The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the cash flows affected by the decision: Use Exhibit A.8. Investment (outflow at time 0) Periodic operating cash flows: Annual cash savings because outside laboratories are not used Additional cash outflow for people and supplies to operate the equipment Salvage value after seven years, which is the estimated life of this project $5,300,000 1,530,000 330,000 530,000 Discount rate 14% Required: Calculate the net present value of this decision. (Round PV factor to 3 decimal places.) Net present value Should the organization buy the equipment? O Yes O No Exhibit A.8 Present Value of $1 Year 6% 8% 10% 12% 14% 15% 16% 18% 20% 0.952 0.943 0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.907 0.890 0.857 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.864 0.840 0.794 0.751 0.712 0.675 0.658 0.641 0.609 0.579 4 0.823 0.792 0.735 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.784 0.747 0.681 0.621 0.567 0.519 0.497 0.476 0.437 0,402 0.746 0.705 0.630 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.711 0.665 0.583 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.677 0.627 0.540 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.645 0.592 0.500 0.424 0.361 0.308 0.284 0.263 0.225 0.194 10 0.614 0.558 0.463 0.386 0.322 0.270 0.247 0.227 0.191 0.162 11 0.585 0.527 0.429 0.350 0.287 0.237 0.215 0.195 0.162 0.135 12 0.557 0.497 0.397 0.319 0.257 0.208 0.187 0.168 0.137 0.112 13 0.530 0.469 0.368 0.290 0.229 0.182 0.163 0.145 0.116 0.093 14 0.505 0.442 0.340 0.263 0.205 0.160 0.141 0.125 0.099 0.078 15 0.481 0.417 0.315 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Year 22% 24% 25% 26% 28% 30% 32% 34% 35% 40% 0.820 0.806 0.S00 0.794 0.781 0.769 0.758 0.746 0.741 0.714 0.672 0.650 0.640 0.630 0.610 0.592 0.574 0.557 0.549 0.510 0.551 0.524 0.512 0.500 0.477 0.455 0.435 0.416 0.406 0.364 4 0.451 0.423 0.410 0.397 0.373 0.350 0.329 0.310 0.301 0.260 0.370 0.341 0.328 0.315 0.291 0.269 0.250 0.231 0.223 0.186 0.303 0.275 0.262 0.250 0.227 0.207 0.189 0.173 0.165 0.133 0.249 0.222 0.210 0.198 0.178 0.159 0.143 0.129 0.122 0.095 0.204 0.179 0.168 0.157 0.139 0.123 0.108 0.096 0.091 0,068 0.167 0.144 0.134 0.125 0.108 0.094 0.082 0.072 0.067 0.048 10 0.137 0.116 0.107 0.099 0.085 0.073 0.062 0.054 0.050 0.035 11 0.112 0.094 0.086 0.079 0.066 0.056 0.047 0.040 0.037 0.025 12 0.092 0.076 0.069 0.062 0.052 0.043 0.036 0.030 0.027 0.018 13 0.075 0.061 0.055 0.050 0.040 0.033 0.027 0.022 0.020 0.013 14 0.062 0.049 0.044 0.039 0.032 0.025 0.021 0.017 0.015 0.009 15 0.051 0.040 0.035 0.031 0.025 0.020 0.016 0.012 0.011 0.006 3. 7. 2. 3.

The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the cash flows affected by the decision: Use Exhibit A.8. Investment (outflow at time 0) Periodic operating cash flows: Annual cash savings because outside laboratories are not used Additional cash outflow for people and supplies to operate the equipment Salvage value after seven years, which is the estimated life of this project $5,300,000 1,530,000 330,000 530,000 Discount rate 14% Required: Calculate the net present value of this decision. (Round PV factor to 3 decimal places.) Net present value Should the organization buy the equipment? O Yes O No Exhibit A.8 Present Value of $1 Year 6% 8% 10% 12% 14% 15% 16% 18% 20% 0.952 0.943 0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.907 0.890 0.857 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.864 0.840 0.794 0.751 0.712 0.675 0.658 0.641 0.609 0.579 4 0.823 0.792 0.735 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.784 0.747 0.681 0.621 0.567 0.519 0.497 0.476 0.437 0,402 0.746 0.705 0.630 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.711 0.665 0.583 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.677 0.627 0.540 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.645 0.592 0.500 0.424 0.361 0.308 0.284 0.263 0.225 0.194 10 0.614 0.558 0.463 0.386 0.322 0.270 0.247 0.227 0.191 0.162 11 0.585 0.527 0.429 0.350 0.287 0.237 0.215 0.195 0.162 0.135 12 0.557 0.497 0.397 0.319 0.257 0.208 0.187 0.168 0.137 0.112 13 0.530 0.469 0.368 0.290 0.229 0.182 0.163 0.145 0.116 0.093 14 0.505 0.442 0.340 0.263 0.205 0.160 0.141 0.125 0.099 0.078 15 0.481 0.417 0.315 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Year 22% 24% 25% 26% 28% 30% 32% 34% 35% 40% 0.820 0.806 0.S00 0.794 0.781 0.769 0.758 0.746 0.741 0.714 0.672 0.650 0.640 0.630 0.610 0.592 0.574 0.557 0.549 0.510 0.551 0.524 0.512 0.500 0.477 0.455 0.435 0.416 0.406 0.364 4 0.451 0.423 0.410 0.397 0.373 0.350 0.329 0.310 0.301 0.260 0.370 0.341 0.328 0.315 0.291 0.269 0.250 0.231 0.223 0.186 0.303 0.275 0.262 0.250 0.227 0.207 0.189 0.173 0.165 0.133 0.249 0.222 0.210 0.198 0.178 0.159 0.143 0.129 0.122 0.095 0.204 0.179 0.168 0.157 0.139 0.123 0.108 0.096 0.091 0,068 0.167 0.144 0.134 0.125 0.108 0.094 0.082 0.072 0.067 0.048 10 0.137 0.116 0.107 0.099 0.085 0.073 0.062 0.054 0.050 0.035 11 0.112 0.094 0.086 0.079 0.066 0.056 0.047 0.040 0.037 0.025 12 0.092 0.076 0.069 0.062 0.052 0.043 0.036 0.030 0.027 0.018 13 0.075 0.061 0.055 0.050 0.040 0.033 0.027 0.022 0.020 0.013 14 0.062 0.049 0.044 0.039 0.032 0.025 0.021 0.017 0.015 0.009 15 0.051 0.040 0.035 0.031 0.025 0.020 0.016 0.012 0.011 0.006 3. 7. 2. 3.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 25P

Related questions

Question

Calculate the

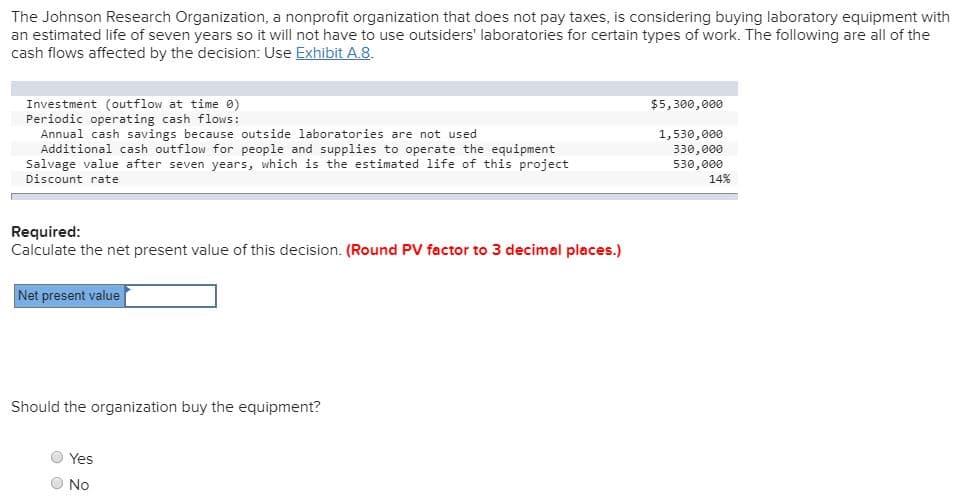

Transcribed Image Text:The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with

an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the

cash flows affected by the decision: Use Exhibit A.8.

Investment (outflow at time 0)

Periodic operating cash flows:

Annual cash savings because outside laboratories are not used

Additional cash outflow for people and supplies to operate the equipment

Salvage value after seven years, which is the estimated life of this project

$5,300,000

1,530,000

330,000

530,000

Discount rate

14%

Required:

Calculate the net present value of this decision. (Round PV factor to 3 decimal places.)

Net present value

Should the organization buy the equipment?

O Yes

O No

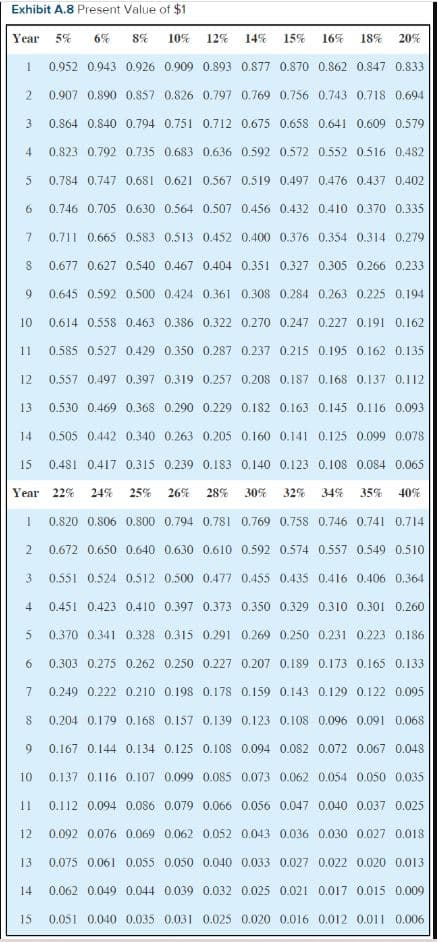

Transcribed Image Text:Exhibit A.8 Present Value of $1

Year

6%

8%

10%

12% 14% 15%

16%

18%

20%

0.952 0.943 0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833

0.907 0.890 0.857 0.826 0.797 0.769 0.756 0.743 0.718 0.694

0.864 0.840 0.794 0.751 0.712 0.675 0.658 0.641 0.609 0.579

4

0.823 0.792 0.735 0.683 0.636 0.592 0.572 0.552 0.516 0.482

0.784 0.747 0.681 0.621 0.567 0.519 0.497 0.476 0.437 0,402

0.746 0.705 0.630 0.564 0.507 0.456 0.432 0.410 0.370 0.335

0.711 0.665 0.583 0.513 0.452 0.400 0.376 0.354 0.314 0.279

0.677 0.627 0.540 0.467 0.404 0.351 0.327 0.305 0.266 0.233

0.645 0.592 0.500 0.424 0.361 0.308 0.284 0.263 0.225 0.194

10

0.614 0.558 0.463 0.386 0.322 0.270 0.247 0.227 0.191 0.162

11

0.585 0.527 0.429 0.350 0.287 0.237 0.215 0.195 0.162 0.135

12

0.557 0.497 0.397 0.319 0.257 0.208 0.187 0.168 0.137 0.112

13

0.530 0.469 0.368 0.290 0.229 0.182 0.163 0.145 0.116 0.093

14

0.505 0.442 0.340 0.263 0.205 0.160 0.141 0.125 0.099 0.078

15

0.481 0.417 0.315 0.239 0.183 0.140 0.123 0.108 0.084 0.065

Year 22%

24%

25%

26%

28%

30%

32%

34%

35%

40%

0.820 0.806 0.S00 0.794 0.781 0.769 0.758 0.746 0.741 0.714

0.672 0.650 0.640 0.630 0.610 0.592 0.574 0.557 0.549 0.510

0.551 0.524 0.512 0.500 0.477 0.455 0.435 0.416 0.406 0.364

4

0.451 0.423 0.410 0.397 0.373 0.350 0.329 0.310 0.301 0.260

0.370 0.341 0.328 0.315 0.291 0.269 0.250 0.231 0.223 0.186

0.303 0.275 0.262 0.250 0.227 0.207 0.189 0.173 0.165 0.133

0.249 0.222 0.210 0.198 0.178 0.159 0.143 0.129 0.122 0.095

0.204 0.179 0.168 0.157 0.139 0.123 0.108 0.096 0.091 0,068

0.167 0.144 0.134 0.125 0.108 0.094 0.082 0.072 0.067 0.048

10

0.137 0.116 0.107 0.099 0.085 0.073 0.062 0.054 0.050 0.035

11

0.112 0.094 0.086 0.079 0.066 0.056 0.047 0.040 0.037 0.025

12

0.092 0.076 0.069 0.062 0.052 0.043 0.036 0.030 0.027 0.018

13

0.075 0.061 0.055 0.050 0.040 0.033 0.027 0.022 0.020 0.013

14

0.062 0.049 0.044 0.039 0.032 0.025 0.021 0.017 0.015 0.009

15

0.051 0.040 0.035 0.031 0.025 0.020 0.016 0.012 0.011 0.006

3.

7.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College