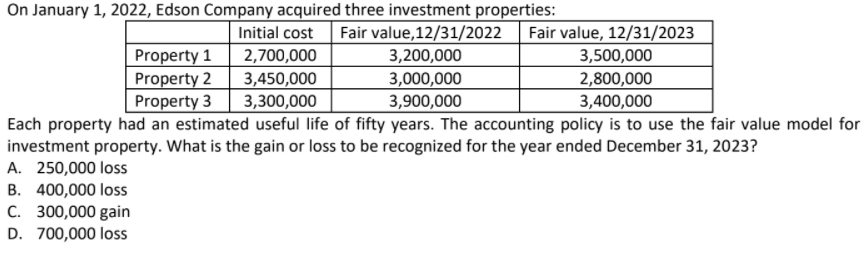

Fair value, 12/ Fair value,12/31/2022 3,200,000 3,500,0 3,000,000 3,900,000 2,800,0 3,400,0 e of fifty years. The accounting policy is t ss to be recognized for the year ended Dec

Q: $4,775.68

A: The after tax income of an individual is calculated by deducting the paid taxes from the income for ...

Q: Shares were issued at 160 each but the issuance cost is 10 per share. The expected dividend to be re...

A: 1) Computation of cost of equity ( Dividend price approach ): According to the Dividend price approa...

Q: Non-recognition of deferral at the end of the accounting period will Group of answer choices unders...

A: Ans. In case of non-recognition of deferral the income or expenses which is deferred but not recogni...

Q: Dr. Mark Scholz places an order to purchase $300 worth of supplies that he will use in his animal ho...

A: Supplies are consumables or things which are routinely used by business or organisation. We are give...

Q: Jade, Kale, And Lilo are in the process of liquidating their partnership. The balance sheet and the ...

A: Liquidation of Partnership For liquidating the partnership it settle the all expenses and dues which...

Q: What is the effect of omission of accrued expenses in assets at the end of the year of error? a. Un...

A:

Q: Peaceful Enterprises financial statements for the year ended December 31, 2021 are authorized for is...

A: Adjusting events are those events that occurs after reporting date ( i.e. balance sheet date ) but u...

Q: Allied Plumbing spent $16,120 this year on delivery costs alo total sales were $555,400, what percen...

A: The question is based on the concept of Financial Accounting.

Q: As per the accrual concept of accounting, any financial or business transaction should be recorded: ...

A: The correct answer for the above question is given in the following steps for your reference.

Q: Joy, a sole proprietor, and Baby, with no existing business, have decided to form a partnership. Joy...

A:

Q: Required 1. Enter the balances as of 11/30/2021 in the general ledger. 2. Prepare journal entries to...

A: Journal Entry The purpose of preparing the Journal entry to enter the required information into segr...

Q: Due to this accounting principle I postpone the moment I reveal expenses on my goods to the moment I...

A: Accounting principles are designed and implemented to bring consistency in financial statement for a...

Q: What amount of compensation expense should Sheridan recognize as a result of this plan for the year ...

A: Solution:- Given, Compensation expense = $1,508,000 Market price of shares available in the question...

Q: 3.1 Calculate the number of athletic scholarships Midwest University can offer each year. 3.2...

A: The number of scholarship can offer depend on fixed cost and variable cost of each of the scholarshi...

Q: The ABC Company manufactures stationary that goes through two processing stages prior to completion....

A: The equivalent units are calculated on the basis of percentage of the work completed during the pe...

Q: In October, November, and December, CVM Inc. expects to sell 50,000, 48,000, and 51,000 units, respe...

A: Budgeted production = Budgeted sales + Desired ending inventory - Beginning inventory Where, Desire...

Q: home office Aa a ret, the ccounting recorts for October were paely dey ronics hae hred you te help f...

A: Answer a) Calculation of Cost of Goods Sold Cost of Goods sold = Revenue – Gross Profit Cost of Good...

Q: Activity 1. Prepare an CFI/SCF Instruction: Show you solution in a sheet of paper with a complete re...

A: 1. Statement of Cash Flow - Statement of Cash flow is the statement that shows the actual cash posit...

Q: Pikotaro's annual rental fee for his condominium unit is P180,000. On November 30, 2021, He paid 3 m...

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new ques...

Q: Recording of next year's sales as sales of the current year will Group of answer choices a. underst...

A: Option a is incorrect because recording next year sales as current year sales will understate our ne...

Q: What should Monty report as preferred stocks on its December 31, 2021, balance sheet?

A: The Shares on the company's balance sheet are to be recognized on the par value. Any excess of issue...

Q: Overhead Variances, Two- And Three-Variance Analyses Oerstman, Inc., uses a standard costing system ...

A: given The budget is based on an expected annual output of 123,000 units requiring 492,000 direct lab...

Q: Inventory at December 31, 2021 was understated by P 15,000. What would be the adjusting entry if the...

A: As per relevant accounting standards, whenever a error of previous year identified in the current ye...

Q: peg. on to view the additional information.) e Income and Part I Federal Tax Payable for the Sebago ...

A: Taxable income refers to the total sum of money earned by an entity that is subject to the mandatory...

Q: A Bank granted a loan to a borrower in the amount of P5,000,000 on January 1, 2021, The interest rat...

A: Solution Carrying amount is the cost of an asset less accumulated depreciation.

Q: The ABC Company manufactures stationary that goes through two processing stages prior to completion....

A: Solution a: Nos of units completed and transferred to next department = Beginning WIP units + Units ...

Q: Required: a) Prepare the contribution format income statement for last month. b) Compute the breakev...

A: Income statement refers to a statement which shows the revenue and expense of the company of a parti...

Q: How to do Question 3

A: Under Activity Based Costing, Overhead Costs are allocated on the products or processes on the basis...

Q: Problem 4: A piece of equipment used in a business has a first cost of P 50,000 and is expected to h...

A:

Q: On January 1, 2022, Charis Company adopted a plan anuary 1, 2026 at an estimated cost of P20,000,000...

A: In this question, we have to find out the annual deposit to the fund.

Q: Sagada Company's summary of cash records show the following for the year 2022, its first year of ope...

A: The net income is calculated as difference between total revenues and total expenses. for cash basis...

Q: How many kanban card sets are required for this process?

A:

Q: How much is her EBITDA at the end of the first month?

A: EBITDA is an acronym of earnings before interest tax depreciation and amortization, this is used by ...

Q: Pasig Corp uses job order costing to produce its products. It applied a factory overhead at P18.00 p...

A: The factory overhead is applied to the production on the basis of predetermined overhead rate for th...

Q: Prepaid Insurance of P 60,000 was overlooked at the end of 2021. What would be the adjusting entry i...

A: Note: overlooking of prepaid insurance means insurance expense are understated, due to which income ...

Q: During 2021, Colombo Company changed its inventory costing method from FIFO to weighted average meth...

A: Inventory is one of the important current asset of the business. Regular management and valuation of...

Q: Find Total Capital: Tier 1 capital = 350 Subordinated unsecured debt, 15-year remaining maturity = 9...

A: Bank needs to maintain various ratios and tier 2 capital is the 2nd layer of capital which needs to ...

Q: Miriam deposite an amount of php89632.37 from abc bank on the 7th birthday of her daughter that pays...

A: Interest is the amount which has been earned by the company or the depositor on the money which has ...

Q: Pangan Corp. acquired 4,000 shares of Agustin, Inc. ordinary shares on Oct. 20, 2017 for P 660,000. ...

A: As Augstin Inc distributed stock dividend of 10%

Q: Dream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the pu...

A: Payment in quarter 1 Jan Feb Mar Month of purchase 33,000 x 65% = 21,450 39,000 x 65% = 25,350 ...

Q: During your audit of the books of Alarcon Corporation for the year ended December 31, 2021, you disc...

A: Since we answer up to 3 sub-parts, we'll answer the first 3. Please resubmit the question and specif...

Q: The invoice date for a bill is April 14 with the terms 2/15 ROG. If the goods were received on June ...

A: The Receipt-of-goods (ROG) is the method of payment, wherein the date of commencement is the day on ...

Q: 1. Prepare a table that shows how the cost of supervision behaves in total and on per-unit basis as ...

A: Fixed costs are those costs which will not change with change in activity level. These costs will be...

Q: These errors were discovered in the account of Golden Arches Company: Salaries payable amounting to...

A: Following is the error correction.

Q: Unearned Sales Revenue of P 120,000 was overlooked at the end of 2021. What would be the adjusting e...

A: A situation of Unearned Revenue arises when any advance has been collected from customers but no goo...

Q: Compute basic earnings per share for 2021 Compute the diluted earnings per share for 2021

A: Calculation of basic and diluted earnings per share are as follows

Q: In the consolidated statement of financial position of the parent and its subsidiaries, what total a...

A: IAS defines investment property as a land or a building or both which are held to earn rentals or f...

Q: Jade, Kale, And Lilo are in the process of liquidating their partnership. The balance sheet and the ...

A: In liquidation of partnership we prepare Realisation A/c to find out...

Q: In year 2022, cash sales is credited to Rent Income. What is the effect of the error in the year 202...

A: >Income Statement is one of the financial statement. >It shows various revenues and expens...

Q: These were issued at £1.50 per share. On February 20X8 Dr made a 2 for 3 bonus issue. Before account...

A: Retained earnings balance after bonus shares = 717,000 - 300,000 Retained earnings balance after bon...

Step by step

Solved in 2 steps

- The following intangible assets were purchased by Hanna Unlimited: A. A patent with a remaining legal life of twelve years is bought, and Hanna expects to be able to use it for six years. It is purchased at a cost of $48,000. B. A copyright with a remaining life of thirty years is purchased, and Hanna expects to be able to use it for ten years. It is purchased for $70,000. Determine the annual amortization amount for each intangible asset.Assets Acquired by Exchange Bremer Company made the following exchanges of assets during 2019: 1. Acquired a more advanced machine worth 10,000 by paying 2,000 cash and giving up a machine that had originally cost 40,000 and has a book value of 12,000, 2. Acquired a building worth 55,000 by paying 5,000 cash and giving up a piece of land that had originally cost 35,000. 3. Acquired a more advanced machine worth 20,000 by paying 5,000 cash and giving up a machine that had originally cost 13,000 and has a book value of 11,000. 4. Acquired a car by giving up a truck that had originally cost 20,000, has a book value of 15,000, and has a blue book value of 16,800. In addition, the company received 1,000 cash. Required: Prepare Bremers journal entry for each exchange. Assume all exchanges were determined to have commercial substance.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000

- The following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaining legal life of twelve years is bought, and Goldstein expects to be able to use it for seven years. B. A copyright with a remaining life of thirty years is purchased, and Goldstein expects to be able to use it for ten years. For each of these situations, determine the useful life over which Goldstein will amortize the intangible assets.Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?Dayanara Company owns three properties which are classified as investment properties. Details of the properties are as follows: Initial Cost Fair Value 12/31/2019 Fair Value 12/31/2020 Property 1 2,700,000 3,200,000 3,500,000 Property 2 3,450,000 3,000,000 2,280,000 Property 3 3,300,000 3,900,000 3,400,000 Each property had an estimated useful life of 25 years. The entity’s accounting policy is to use the fair value model for investment properties. What is the carrying value of the investment properties that should be presented for the year ended December 31,2020 in the statement of financial position?

- PEARS Company owned three investment properties. Details of the properties are as follows: Initial Cost Fair Value Dec. 31, 2019 Fair Value Dec. 31, 2020 Property 1 2,700,000 3,200,000 3,500,000 Propert 2 3,450,000 3,000,000 2,800,000 Property 3 3,300,000 3,900,000 3,400,000 Each property had an estimated useful life of 50 years. The accounting policy is to use the fair value model for investment properties. What is the carrying value of the investment properties that should be presented in the 2020 statement of financial position?Investment PropertyDEF Company owns land and building being used for its operations and administrative functions. The land and building are carried in its books using the cost model and have the following data at January 1,2023.Land:Cost - P10,000,000Fair value - 14,000,000Building:Cost -P20,000,000Accumulated depreciation -13,500,000Fair value - 9,000,000On this date, the company vacated the old building and occupied a newly constructed one located in the commercial area of the Central Business District. The old building is then reclassified as investment property using the fair value model. The company uses the fair value model in all of its other investment property.What is the amount of fair value gain reported in profit/loss resulting from the reclassification from owner occupied to investments property due to change in use of the property? a. P0 b. P2,500,000 c. P4,000,000 d. P6,500,000Them Company has a single investment property, which had original cost of P5,800,000 and estimated residual value of P200,000. on January 1, 2018. At Dec. 31, 2020, its fair value was P6,000,000 and at December 31, 2021, it had fair value of P5,900,000. On acquisition date, the property has estimated useful life of 40 years. The company uses the cost model for its investment property and uses straight-line method.What is the carrying value of the investment property at Dec. 31, 2021?

- 16. On April 27, 2021, BatoBatoPik purchased for P6,000,000 a warehouse building and the land on which it is located. The following data were available concerning the property: Current Appraised Value Original Cost Land P2,200,000 P1,800,000 Warehouse P3,300,000 P3,000,000 Total P5,500,000 P4,800,000 At what amount should the warehouse be recorded?The draft balance sheet of Tere Corporation as of December 31, 2019 reported the net property, plant and equipment at P110,000,000. Details of the amount follow: Land at cost P10,000,000Building at cost P50,000,000Less accumulateddepreciation at 12/31/18 (20,000,000) 30,000,000Plant at cost 94,500,000Less accumulateddepreciation at 12/31/18 (24,500,000) 70,000,000 110,000,000The following matters are relevant:• On 30 June 2019, Tere terminated the production of one of its product lines. From this date, the plant used to manufacture the product has been actively marketed at an advertised price of P4.2 million which is considered realistic. Assume that this plant qualified as held for sale in accordance withPFRS 5. It is…We Company has a single investment property, which had original cost of P5,800,000 and estimated residual value of P200,000. on January 1, 2018. At Dec. 31, 2020, its fair value was P6,000,000 and at December 31, 2021, it had fair value of P5,900,000. On acquisition date, the property has estimated useful life of 40 years. The company uses fair value model for its investment property.what is the carrying value of the property at December 31, 2020?