The information for Sacramento Corporation is given below. Degree of operating leverage: Break-even revenue: %24 360,000 Variable Expense: 60% of Sales What is the actual net operating income? A. $ 180,000 B. $ 216,000 C. $ 144,000 D. $ 108,000 E. None of the above

The information for Sacramento Corporation is given below. Degree of operating leverage: Break-even revenue: %24 360,000 Variable Expense: 60% of Sales What is the actual net operating income? A. $ 180,000 B. $ 216,000 C. $ 144,000 D. $ 108,000 E. None of the above

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 2Q: Would each of the following increase, decrease, or have an indeterminant effect on a firms...

Related questions

Question

Please I want to learn how to make this problem with a good explanation. One of those there is the possible answer.

Thank you

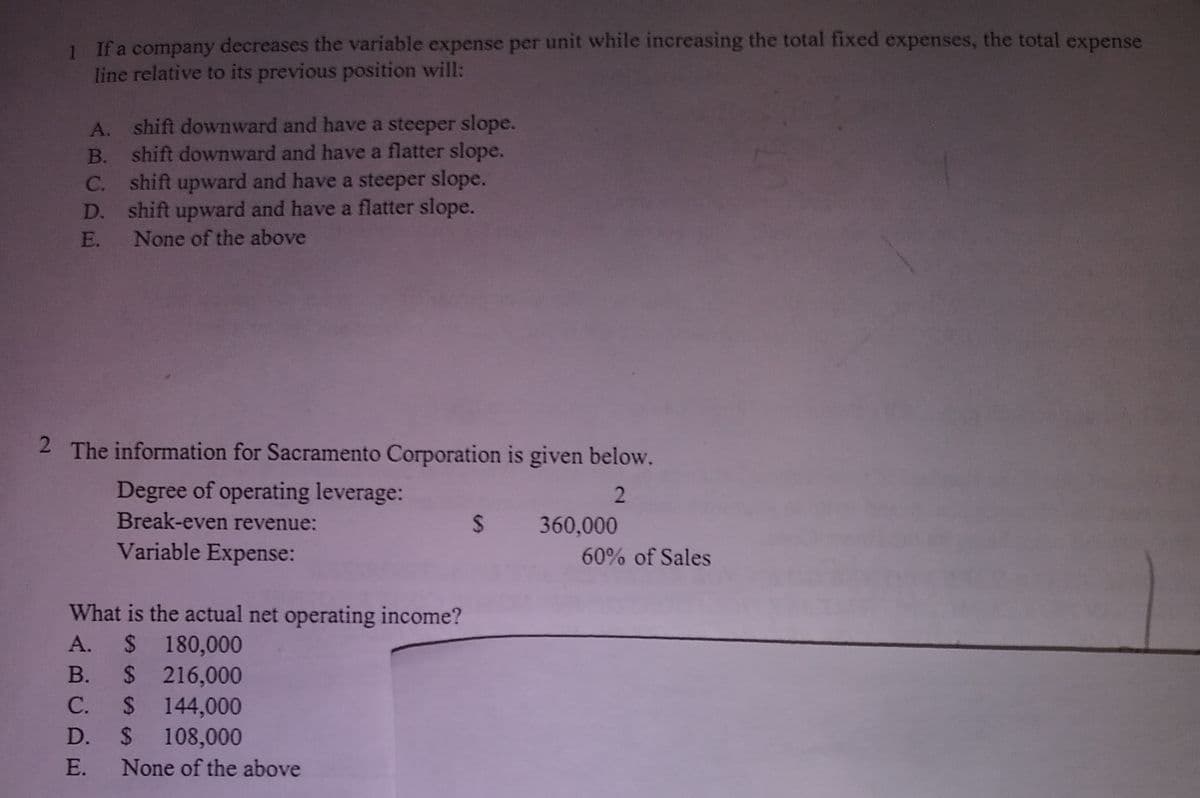

Transcribed Image Text:If a company decreases the variable expense per unit while increasing the total fixed expenses, the total expense

line relative to its previous position will:

A. shift downward and have a steeper slope.

B. shift downward and have a flatter slope.

C. shift upward and have a steeper slope.

D. shift upward and have a flatter slope.

E. None of the above

2 The information for Sacramento Corporation is given below.

Degree of operating leverage:

Break-even revenue:

2

24

360,000

Variable Expense:

60% of Sales

What is the actual net operating income?

A. $ 180,000

B. $ 216,000

C. $ 144,000

D. $ 108,000

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning