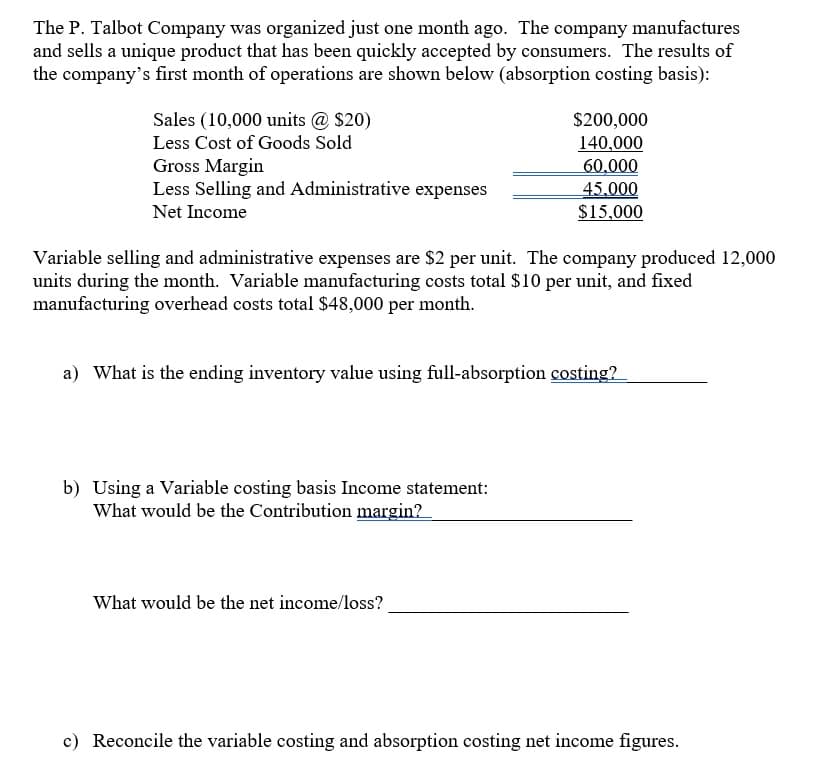

The P. Talbot Company was organized just one month ago. The company manufactures and sells a unique product that has been quickly accepted by consumers. The results of the company’s first month of operations are shown below (absorption costing basis): Sales (10,000 units @ $20) $200,000 Less Cost of Goods Sold 140,000 Gross Margin 60,000 Less Selling and Administrative expenses 45,000 Net Income $15,000 Variable selling and administrative expenses are $2 per unit. The company produced 12,000 units during the month. Variable manufacturing costs total $10 per unit, and fixed manufacturing overhead costs total $48,000 per month. What is the ending inventory value using full-absorption costing?_________ Using a Variable costing basis Income statement: What would be the Contribution margin?_____________________ What would be the net income/loss? ________________________ Reconcile the variable costing and absorption costing net income figures.

The P. Talbot Company was organized just one month ago. The company manufactures and sells a unique product that has been quickly accepted by consumers. The results of the company’s first month of operations are shown below (absorption costing basis):

Sales (10,000 units @ $20) $200,000

Less Cost of Goods Sold 140,000

Gross Margin 60,000

Less Selling and Administrative expenses 45,000

Net Income $15,000

Variable selling and administrative expenses are $2 per unit. The company produced 12,000 units during the month. Variable

- What is the ending inventory value using full-absorption costing?_________

- Using a Variable costing basis Income statement:

What would be the Contribution margin?_____________________

What would be the net income/loss? ________________________

- Reconcile the variable costing and absorption costing net income figures.

Step by step

Solved in 2 steps with 3 images