ 1,421,700

$(122,000)

(78,000)

$(295,320)

(130,000)

(32,000)

(92,940)

(871,440)

Liabilities

(198,320)

(130,000)

(32,000)

Common stock

Additional paid-in capital

Noncontrolling interest in Syber

Retained earnings (above)

(871,440)

(382,000)

Total liabilities and equities

$(1,231,760)

$(582,000)

$(1,421,700)

a. What method does Parson use to account for its investment in Syber?

b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period?

c. What amount was originally allocated to the trademarks?

d. What is the amount of the current-year intra-entity inventory sales?

e. Were the intra-entity inventory sales made upstream or downstream?

f. What is the balance of the intra-entity liability at the end of the current year?

g. What amount of intra-entity gross profit was deferred from the preceding period and recognized in the current

period?

h. What was the ending Noncontrolling Interest in Syber Company computed?

i. With a tax rate of 21 percent, what income tax journal entry is recorded if the companies prepare a consolidated

tax return?

j. With a tax rate of 21 percent, what income tax journal entry is recorded if these two companies prepare separate

tax returns?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning