The Owner's Capital has a beginning balance of P626,000. The owner gave P130,000 additional contribution during the year. Based on the Statement of Comprehensive Income, net income for the year was P355,000. How much should be reported as total assets in the statement of financial position? Accounts Payable Accounts Receivable Accrued Expenses Accumulated Depreciation Cash Inventory Investments 57,000 Mortgage Payable 65,000 Notes Payable 37,000 Notes Receivable Owner, Capital 110,000 91,000 Prepaid Expenses 89,000 Property, Plant and Equipment 143,000 Unearned Revenue 400,000 130,000 283,000 ? 64,000 850,000 18,000

The Owner's Capital has a beginning balance of P626,000. The owner gave P130,000 additional contribution during the year. Based on the Statement of Comprehensive Income, net income for the year was P355,000. How much should be reported as total assets in the statement of financial position? Accounts Payable Accounts Receivable Accrued Expenses Accumulated Depreciation Cash Inventory Investments 57,000 Mortgage Payable 65,000 Notes Payable 37,000 Notes Receivable Owner, Capital 110,000 91,000 Prepaid Expenses 89,000 Property, Plant and Equipment 143,000 Unearned Revenue 400,000 130,000 283,000 ? 64,000 850,000 18,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PB: Johnson, Incorporated, had the following transactions during the year: Purchased a building for...

Related questions

Question

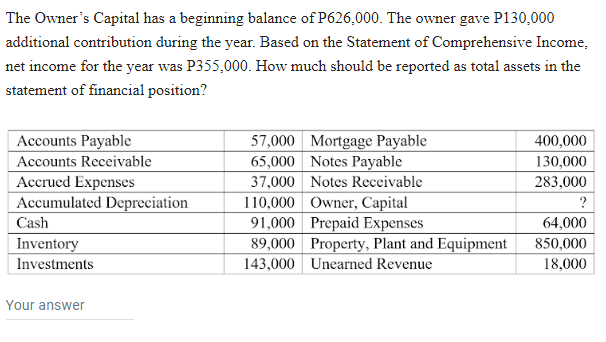

Transcribed Image Text:The Owner's Capital has a beginning balance of P626,000. The owner gave P130,000

additional contribution during the year. Based on the Statement of Comprehensive Income,

net income for the year was P355,000. How much should be reported as total assets in the

statement of financial position?

Accounts Payable

Accounts Receivable

Accrued Expenses

Accumulated Depreciation

Cash

Inventory

Investments

Your answer

57,000 Mortgage Payable

65,000 Notes Payable

37,000 Notes Receivable

110,000 Owner, Capital

91,000 Prepaid Expenses

89,000 Property, Plant and Equipment

143,000 Unearned Revenue

400,000

130,000

283,000

?

64,000

850,000

18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning