The Parkview Hospital is considering the purchase of a new autoclave. This equipment will cost $161,000. This asset will be depreciated using an MACRS (GDS) recovery period three years. What is the BV at the end of the second year? Click the icon to view the GDS Recovery Rates (r) for the 3-year property class. Choose the correct answer below. O A. The BV at the end of the second year is $51,520, O B. The BV at the end of the second year is $107,339 OC. The BV at the end of the second year is $35,774. O D. The BV at the end of the second year is $71,565,

The Parkview Hospital is considering the purchase of a new autoclave. This equipment will cost $161,000. This asset will be depreciated using an MACRS (GDS) recovery period three years. What is the BV at the end of the second year? Click the icon to view the GDS Recovery Rates (r) for the 3-year property class. Choose the correct answer below. O A. The BV at the end of the second year is $51,520, O B. The BV at the end of the second year is $107,339 OC. The BV at the end of the second year is $35,774. O D. The BV at the end of the second year is $71,565,

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 17P

Related questions

Question

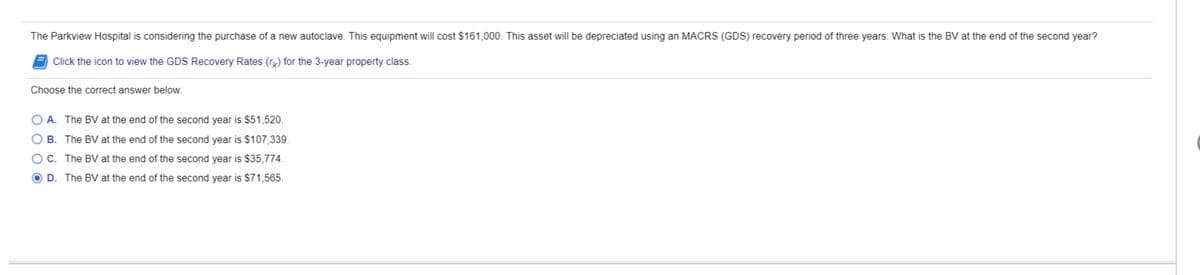

Transcribed Image Text:The Parkview Hospital is considering the purchase of a new autoclave. This equipment will cost $161,000. This asset will be depreciated using an MACRS (GDS) recovery period of three years. What is the BV at the end of the second year?

Click the icon to view the GDS Recovery Rates (r) for the 3-year property class.

Choose the correct answer below.

O A. The BV at the end of the second year is $51,520.

O B. The BV at the end of the second year is $107,339.

OC. The BV at the end of the second year is $35,774.

O D. The BV at the end of the second year is $71,565.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning