The information that follows pertains to Richards Refrigeration, Incorporated: At December 31, 2024, temporary differences existed between the financial statement book values and the tax bases of the following: ($ in millions) Book Value Tax Basis Future Taxable (Deductible) Amount Buildings and equipment (net of accumulated depreciation) $ 120 $ 90 $ 30 Prepaid insurance 50 0 50 Liability-Loss contingency 25 0 (25) No temporary differences existed at the beginning of 2024. Pretax accounting income was $200 million and taxable income was $145 million for the year ended December 31, 2024. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. What is the 2024 net income? General Journal Record 2024 income taxes Transaction General Journal Debit Credit 1

The information that follows pertains to Richards Refrigeration, Incorporated: At December 31, 2024, temporary differences existed between the financial statement book values and the tax bases of the following: ($ in millions) Book Value Tax Basis Future Taxable (Deductible) Amount Buildings and equipment (net of accumulated depreciation) $ 120 $ 90 $ 30 Prepaid insurance 50 0 50 Liability-Loss contingency 25 0 (25) No temporary differences existed at the beginning of 2024. Pretax accounting income was $200 million and taxable income was $145 million for the year ended December 31, 2024. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. What is the 2024 net income? General Journal Record 2024 income taxes Transaction General Journal Debit Credit 1

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

Intermediate Accounting ll ch 16

6. The information that follows pertains to Richards Refrigeration, Incorporated:

-

At December 31, 2024, temporary differences existed between the financial statement book values and the tax bases of the following:

($ in millions)

| Book Value | Tax Basis |

Future Taxable (Deductible) Amount |

|

| Buildings and equipment (net of |

$ 120 | $ 90 | $ 30 |

| Prepaid insurance | 50 | 0 | 50 |

| Liability-Loss contingency | 25 | 0 | (25) |

-

No temporary differences existed at the beginning of 2024.

-

Pretax accounting income was $200 million and taxable income was $145 million for the year ended December 31, 2024. The tax rate is 25%.

Required:

- Complete the following table given below and prepare the appropriate

journal entry to record income taxes for 2024. - What is the 2024 net income?

- General Journal

Record 2024 income taxes

| Transaction | General Journal | Debit | Credit |

| 1 | |||

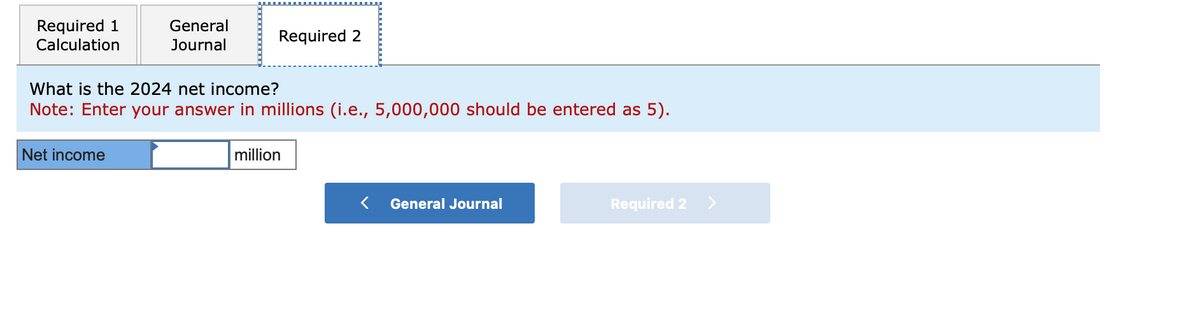

Transcribed Image Text:Required 1

Calculation

General

Journal

Net income

Required 2

What is the 2024 net income?

Note: Enter your answer in millions (i.e., 5,000,000 should be entered as 5).

million

< General Journal

Required 2

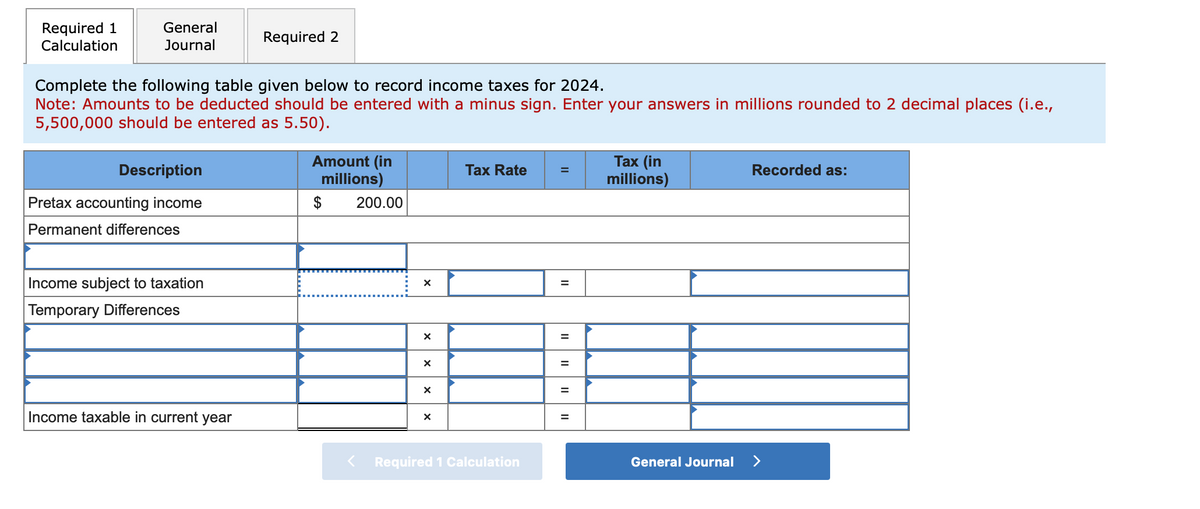

Transcribed Image Text:Required 1

Calculation

General

Journal

Complete the following table given below to record income taxes for 2024.

Note: Amounts to be deducted should be entered with a minus sign. Enter your answers in millions rounded to 2 decimal places (i.e.,

5,500,000 should be entered as 5.50).

Description

Pretax accounting income

Permanent differences

Income subject to taxation

Temporary Differences

Required 2

Income taxable in current year

Amount (in

millions)

$

200.00

X

X

X

X

X

Tax Rate

Required 1 Calculation

=

II

=

=

||

II

Tax (in

millions)

General Journal

Recorded as:

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning