The Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000

The Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 22P: The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500,...

Related questions

Question

The Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are

- Part A: What is the net cash flow if they sell the used carts for $36,000?

- Part B: What are the net cash flows if they sell the used carts for $30,000?

- Part C: What is the net cash flow if they sell the used carts for $25,000

Expert Solution

Introduction

Net proceeds from sale of an asset is the proceeds as adjusted by the tax effects. In case there is a gain on sale of asset then such gain would be subject to capital gain tax and net proceeds would be proceeds minus tax.

Similarly, in case there is a loss on sale, there would be tax saving and net proceeds would be proceeds plus tax savings.

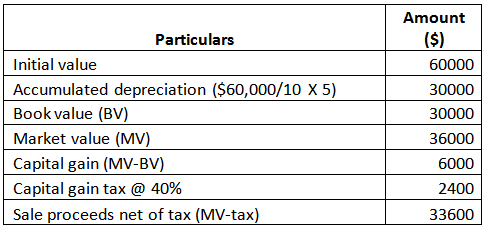

Gain on Sale

Computation of net proceeds:

Thus, net proceeds are $33,600.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning