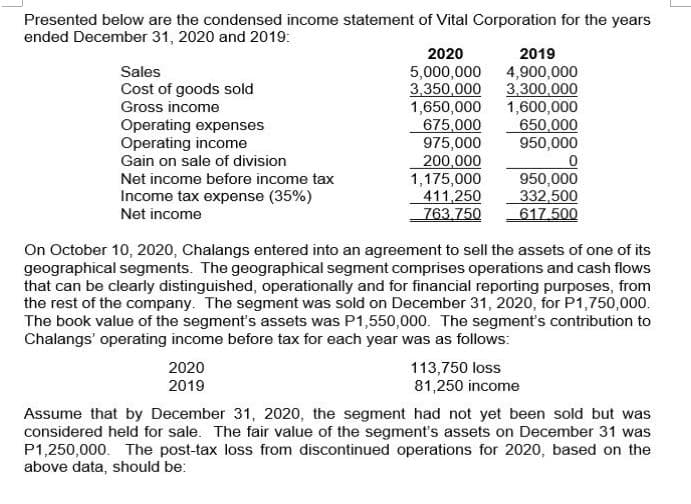

Presented below are the condensed income statement of Vital Corporation for the years ended December 31, 2020 and 2019: 2020 5,000,000 4,900,000 3,350,000 3,300,000 1,650,000 1,600,000 675,000 975,000 200,000 1,175,000 411,250 763.750 2019 Sales Cost of goods sold Gross income Operating expenses Operating income Gain on sale of division 650,000 950,000 Net income before income tax Income tax expense (35%) 950,000 332,500 617.500 Net income On October 10, 2020, Chalangs entered into an agreement to sell the assets of one of its geographical segments. The geographical segment comprises operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the company. The segment was sold on December 31, 2020, for P1,750,000. The book value of the segment's assets was P1,550,000. The segment's contribution to Chalangs' operating income before tax for each year was as follows: 2020 2019 113,750 loss 81,250 income Assume that by December 31, 2020, the segment had not yet been sold but was considered held for sale. The fair value of the segment's assets on December 31 was P1,250,000. The post-tax loss from discontinued operations for 2020, based on the above data, should be:

Presented below are the condensed income statement of Vital Corporation for the years ended December 31, 2020 and 2019: 2020 5,000,000 4,900,000 3,350,000 3,300,000 1,650,000 1,600,000 675,000 975,000 200,000 1,175,000 411,250 763.750 2019 Sales Cost of goods sold Gross income Operating expenses Operating income Gain on sale of division 650,000 950,000 Net income before income tax Income tax expense (35%) 950,000 332,500 617.500 Net income On October 10, 2020, Chalangs entered into an agreement to sell the assets of one of its geographical segments. The geographical segment comprises operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the company. The segment was sold on December 31, 2020, for P1,750,000. The book value of the segment's assets was P1,550,000. The segment's contribution to Chalangs' operating income before tax for each year was as follows: 2020 2019 113,750 loss 81,250 income Assume that by December 31, 2020, the segment had not yet been sold but was considered held for sale. The fair value of the segment's assets on December 31 was P1,250,000. The post-tax loss from discontinued operations for 2020, based on the above data, should be:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

Requirement:

1. Net income in 2019 and 2020.

2. Post-tax loss from discontinued operations for 2020.

Transcribed Image Text:Presented below are the condensed income statement of Vital Corporation for the years

ended December 31, 2020 and 2019:

2020

2019

Sales

5,000,000 4,900,000

3,350,000

1,650,000

675,000

975,000

200,000

1,175,000

411,250

763.750

3.300.000

1,600,000

650,000

950,000

Cost of goods sold

Gross income

Operating expenses

Operating income

Gain on sale of division

950,000

332,500

617.500

Net income before income tax

Income tax expense (35%)

Net income

On October 10, 2020, Chalangs entered into an agreement to sell the assets of one of its

geographical segments. The geographical segment comprises operations and cash flows

that can be clearly distinguished, operationally and for financial reporting purposes, from

the rest of the company. The segment was sold on December 31, 2020, for P1,750,000.

The book value of the segment's assets was P1,550,000. The segment's contribution to

Chalangs' operating income before tax for each year was as follows:

113,750 loss

81,250 income

2020

2019

Assume that by December 31, 2020, the segment had not yet been sold but was

considered held for sale. The fair value of the segment's assets on December 31 was

P1,250,000. The post-tax loss from discontinued operations for 2020, based on the

above data, should be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning