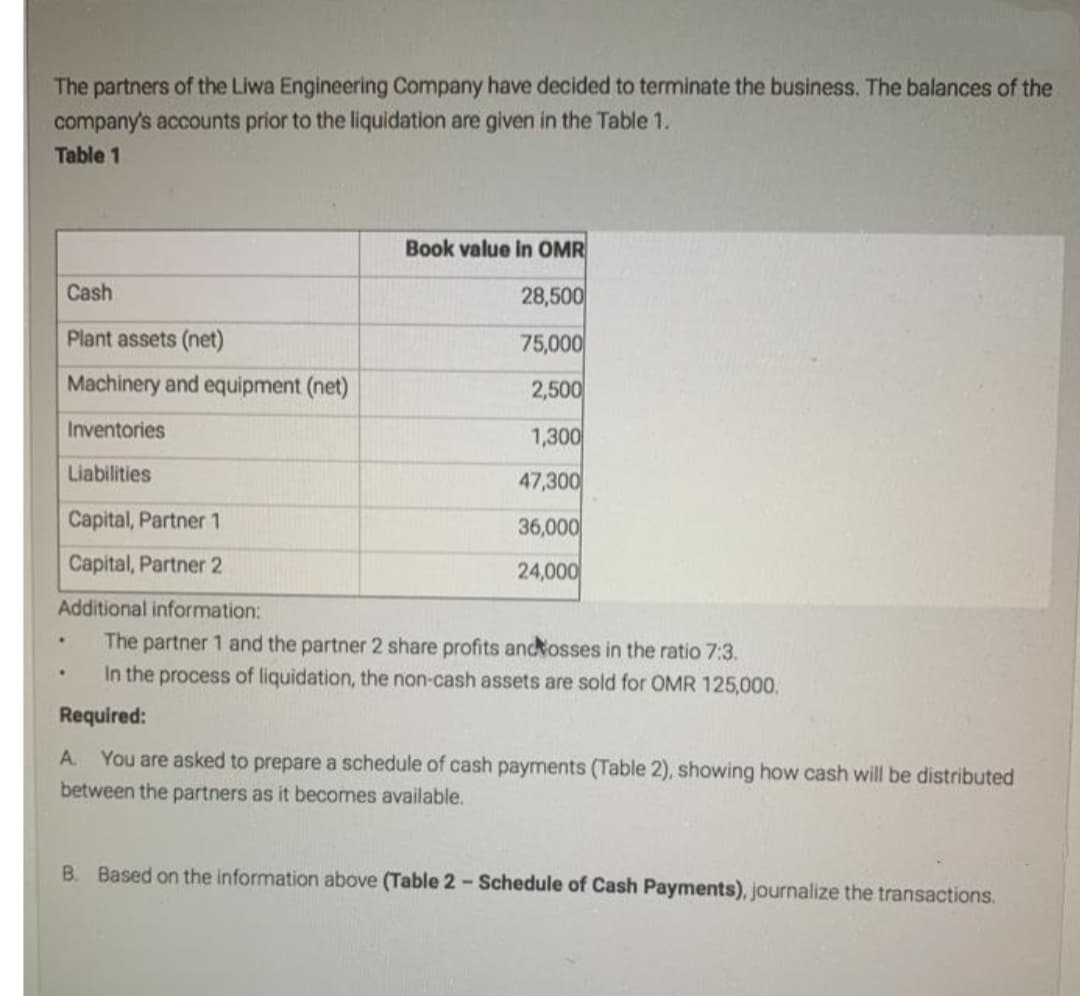

The partners of the Liwa Engineering Company have decided to terminate the business. The balances of the company's accounts prior to the liquidation are given in the Table 1. Table 1 Book value in OMR Cash 28,500 Plant assets (net) 75,000 Machinery and equipment (net) 2,500 Inventories 1,300 Liabilities 47,300 Capital, Partner 1 36,000 Capital, Partner 2 24,000 Additional information: The partner 1 and the partner 2 share profits andkosses in the ratio 7:3. In the process of liquidation, the non-cash assets are sold for OMR 125,000, Required: A You are asked to prepare a schedule of cash payments (Table 2), showing how cash will be distributed between the partners as it becomes available. B. Based on the information above (Table 2- Schedule of Cash Payments), journalize the transactions.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 3 steps with 2 images