the long run, if an economy's consumption spending is $5 trillion, its planned investment = $2 trillion, government spending is $1 trillion, net tax revenue is $1 trillion, and ousehold savings are $2 trillion, total output should be a. O$7 trillion b. O$8 trillion c. O$11 trillion d. O$3 trillion e. O$5 trillion

the long run, if an economy's consumption spending is $5 trillion, its planned investment = $2 trillion, government spending is $1 trillion, net tax revenue is $1 trillion, and ousehold savings are $2 trillion, total output should be a. O$7 trillion b. O$8 trillion c. O$11 trillion d. O$3 trillion e. O$5 trillion

Chapter11: Fiscal Policy

Section: Chapter Questions

Problem 1.4P

Related questions

Question

E4

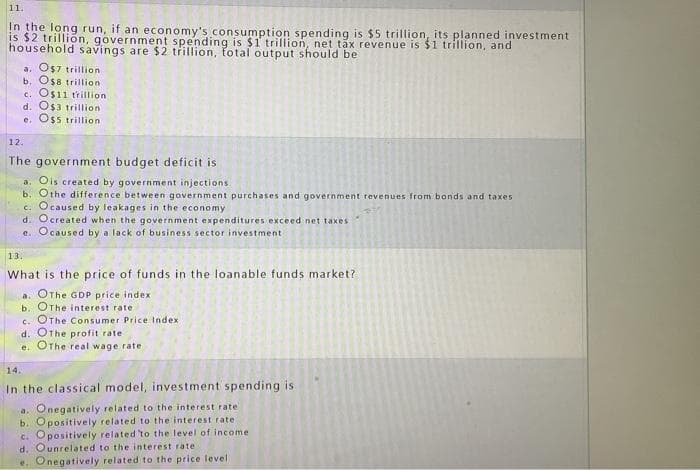

Transcribed Image Text:11.

In the long run, if an economy's consumption spending is $5 trillion, its planned investment

is $2 trillion, government spending is $1 trillion, net tax revenue is $1 trillion, and

household savings are $2 trillion, total output should be

a. O$7 trillion

b. O$8 trillion

c. O$11 trillion

d. O$3 trillion

e. O$5 trillion

12.

The government budget deficit is

a. Ois created by government injections

b. Othe difference between government purchases and government revenues from bonds and taxes

c. Ocaused by leakages in the economy

d. Ocreated when the government expenditures exceed net taxes

e. Ocaused by a lack of business sector investment i

13.

What is the price of funds in the loanable funds market?

a. OThe GDP price index

b. OThe interest rate

c. OThe Consumer Price Index.

d. OThe profit rate

e. OThe real wage rate

14.

In the classical model, investment spending is

a. Onegatively related to the interest rate

b. Opositively related to the interest rate.

c. Opositively related to the level of income

d. Ounrelated to the interest rate:

e. Onegatively related to the price level

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you