The inverse demand function for the market is Р%3D 100 — Qт where Qr is total output, the sum of output from the fringe (QF) and from the dominant firm (QD): Qr = Qr + Qp. For example, in the global oil market, the dominant firm may be OPEC, and the fringe may consist of nations producing oil that do not belong to OPEC. Assume that the fringe is competitive and that the dominant firm behaves like a monopoly. The marginal cost function for the fringe is MC; = 20 + QF and the marginal cost function for the dominant firm is MC, 10 + QD. (1) Solve this model for the market price and for the amount of output from the fringe (QF) and from the dominant firm (QD). (2) Is this market outcome efficient?

The inverse demand function for the market is Р%3D 100 — Qт where Qr is total output, the sum of output from the fringe (QF) and from the dominant firm (QD): Qr = Qr + Qp. For example, in the global oil market, the dominant firm may be OPEC, and the fringe may consist of nations producing oil that do not belong to OPEC. Assume that the fringe is competitive and that the dominant firm behaves like a monopoly. The marginal cost function for the fringe is MC; = 20 + QF and the marginal cost function for the dominant firm is MC, 10 + QD. (1) Solve this model for the market price and for the amount of output from the fringe (QF) and from the dominant firm (QD). (2) Is this market outcome efficient?

Chapter19: Externalities And Public Goods

Section: Chapter Questions

Problem 19.3P

Related questions

Question

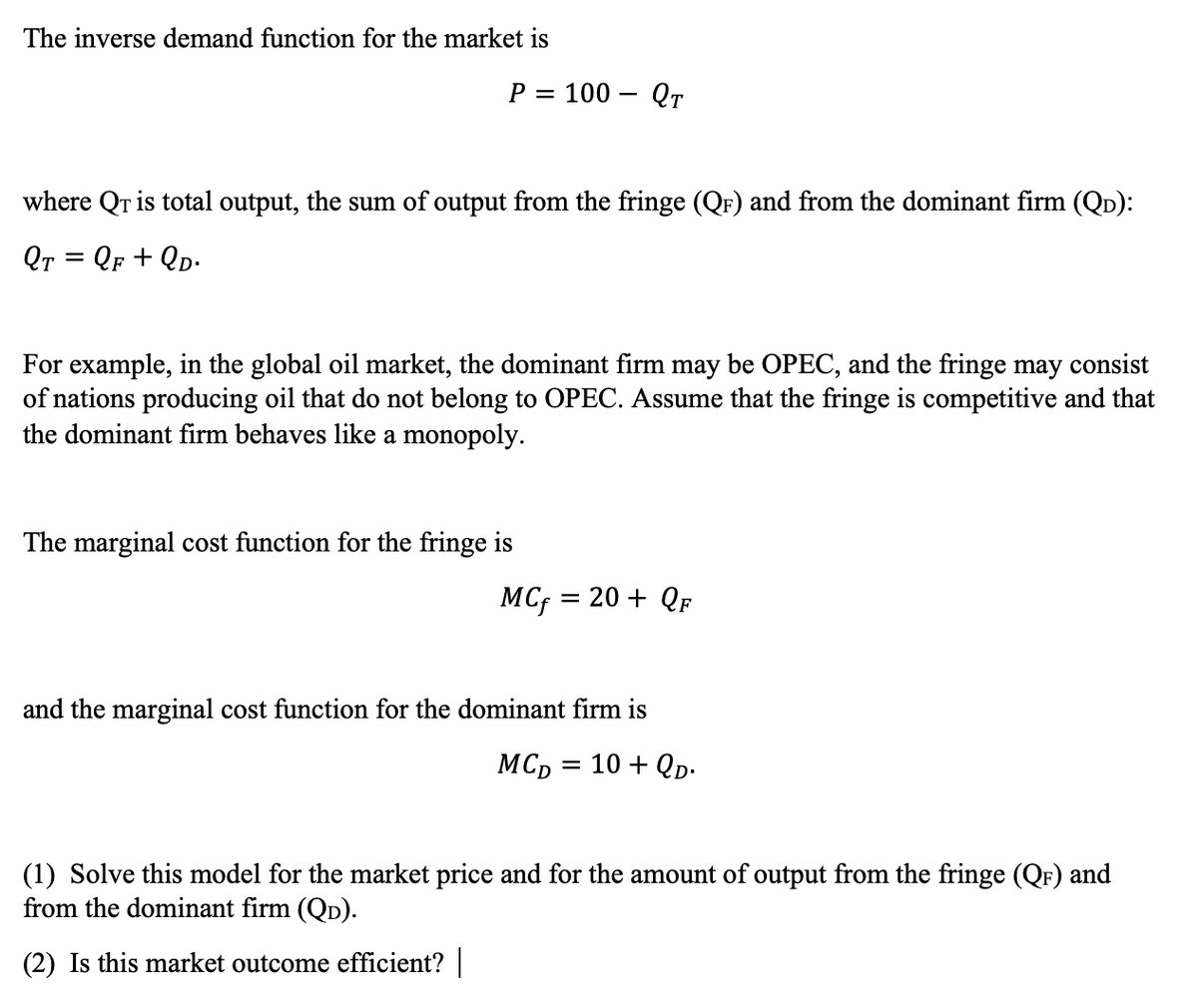

Transcribed Image Text:The inverse demand function for the market is

P =

100 – Qr

where Qr is total output, the sum of output from the fringe (QF) and from the dominant firm (QD):

Qr = QF + QD-

For example, in the global oil market, the dominant firm may be OPEC, and the fringe may consist

of nations producing oil that do not belong to OPEC. Assume that the fringe is competitive and that

the dominant firm behaves like a monopoly.

The marginal cost function for the fringe is

MC; =

= 20 + QF

and the marginal cost function for the dominant firm is

MC, = 10 + QD-

(1) Solve this model for the market price and for the amount of output from the fringe (QF) and

from the dominant firm (QD).

(2) Is this market outcome efficient?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning