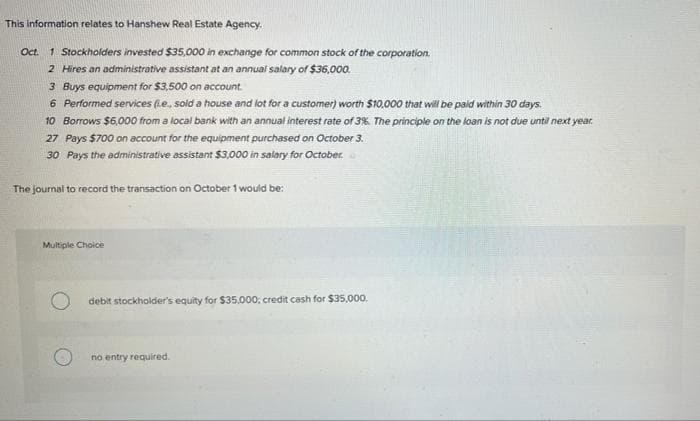

The journal to record the transaction on October 1 would be:

Q: 1. What will be the earnings of a worker at 60 paise per hour when he takes 100 hours to do a volume…

A: You have asked three questions but our protocol allows us to answer or solve one question only…

Q: Louise Edwards is a newly appointed director of LaybyX Ltd, a listed company that provides financial…

A: According to Australian Accounting Standard 124, related party is a person or entity who has control…

Q: Raw materials consumed =15,000 Direct labour charges =9,000 Machine hours worked -900 hrs Machine…

A: Cost per unit can be calculated based on total sales and total cost incurred. Total cost incurred…

Q: Which is preferable: implementing a manual accounting information system or implementing a…

A: Manual accounting information system - These are the accounting system in which all the task of…

Q: Ramos Inc. has total assets of $1,100 and total liabilities of $800 on December 31, 20Y6. Assume…

A: Assets, December 31, 20Y7 = $1,100 + $200 + $1,300 Liabilities, December 31, 20Y7 = $800 - $100 =…

Q: a) Find the Future Value of an annuity for$1000 paid at the end of each year for 3 years assuming…

A: Future Value = Present Value(1+r)^n n =3 years r=7% Present Value =$1000 Future Value…

Q: Jones Supply Services paid $350 cash, the amount owed from the previous month, to a materials…

A: Every business needs to purchase materials and supplies for use in business. It can be credit…

Q: The Marchetti Soup company entered into the following transactions during the month of June:(1)…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: n August 31, 2020, Southampton Co. acquired all of the common stock of Brighton Company, which…

A: Impairment Loss- An impairment loss is defined as a decline in an asset's carrying value caused by a…

Q: From the following list of balances extract from Vivian Trading's book as at 31 May RM RM Cash in…

A: Trial Balance - After transferring all the transactions into Ledgers Company closes the accounts and…

Q: Lola Tinidora, 63 years old, was treated by her grandchildren Alden, Allen, and Ellen to Max's…

A: According to Republic Act No.9994, Senior citizens are resident citizens of Philippines who have…

Q: sestion 8 Which of the following represents a form of communication through financial reporting but…

A: Financial Statements are part of Financial reporting and are used to convey the profits/loss,…

Q: Which of the following stalements is required by Long- Term care insurers when referring lo…

A: The answer for the multiple choice question and relevant explanation are presented hereunder : What…

Q: Mr. Adeel operate his dry fruit business in dubai. On 1st july, 2021, mr adeel exports dry fruit…

A: Foreign exchange gain/loss: Once company buys and/or sells goods and services in a foreign currency,…

Q: On January 1, 2016, Colt Co. issued ten-year bonds with a face amount of $1,000,000 and a stated…

A: Introduction: A bond is a fixed responsibility issued by corporations or government entities to pay…

Q: lenco in Alberta has four employees with total gross earnings of $322,780.00 and excess earnings of…

A: Earnings are assessable to the maximum amount per worker regardless of the the time spent working…

Q: An entity has two office employees Ben and Dan who earn P250 and P400 per day, respectively. They…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: Rudy Anne wants to buy new farm equipment costing P350,000 making a down payment of P50,000. The…

A: In the context of the given question, we are required to compute the monthly amount of payments.…

Q: has an estimated market value of $12,000 at the end of an esti epreciation amount in the third year…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Richie Rich Workshop owns a tow truck and the company is known for providing car towing services…

A: The incremental analysis is a tool used by management when deciding which alternative to be adopted…

Q: arning Task 2: assify the following accounts into the five major account categories. On the space…

A: The different accounts in business have debit or credit balance. The assets, expenses, dividend,…

Q: Two companies have the following financial information: (dollar amounts are in millions) Company A B…

A: The inventory to maintained are different for different firms but in service there is no inventory…

Q: Prepare Trial balance with the given ledger account balances the year ended March 2019. Capital…

A: A trail balance is a summary statement of all the account balances at the end of the accounting…

Q: Item No. 4 is based on the following information: Luningning Corporation sold for cash 400…

A: The share premium is the amount received in excess as compared to the par value of shares.

Q: For each of the accounting elements that follow (A-F), indicate in the space provided the…

A: Financial statements refers to the reports generated by the accounting system in respect of the…

Q: Dividing Partnership Income Tyler Hawes and Piper Albright formed a partnership, investing $70,000…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Problem 5-2 (IAA) At the beginning of current year, Template Company showed the following account…

A: Net Realizable Value of accounts receivable=Ending balance of account receivable-Ending balance of…

Q: Dividing Partnership Income Tyler Hawes and Piper Albright formed a partnership, investing $70,000…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. Partnership…

Q: Perform a vertical analysis for the entry "Gross Sales" on the portion of an income statement shown…

A: Vertical Analysis refers to the income statement analysis where all the line items present in the…

Q: describe the structure of a bank bill. In your explanation, clearly distinguish the roles of the…

A: Introduction: An invoice of barter is a criminal assumption that binds one party to pay another a…

Q: Tutorial Question X: The balances on Festus's insurance account as at 31" of March, 2012 were a…

A: The insurance account indicates detailed information like insurance expenses paid, accrued expenses,…

Q: PA4-4 (Algo) Identifying and Preparing Adjusting Journal Entries [LO 4-1, LO 4-2, LO 4-3, LO 4-6]…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period. The…

Q: Calculate the cost of goods available for sale using the following data: Purchase P 80,000…

A: Direct expenses = Transportation In = P3,000 Net purchases = Purchases - Purchase returns and…

Q: Vacation Corporation produces a single product. Data concerning the company's first year of…

A: Net operating income (NOI) is a metric that measures the viability of revenue-generating real estate…

Q: The following accounting events (A-I) affected the assets, liabilities, and owners’ equity of the…

A: i have explained increase and decrease in the assets and liabilities in a separate format for…

Q: Numba Ephraim plc, a retailing company has an authorized share capital of 700,000 ordinary shares of…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: 1 Transferred cash from a personal bank account in exchange for stock, $50,000 2 Purchased $8,000 of…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: Steven (age 40) and Lori (age 39) Post are married. Lori works as a retail manager and Steven is a…

A: Here asked for multi sub part question we will solve first three sub part question for you. If you…

Q: Cash Fumiture and equipment Vehicle Supplies Prepaid Insurance Note Payable Unearned service revenue…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: During the year a grinding machine was purchased for 700,000. Expenses of cartage and installation…

A: Types of depreciation are straight line method, written down value method etc. Every company has its…

Q: Assuming that a perpetual inventory system is used, what is ending inventory (rounded) under the…

A: Inventory valuation refers to the methods used by the company to determine the value of its…

Q: 4. The Fernandez Corporation was incorporated on September 1, 2021 and was authorized to issue share…

A: Shareholder’s equity is the section in the balance sheet in which equities of the owner is included.…

Q: Prepare journal entries for the following inventory transactions of CSU Ram Vacuum Cleaner Company…

A: April 3-To record the purchase of inventory. An inventory account is used in recording purchases…

Q: Identify cost drivers. BE5-4 (LO 2) Ayala Company manufactures four products in a single production…

A: A cost driver impacts whether the cost of activity goes up or down. The concept has most commonly…

Q: Stockton Company adds materials at the beginning of the process in Department M. Data concerning…

A: The term Equivalent units is used so as to describe how costs are divided between goods that are…

Q: Shoes Wisely, Inc. allocates overhead using machine hours as the allocation base. The following…

A: Introduction: Allocation of overhead is the allocation of all indirect costs incurred to the goods…

Q: In celebration of Best Friends' Day 2022, Besties' Tea Shop, offers a promo to its valued customers…

A: Here we calculate cost per ounce first, then accordingly total cost for given ounce for a cup, then…

Q: How much is in the fund at the end of 12 years, if it accumulated at 5% for the first 8 years, and…

A: Balance in the fund at the end of any period is the amount of money which includes the deposits…

Q: Estimate the capital that will be required in establishing a one-hectare fruit farm based on the…

A: The capital required to begin a business shall be equal to at least the minimum expenses which will…

Q: Assuming all applicable input taxes are to be claimed as credits against output taxes, the VAT…

A: Vat payable is the tax payable which is the indirect tax which is paid to the government, its…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Analyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.A business has the following transactions: The business is started by receiving cash from an investor in exchange for common stock $20,000 The business purchases supplies on account $500 The business purchases furniture on account $2,000 The business renders services to various clients on account totaling $9,000 The business pays salaries $2,000 The business pays this months rent $3,000 The business pays for the supplies purchased on account. The business collects from one of its clients for services rendered earlier in the month $1,500. What is total income for the month?

- Discuss how each of the following transactions will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. A company purchased $450 worth of office supplies on credit. B. The company parking lot was plowed after a blizzard. A check for $75 was given to the plow truck operator. C. $250 was paid on account. D. A customer paid $350 on account. E. Provided services for a customer, $500. The customer asked to be billed.The following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $100,000 worth of common stock. B. Six months rent was paid in advance, $4,500. C. Provided services in the amount of $1,000. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $275 per week. E. Received $500 in payment from the customer in C. F. Purchased $250 worth of supplies on credit. G. Received the electricity bill. We will pay the $110 in thirty days. H. Paid the worker hired in D for one weeks work. I. Received $100 from a customer for services we will provide next week. J. Dividends in the amount of $1,500 were distributed. Prepare the necessary journal entries to record these transactions. If an entry is not required for any of these transactions, state this and explain why.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- Determine the following amounts: a. The amount of the liabilities of a business that has 60,800 in assets and in which the owner has 34,500 equity. b. The equity of the owner of a tour bus that cost 57,000 and on which is owed 21,800 on an installment loan payable to the bank. c. The amount of the assets of a business that has 11,780 in liabilities and in which the owner has 28,500 equity.B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.Transaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March 1 by two former college roommates. The corporation provides computer consulting services to small businesses. The following transactions occurred during the first month of operations: March 2: Received contributions of $20,000 from each of the two principal owners of the new business in exchange for shares of stock. March 7: Signed a two-year promissory note at the bank and received cash of $15,000. Interest, along with the $15,000, will be repaid at the end of the two years. March 12: Purchased $700 in miscellaneous supplies on account. The company has 30 days to pay for the supplies. March 19: Billed a client $4,000 for services rendered by Expert in helping to install a new computer system. The client is to pay 25% of the bill upon its receipt and the remaining balance within 30 days. March 20: Paid $1,300 bill from the local newspaper for advertising for the month of March. March 22: Received 25% of the amount billed to the client on March 19. March 26: Received cash of $2,800 for services provided in assisting a client in selecting software for its computer. March 29: Purchased a computer system for $8,000 in cash. March 30: Paid $3,300 of salaries and wages for March. March 31: Received and paid $1,400 in gas, electric, and water bills. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with the date. Prepare an income statement for the month of March. Prepare a classified balance sheet at March 31. From reading the balance sheet you prepared in part (3), what events would you expect to take place in April? Explain your answer.