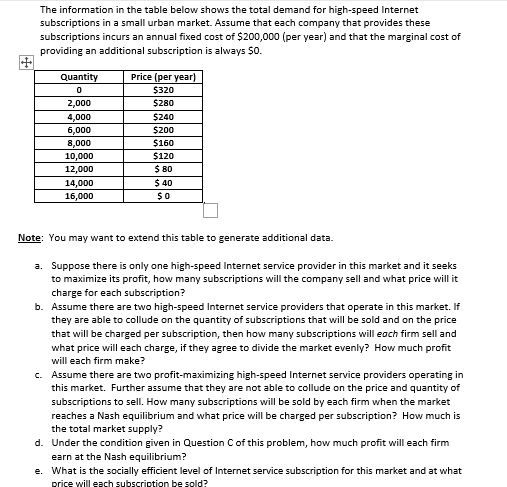

The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $0. Quantity 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 Price (per year) $320 $280 $240 $200 $160 $120 $ 80 $ 40 $0 Note: You may want to extend this table to generate additional data. a. Suppose there is only one high-speed Internet service provider in this market and it seeks to maximize its profit, how many subscriptions will the company sell and what price will it charge for each subscription? b. Assume there are two high-speed Internet service providers that operate in this market. If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged per subscription, then how many subscriptions will each firm sell and what price will each charge, if they agree to divide the market evenly? How much profit will each firm make? c. Assume there are two profit-maximizing high-speed Internet service providers operating in this market. Further assume that they are not able to collude on the price and quantity of subscriptions to sell. How many subscriptions will be sold by each firm when the market reaches a Nash equilibrium and what price will be charged per subscription? How much is the total market supply?

The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $0. Quantity 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 Price (per year) $320 $280 $240 $200 $160 $120 $ 80 $ 40 $0 Note: You may want to extend this table to generate additional data. a. Suppose there is only one high-speed Internet service provider in this market and it seeks to maximize its profit, how many subscriptions will the company sell and what price will it charge for each subscription? b. Assume there are two high-speed Internet service providers that operate in this market. If they are able to collude on the quantity of subscriptions that will be sold and on the price that will be charged per subscription, then how many subscriptions will each firm sell and what price will each charge, if they agree to divide the market evenly? How much profit will each firm make? c. Assume there are two profit-maximizing high-speed Internet service providers operating in this market. Further assume that they are not able to collude on the price and quantity of subscriptions to sell. How many subscriptions will be sold by each firm when the market reaches a Nash equilibrium and what price will be charged per subscription? How much is the total market supply?

Chapter13: Monopoly And Antitrust

Section: Chapter Questions

Problem 13P

Related questions

Question

please show me complete and neat solution thank you

Transcribed Image Text:+

The information in the table below shows the total demand for high-speed Internet

subscriptions in a small urban market. Assume that each company that provides these

subscriptions incurs an annual fixed cost $200,000 (per year) and that the marginal cost of

providing an additional subscription is always $0.

Quantity

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Price (per year)

$320

$280

$240

$200

$160

$120

$ 80

$ 40

$0

Note: You may want to extend this table to generate additional data.

a. Suppose there is only one high-speed Internet service provider in this market and it seeks

to maximize its profit, how many subscriptions will the company sell and what price will it

charge for each subscription?

b. Assume there are two high-speed Internet service providers that operate in this market. If

they are able to collude on the quantity of subscriptions that will be sold and on the price

that will be charged per subscription, then how many subscriptions will each firm sell and

what price will each charge, if they agree to divide the market evenly? How much profit

will each firm make?

c. Assume there are two profit-maximizing high-speed Internet service providers operating in

this market. Further assume that they are not able to collude on the price and quantity of

subscriptions to sell. How many subscriptions will be sold by each firm when the market

reaches a Nash equilibrium and what price will be charged per subscription? How much is

the total market supply?

d.

Under the condition given in Question C of this problem, how much profit will each firm

earn at the Nash equilibrium?

e. What is the socially efficient level of Internet service subscription for this market and at what

price will each subscription be sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning